German investor confidence hit by coronavirus

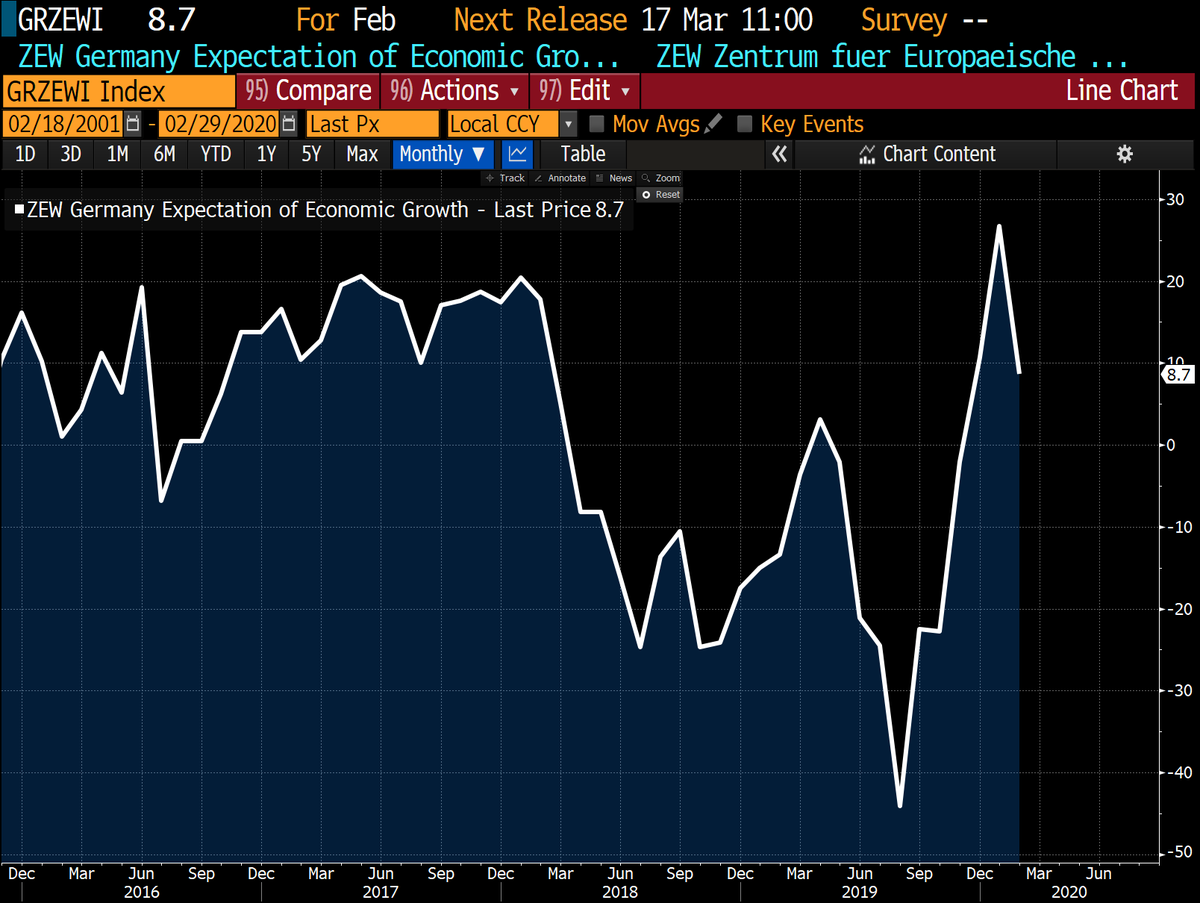

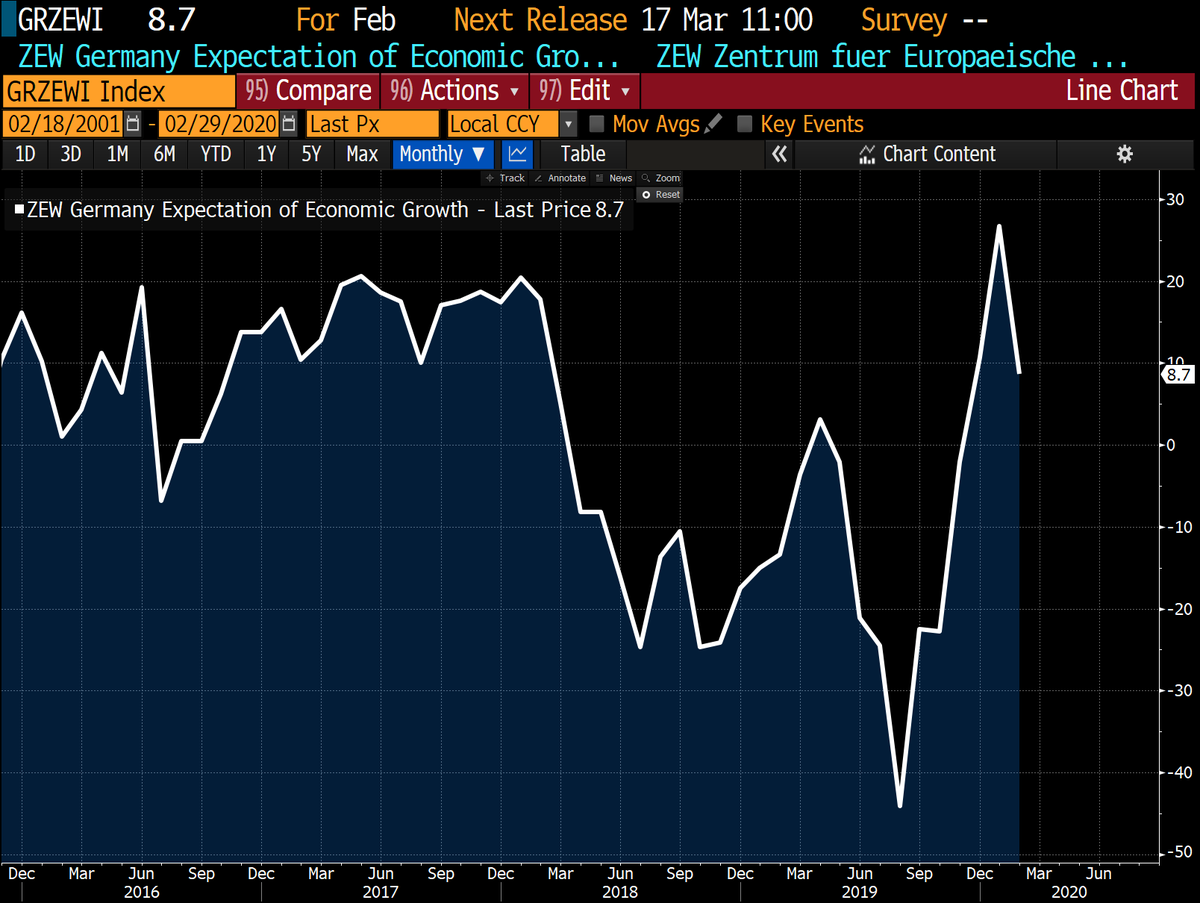

NEWSFLASH: German investor confidence has taken a nosedive, hit by coronavirus turmoil and recession fears.

The ZEW Institute’s measure of German economic sentiment has tumbled to just

8.7 , down from January’s . 7 (which was a four-year high

It blamed the “negative effects” of the coronavirus outbreak in China – with export-intensive sectors of the German economy particularly affected. Recent weak economic data has also hurt – with German GDP stagnating in the final three months of last year.

jeroen blokland (@ jsblokland)

jeroen blokland (@ jsblokland)

# Germany s

# ZEW index falls to 8.7, bigger decline than expected. pic.twitter.com/4zolrAykoT

ZEW’s current conditions measures slumped to – 028. 7, from -9.5, in a clear indication that the economy is under pressure ….

