10 Most Useful Personal Finance reddit Threads

Personal finance reddit (/r/personalfinance) is filled with interesting and helpful advice. Here are 10 most useful thought-provoking threads during coid-19 crises.

The 10 best personal finance tips from Reddit

1. Budgeting

“Please, for the sake of your wallet, meal prep”

Every Sunday, for about 2 hours, I cook and cook and cook. I make sure I make enough for my fiancé and me to have lunches for the entire week. That’s all it takes, two hours! And like $40 in groceries. When I was really struggling for money, I would still find myself going out to lunch every single day and spending $10-$15 a meal. That’s $50-$75 a week! Now I cook for two people for less than that.

Nothing could be truer. It is often so tempting to take the easy way out and live off sites like Seamless and Postmates, but the truth is that food costs add up very quickly and could hold you back from achieving your goals such as building your emergency fund or a sinking fund.

2. Always check your statements

The bill was being auto paid on his credit card. I think he was aware he was paying it (I’m assuming), but not sure that he really knew why. Or he forgot about it as I don’t believe he receives physical bills in the mail and he auto pays everything through his card.

He’s actually super smart financially. Budgets his money, is on track to retire next year (he’s 56 now), uses a credit card for all his spending for points, and owns approximately 14 rental properties.

I don’t think he’s used dial-up for at least the last 10….15 years?

Yikes. This stings. I’ve done this myself before with a gym membership. It can be so easy to overlook an autopay expense that sneaks out of your checking account each month.

The best cure?

Always check your bank statements – every single month. It will take all of 3 minutes to do and will save you thousands. Unfortunately for this poor fellow, it cost him $3,600 which he could have added to his retirement nest egg over the years.

If you’re unsure about a charge on the statement, call your bank to inquire. They can usually help you figure out what it is.

3. Spending on big-ticket items

“Never look at monthly payments. Negotiate on the final price”

Buying anything under a payment plan can be a real doozy. Most of the time, the terms are vague and there is almost no discussion about the most important piece of information for you – the final price. For instance:

– Car dealership, “So what do you want your monthly payment to be?”

– Insurance agent, “Great so your down payment is $XX and your quarterly payments are $XX” etc.

Um, I want to know what the final out the door price would be?

“Well tell me what you can afford and I’ll see if we can make this work for you. So how much are you looking to pay a month?”

Why is this bad? Because you cannot compare apples to apples with just a monthly payment. Sure they can make your monthly payment super low and just extend your term to forever so they make more money. Or for insurance purposes, you cannot compare that policy vs another one.

When faced with a situation where you’re not paying upfront for a product or service, you have to get in the weeds, do the math and understand how much you’re going to be paying in total interest.

When you compare that with the cost of paying upfront or the cost offered by a competitor, you’ll be surprised that what seemed like a great deal might not be so good after all.

4. Leasing a car

“Learn how to calculate a lease”

Leasing isn’t for everyone. In fact, it’s probably a bad idea for most people. But if you are going to lease, you need to know how leases work and where they get the numbers in order to get the best deal. And knowing the numbers may actually make you realize it’s a terrible deal and to stay away.

Leasing is not the cheapest way to drive a car, but if you are going to go ahead with it, you definitely want to take the time to do the math.

Leasing essentially lets you rent a new car from a dealership for a fixed amount of time. Each month, you’ll make monthly payments towards the car and at the end of your lease window, you’ll sometimes have the option to purchase the car upfront.

Lease monthly payments are typically lower than those of car monthly payments. You may, therefore, be wondering what the issue is with leasing? The main downside of leasing is that you’re essentially paying your hard-earned dollars to simply drive a car you don’t own. A car loan, on the other hand, lets you build equity in the car.

The reality though is that for most people, leasing is not a good idea and it initially gives you the right to drive and not own the car and if you do choose to buy the car at the end of the contract, the terms are not always in your best interest.

5. Buying a used car

“Traps to avoid when buying used cars”

Car salesmen are not the ones you need to fear. Many of them are great and work long hard honest hours to push some cars. As my dad told me before he dropped me off to buy my first used car, “When they get you in the back room, that’s when they’re going to try to screw you.”

If you think that’s a joke or an understatement, please accept the fact that it is neither. When you sit down in the chair in the finance office, you need to be as alert as a deer in hunting season. Here’s how they tried to get me, and I hope I can help one person not get taken…

Similar to the thread above about how to lease a car, here the OP shares some really useful insights into the real things to look out for when buying a car. Specifically:

- You are not obligated to take the add-ons they try to sell you e.g. alarm systems, electronics warranty, etc.

