The S&P 500 (SPX) is just three months away from closing the book on an incredible decade. While the index has made gains over the last few days, it appears that we are witnessing the beginning of the end.

Even investors are starting to feel jittery.

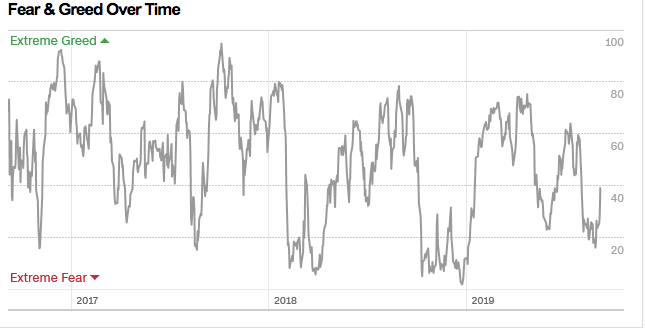

A look at the Fear and Greed Index provided byCNNshows that fear is driving the market right now. Also, a closer look at the S&P 500 index reveals that greed levels have been gradually dropping while fear levels are making new lows in the last two years.

Investors are seeing numerous concerns, any one of which could trigger a massive sell-off. Recent reports on manufacturing and housing data do not inspire confidence.

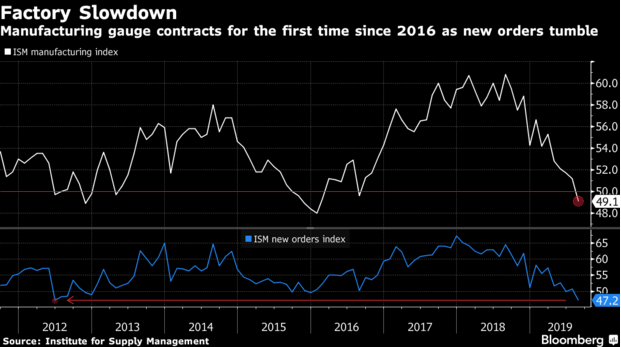

Factory Slowdown Heightens Fears of Recession

The contraction of a US manufacturing measure could be a signal of a weakening economy. TheInstitute for Supply Management’s purchasing manager’s index(ISM Manufacturing Index) is a leading indicator that affects investor confidence, which can then translate to poor performance in the overall stock market; including the S&P 500 Index. The ISM Manufacturing Index dropped to 49. 1 in August. This is a significant development as any number below 50 indicates a shrinking manufacturing economyaccording to Bloomberg.

Many sectors rely heavily on manufacturing. For everydollar spent in manufacturing, an additional $ 1. is added to other sectors such as transportation, retail, and business services. Thus, a shrinking manufacturing industry could significantly impact other sectors of the economy.

The Housing Market Shows Signs of Weakness

Residential homebuilding plunged for thethird straight month in Julyas land and labor shortages hamper the capacity of builders to boost housing construction. Take note, mortgage rates have fallen almost a year ago but it has done very little to drive the construction of residential housing.

The dropping supply ofnew houses could significantly affect the flow of new investmentsin the economy. Experts say that it will likely lead to slower GDP growth. All of this translates to poor market and S&P 500 performance.

S&P 500 Analyst : Short-Term Bullish but Long-Term Bearish

In addition, Hatem Diab, Managing Partner at Gerber Kawasaki, spoke to CCN. The executive said:

As we start seeing the impact of the tariffs in earnings and lower investment and capex, these will start putting real pressure on markets. Many are already predicting an earnings recession starting as early as Q4 which will be detrimental to the S&P by year-end and into 2020

It appears that on top of the housing and manufacturing concerns, there are other issues plaguing the S&P 500 index. It makes sense that investors are feeling more and more jittery.

Disclaimer: The views expressed in this op-ed are solely those of the author and do not represent those of, nor should they be attributed to, CCN Markets.

GIPHY App Key not set. Please check settings