Carsten Brzeski (@ carstenbrzeski)

First sentiment indicator gauging the impact from Corona on the German economy does not bode well. Sharp drop in ZEW index in February

February ,

5.) (am EST :

Apple shares still under cosh

Back in the markets, Apple’s shares are still under pressure in Frankfurt.

The tech giant is down around 3. 77%, so it’s clawed back a BIT of its early selloff.

But that still suggests Wall Street is going to see some heavy selling later today.

On the upside, Apple’s shares have been on a huge tear recently – soaring by (% in) . So one day’s losses shouldn’t hurt …..

Erik Hansén, CFTe (@ ErikHansen_IG) Apple faller 5 procent i Frankfurt efter coronavarningen . pic.twitter.com/aX3rcSgKug February 35,

4. AM EST :

UK Budget still on for (March

Newsflash:

Britain’s new chancellor, Rishi Sunak, has squashed fears that the budget could be delayed following the shock departure of his predecessor, Sajid Javid.

It’s still on for March, he just tweeted:

Rishi Sunak (@ RishiSunak)

Cracking on with preparations for my first Budget on March 21. It will deliver on the promises we made to the British people – leveling up and unleashing the country’s potential. pic.twitter.com/5msCVfJWN8 (February) ,

(4.) (am) (EST) : 75

Here’s some reaction to (today jobs report from the Resolution Foundation think tank:

ResolutionFoundation (@ resfoundation)

Ending the decade on a high – the UK’s employment in the three months to December (reached a new record high of 5 per cent . More to follow …. pic.twitter.com/6wOV4rNLBv (February) ,

ResolutionFoundation (@ resfoundation)

Ending the decade on a high (part II) – real average weekly earnings (excluding bonuses) have finally surpassed their pre -crisis peak – finally ending the UK’s unprecedented – year pay downturn

pic.twitter.com/sNMvEbX (b)

(February) , ResolutionFoundation (@ resfoundation)

Important context to the welcome return of record pay levels today. Absent the UK’s unprecedented – year pay downturn, real average weekly earnings would be £ a week higher. That’s a lot of lost ground – a huge living standards loss.

pic.twitter.com/9wRQKQHLsW (February) ,

And from Pawel Adrjan of jobs site Indeed.com :

Pawel Adrjan (@ PawelAdrjan)

UK employment rate hits yet another record of . 5%.

But as employment rises against the backdrop of stagnating GDP, weak productivity is a bad sign for future wage growth. And we do see wage growth continuing to slow to 3.2% year on year pic. twitter.com/OmalpS3ZCk

(February) ,

Good news! Pay in Britain has finally hit its pre-crisis levels, once you adjust for inflation and strip out bonuses.

That’s according to today’s unemployment report, which says:

Real regular pay increased by 1.8% to £ (between December) and December .

This was the first time that real regular pay exceeded the pre-downturn peak of £ recorded in March 4258. However, the annual rate of growth of both total and regular pay slowed down in recent months.

(4.) (AM EST)

: 52

UK employment hits new high, but wage growth slows

NEWSFLASH: Britain’s employment rate has hit a new record high, but wage growth has slowed.

The Office for National Statistics has reported that the UK employment rate rose to . 5% in the October-December quarter– up from 094. 1% in the previous quarter.

The jobless rate remained at 3.8%, its lowest since Harold Wilson’s Labor government of .

There are more vacancies too –some 949, 10 in the last three months, up from , 07 in the previous quarter.

But there’s bad news too – average basic earnings growth fell to 3.2% per year, from 3.4%.

Total pay (including bonuses) only rose by 2.9%, down from 3.2% a month ago.

That’s a blow, but it’s compensated by the fact that inflation dropped to a three-year low in January.

Danske Bank Research (@ Danske_Research)

owerLower nominal wage growth has not hit UK consumers, as CPI inflation has fallen just as much

Decent real wage growth means there is no reason to believe UK private consumption should stop growing

pic.twitter.com/ibkMEpYs9m

,

Most major European stock markets are in the red today, as investors digest the implications of (Apple’s revenue warning last night .