- If you don’t ask, don’t expect to be told everything about the car you are buying.

As exciting as the process is, one needs to go into it fully alert at all times to the tactics deployed at car dealerships.

Not all are sneaky, but they do have their ways to maximize on a sale and it’s in your best interest to know what those are!

6. Managing your prescription costs

“If you have an expensive prescription, contact the manufacturer and tell them you can’t afford it”

Bristol Myers just gave me a copay card that changed my monthly medication from $500 a month to $10. It lasts 2 years and they will renew it then with one phone call. Sorry if this is a repost, but this was a literal lifesaver for me.

Unless you’ve been hiding under a rock, you’ll know that health insurance costs can be astronomical in the U.S.

If you have a long-term condition that requires expensive medication, and few to no generic alternatives exist, you can try reaching out to the manufacturer of the needed drug and letting them know your situation.

This can make a world of a difference when you have other medical costs to contend with.

7. Do you really need all that dental work?

I went to a popular chain for a $57 new patient exam, cleaning, and x-rays. They found multiple cavities and I spent $600 on getting them fixed. I could only afford to do half of them at once and was going to come back to finish on another day.

In the meantime, I got a new job that offered dental insurance. So I went to a private dentist office instead to finish up the work. They said I had zero cavities or problem teeth. I went to a second office just to be safe, and they said the same thing.

It seems pretty scammy to me. Just be careful.

Dentists do great work and we all need them. However, as with many other fields, there are those who take advantage of people who might not understand the technicalities during their visits.

Be wary of finding a dentist on discount sites like Groupon as one user in the thread noted that false claims of cavities were made by a specialist from there. If possible, stick with a family doctor – someone who has been known to you for years whose work you can truly trust.

Additionally, if you’re faced with procedures outside of regular cleaning, always ask for an estimate or what is sometimes referred to as a treatment plan. You’ll be glad you did and you can use that during a 2nd opinion with another dentist.

8. Going from a two-income household to just one income

“Should my wife quit work and stay at home to care for our child?”

Just had our first kid a few months ago, and at the 11th hour my wife hit me with “I want to be a stay at home mom.” Didn’t see that one coming. My wife was making close to $100k though, so I think I’m in for a pretty big lifestyle shift even though our bills look pretty good.

This is a tricky one. Many families ponder this every year. Having a baby is one of the most exciting chapters for many parents and the desire to have one parent stay at home would be the dream for a huge portion of households. In the case of the OP, his wife wanted to quit and stay at home but her income counted for 50% of the household income, making it a really difficult and potentially risky decision.

Whatever a family decides to do, it is important that a healthy emergency fund is in place (preferably up to a year’s worth), a new one-income budget for the family is created and that your financial advisor is consulted in the decision-making process.

9. An easy side hustle to start

“Sell the things that aren’t bringing value to you anymore”

$5 to $20 per item may not seem worth the effort to sell something, but it adds up. We’ve focused on this at our house and have made a couple hundred bucks now.

In this age where we have too much stuff in our homes, decluttering is a huge positive that can also come with financial benefits. Sites such as eBay and OfferUp provide easy ways to upload your unwanted items for sale. As OP noted, it may not seem worth the effort, but it sure does add up.

10. financial peace of mind

“Stop freaking out about “the recession”

I see an awful lot of threads here about people wondering how on earth they’ll possibly survive this horrible doomsday recession that is just absolutely going to happen any day now…

The last recession was called the Great Recession for a reason – it was a harder-hitting one than those that came before. And since it was largely based on a housing crisis, it felt even worse because people were losing their homes due to ridiculous mortgages that they never should have been offered, or agreed to, in the first place. Which leads me to…

Just be smart. Are you living within your means now? Great! Make sure your emergency fund is in good shape, and continue about your business. If you’re overspending, take a look at your budget and see what you can cut out of it. This is something you should be doing regardless of how the markets look. Find a cheaper cell phone plan, ditch that $100 / mo cable bill, subscribe to a slower internet package, go out to eat less often, etc.

Why I LOVE /r/personalfinance

You probably wouldn’t say anything if a friend or coworker tells you about a money decision you don’t agree with racking up with little income, etc.