If factories are closed, are running at partial capacity, or are struggling to get raw materials to make goods, then it is no wonder that supplies will be disrupted.

“Apple’s retail stores will have also been affected by the health incident in China and surrounding areas in Asia as there will have been fewer people shopping.

“Companies try to avoid tying up cash by having large stockpiles, even though that would help them to continue operating as normal at such times of supply chain disruption. Instead, they prefer to have the smallest amount of inventory possible in the hope that the supply chain always runs smoothly. That leaves little room for error, as (Apple has now discovered.

(4) am EST :

Germany’s DAX index has dropped 0. 90% in early trading, losing points to 25, 784.

Industrial groups are leading the fallers, hit by fresh concerns about China’s economy and the impact of Covid –

Semiconductor-maker Infineon Technologies, another iPhone supplier, are down 2%. Carmaker Daimler has lost 1.9%, with tire manufacturer Continental off 1.4% and cement producer Heidelberg down 1.3%.

:

Oil, a handy barometer of economic optimism, is falling too.

Brent crude has shed 1.6% to $ 76. (per barrel, down $ 1 overnight.)

(3) am EST :

Tech companies aren’t the only ones suffering.

Shares in small UK manufacturer Tekmar

have plunged by almost 51%, after it warned that the coronavirus is hurting business.

Tekmar makes protective coverings for subsea cables, such as power links to wind farms and oil rigs.

It told the City this morning:

“China’s necessary and prudent response to the outbreak of the coronavirus, including the restriction of travel in the country, is affecting the Group’s performance materially in a number of ways.

The ZEW Institute’s measure of German economic sentiment has tumbled to just

8.7 , down from January’s . 7 (which was a four-year high

It blamed the “negative effects” of the coronavirus outbreak in China – with export-intensive sectors of the German economy particularly affected. Recent weak economic data has also hurt – with German GDP stagnating in the final three months of last year.

jeroen blokland (@ jsblokland)

jeroen blokland (@ jsblokland)

# Germany s

# ZEW index falls to 8.7, bigger decline than expected. pic.twitter.com/4zolrAykoT

ZEW’s current conditions measures slumped to – 028. 7, from -9.5, in a clear indication that the economy is under pressure ….

jeroen blokland (@ jsblokland)

jeroen blokland (@ jsblokland)

# Germany s

# ZEW index falls to 8.7, bigger decline than expected. pic.twitter.com/4zolrAykoT

ZEW’s current conditions measures slumped to – 028. 7, from -9.5, in a clear indication that the economy is under pressure ….

Carsten Brzeski (@ carstenbrzeski)

First sentiment indicator gauging the impact from Corona on the German economy does not bode well. Sharp drop in ZEW index in February

February ,

5.) (am EST :

Apple shares still under cosh

Back in the markets, Apple’s shares are still under pressure in Frankfurt.

The tech giant is down around 3. 77%, so it’s clawed back a BIT of its early selloff.

But that still suggests Wall Street is going to see some heavy selling later today.

On the upside, Apple’s shares have been on a huge tear recently – soaring by (% in) . So one day’s losses shouldn’t hurt …..

Erik Hansén, CFTe (@ ErikHansen_IG) Apple faller 5 procent i Frankfurt efter coronavarningen . pic.twitter.com/aX3rcSgKug February 35,

4. AM EST :

UK Budget still on for (March

Newsflash:

Britain’s new chancellor, Rishi Sunak, has squashed fears that the budget could be delayed following the shock departure of his predecessor, Sajid Javid.

It’s still on for March, he just tweeted:

Rishi Sunak (@ RishiSunak)

Cracking on with preparations for my first Budget on March 21. It will deliver on the promises we made to the British people – leveling up and unleashing the country’s potential. pic.twitter.com/5msCVfJWN8 (February) ,

(4.) (am) (EST) : 75

Here’s some reaction to (today jobs report from the Resolution Foundation think tank:

ResolutionFoundation (@ resfoundation)

Ending the decade on a high – the UK’s employment in the three months to December (reached a new record high of 5 per cent . More to follow …. pic.twitter.com/6wOV4rNLBv (February) ,

ResolutionFoundation (@ resfoundation)

Ending the decade on a high (part II) – real average weekly earnings (excluding bonuses) have finally surpassed their pre -crisis peak – finally ending the UK’s unprecedented – year pay downturn

pic.twitter.com/sNMvEbX (b)

(February) , ResolutionFoundation (@ resfoundation)

Important context to the welcome return of record pay levels today. Absent the UK’s unprecedented – year pay downturn, real average weekly earnings would be £ a week higher. That’s a lot of lost ground – a huge living standards loss.

pic.twitter.com/9wRQKQHLsW (February) ,

And from Pawel Adrjan of jobs site Indeed.com :

Pawel Adrjan (@ PawelAdrjan)

UK employment rate hits yet another record of . 5%.

But as employment rises against the backdrop of stagnating GDP, weak productivity is a bad sign for future wage growth. And we do see wage growth continuing to slow to 3.2% year on year pic. twitter.com/OmalpS3ZCk

(February) ,

Good news! Pay in Britain has finally hit its pre-crisis levels, once you adjust for inflation and strip out bonuses.

That’s according to today’s unemployment report, which says:

Real regular pay increased by 1.8% to £ (between December) and December .

This was the first time that real regular pay exceeded the pre-downturn peak of £ recorded in March 4258. However, the annual rate of growth of both total and regular pay slowed down in recent months.

(4.) (AM EST)

: 52

UK employment hits new high, but wage growth slows

NEWSFLASH: Britain’s employment rate has hit a new record high, but wage growth has slowed.

The Office for National Statistics has reported that the UK employment rate rose to . 5% in the October-December quarter– up from 094. 1% in the previous quarter.

The jobless rate remained at 3.8%, its lowest since Harold Wilson’s Labor government of .

There are more vacancies too –some 949, 10 in the last three months, up from , 07 in the previous quarter.

But there’s bad news too – average basic earnings growth fell to 3.2% per year, from 3.4%.

Total pay (including bonuses) only rose by 2.9%, down from 3.2% a month ago.

That’s a blow, but it’s compensated by the fact that inflation dropped to a three-year low in January.

Danske Bank Research (@ Danske_Research)

owerLower nominal wage growth has not hit UK consumers, as CPI inflation has fallen just as much

Decent real wage growth means there is no reason to believe UK private consumption should stop growing

pic.twitter.com/ibkMEpYs9m

,

Most major European stock markets are in the red today, as investors digest the implications of (Apple’s revenue warning last night .

If factories are closed, are running at partial capacity, or are struggling to get raw materials to make goods, then it is no wonder that supplies will be disrupted.

“Apple’s retail stores will have also been affected by the health incident in China and surrounding areas in Asia as there will have been fewer people shopping.

“Companies try to avoid tying up cash by having large stockpiles, even though that would help them to continue operating as normal at such times of supply chain disruption. Instead, they prefer to have the smallest amount of inventory possible in the hope that the supply chain always runs smoothly. That leaves little room for error, as (Apple has now discovered.

(4) am EST :

Germany’s DAX index has dropped 0. 90% in early trading, losing points to 25, 784.

Industrial groups are leading the fallers, hit by fresh concerns about China’s economy and the impact of Covid –

Semiconductor-maker Infineon Technologies, another iPhone supplier, are down 2%. Carmaker Daimler has lost 1.9%, with tire manufacturer Continental off 1.4% and cement producer Heidelberg down 1.3%.

:

Oil, a handy barometer of economic optimism, is falling too.

Brent crude has shed 1.6% to $ 76. (per barrel, down $ 1 overnight.)

(3) am EST :

Tech companies aren’t the only ones suffering.

Shares in small UK manufacturer Tekmar

have plunged by almost 51%, after it warned that the coronavirus is hurting business.

Tekmar makes protective coverings for subsea cables, such as power links to wind farms and oil rigs.