But if you saw the same issues on Reddit personal finance, you’d let the world know exactly how you feel about their issues and what you’d do instead.

It’s this level of honesty that helps us see how people really use money — and how to use it yourself.

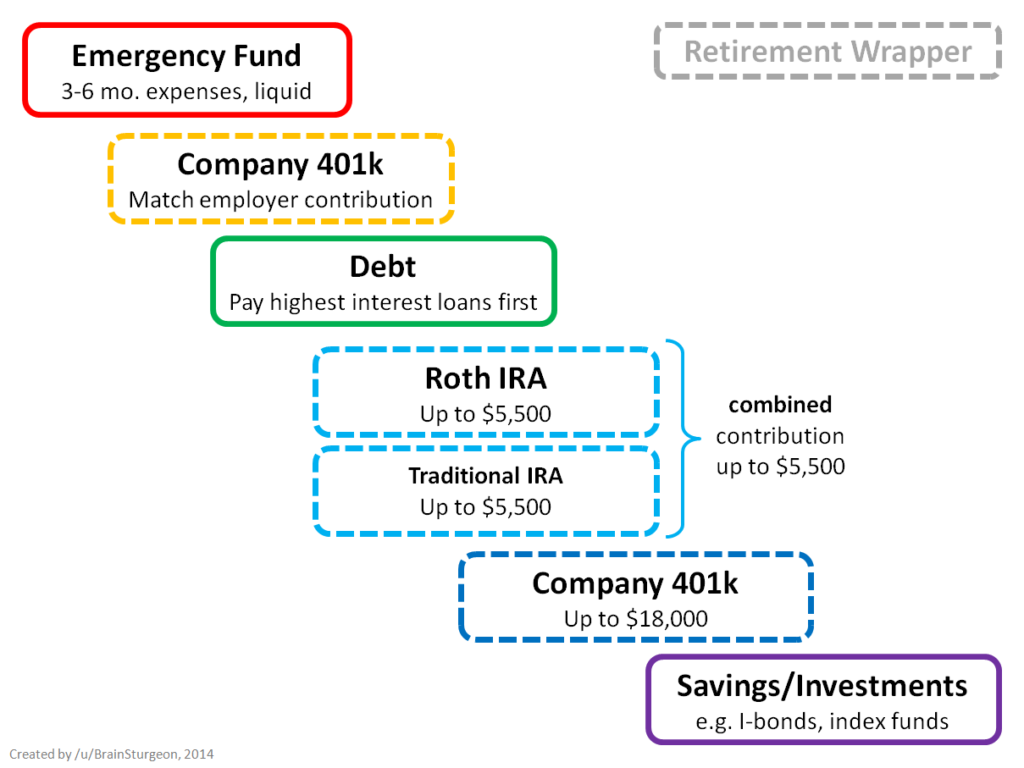

Personal finance reddit flowchart:

You may like this budget idea but with 3 buckets: Savings, Expenses, Flex

FAQ

Most frequent questions and answers

according to reddit the best personal finance books reddit are

As I glance over my shoulder at the bookshelf behind me, I notice many personal finance books such as:

- Millionaire Next Door

this is serious about personal finance which everyone should read.

- Money or Your Life

this book worth to read in your free time

- Rich Dad, Poor Dad!

such a great primer to understanding cashflow and assets vs liabilities.

the best finance audiobooks reddit are

- A random walk down wallstreet

-

More Money than God

-

Flash Boys

- Thinking Fast and slow

The millionaire next door best ever finance book on earth

The millionaire next door summary

One way the authors determined whether someone was wealthy or not was based on their net worth.

Net worth = Assets – Liabilities

For those labeled as being wealthy in the book (around 1996), they had a net worth of $1 million or more.

How wealthy should you be?

Another way of defining whether or not a person, household, or family is wealthy is based on one’s expected level of net worth. A person’s income and age are strong determinants of how much that person should be worth.

Millionaire next door formula

After surveying people, the authors developed a formula or simple rule of thumb to determine if you’re wealthy:

Multiply your age times your realized pretax annual household income from all sources except inheritances. Divide by ten. This, less any inherited wealth, is what your net worth should be.

Netflix stopped publishing new user data, Netflix fell 9%; Zhou Hongyi said he would sell Maybach to buy domestic new energy; Taobao will promote unlimited returns and free shipping | Geeks would have known

Bitcoin mining rewards halved for fourth time

GIPHY App Key not set. Please check settings