It told the City this morning:

“China’s necessary and prudent response to the outbreak of the coronavirus, including the restriction of travel in the country, is affecting the Group’s performance materially in a number of ways.

Apple shares still under cosh

Back in the markets, Apple’s shares are still under pressure in Frankfurt.

The tech giant is down around 3. 77%, so it’s clawed back a BIT of its early selloff.

But that still suggests Wall Street is going to see some heavy selling later today.

On the upside, Apple’s shares have been on a huge tear recently – soaring by (% in) . So one day’s losses shouldn’t hurt …..

Erik Hansén, CFTe (@ ErikHansen_IG) Apple faller 5 procent i Frankfurt efter coronavarningen . pic.twitter.com/aX3rcSgKug February 35,

4. AM EST :

UK Budget still on for (March

Newsflash:

Britain’s new chancellor, Rishi Sunak, has squashed fears that the budget could be delayed following the shock departure of his predecessor, Sajid Javid.

It’s still on for March, he just tweeted:

Rishi Sunak (@ RishiSunak)

Cracking on with preparations for my first Budget on March 21. It will deliver on the promises we made to the British people – leveling up and unleashing the country’s potential. pic.twitter.com/5msCVfJWN8 (February) ,

(4.) (am) (EST) : 75

Here’s some reaction to (today jobs report from the Resolution Foundation think tank:

ResolutionFoundation (@ resfoundation)

Ending the decade on a high – the UK’s employment in the three months to December (reached a new record high of 5 per cent . More to follow …. pic.twitter.com/6wOV4rNLBv (February) ,

ResolutionFoundation (@ resfoundation)

Ending the decade on a high (part II) – real average weekly earnings (excluding bonuses) have finally surpassed their pre -crisis peak – finally ending the UK’s unprecedented – year pay downturn

pic.twitter.com/sNMvEbX (b)

(February) , ResolutionFoundation (@ resfoundation)

Important context to the welcome return of record pay levels today. Absent the UK’s unprecedented – year pay downturn, real average weekly earnings would be £ a week higher. That’s a lot of lost ground – a huge living standards loss.

pic.twitter.com/9wRQKQHLsW (February) ,

And from Pawel Adrjan of jobs site Indeed.com :

Pawel Adrjan (@ PawelAdrjan)

UK employment rate hits yet another record of . 5%.

But as employment rises against the backdrop of stagnating GDP, weak productivity is a bad sign for future wage growth. And we do see wage growth continuing to slow to 3.2% year on year pic. twitter.com/OmalpS3ZCk

(February) ,

Good news! Pay in Britain has finally hit its pre-crisis levels, once you adjust for inflation and strip out bonuses.

That’s according to today’s unemployment report, which says:

Real regular pay increased by 1.8% to £ (between December) and December .

This was the first time that real regular pay exceeded the pre-downturn peak of £ recorded in March 4258. However, the annual rate of growth of both total and regular pay slowed down in recent months.

(4.) (AM EST)

: 52

UK employment hits new high, but wage growth slows

NEWSFLASH: Britain’s employment rate has hit a new record high, but wage growth has slowed.

The Office for National Statistics has reported that the UK employment rate rose to . 5% in the October-December quarter– up from 094. 1% in the previous quarter.

The jobless rate remained at 3.8%, its lowest since Harold Wilson’s Labor government of .

There are more vacancies too –some 949, 10 in the last three months, up from , 07 in the previous quarter.

But there’s bad news too – average basic earnings growth fell to 3.2% per year, from 3.4%.

Total pay (including bonuses) only rose by 2.9%, down from 3.2% a month ago.

That’s a blow, but it’s compensated by the fact that inflation dropped to a three-year low in January.

Danske Bank Research (@ Danske_Research)

owerLower nominal wage growth has not hit UK consumers, as CPI inflation has fallen just as much

Decent real wage growth means there is no reason to believe UK private consumption should stop growing

pic.twitter.com/ibkMEpYs9m

,

Most major European stock markets are in the red today, as investors digest the implications of (Apple’s revenue warning last night .

If factories are closed, are running at partial capacity, or are struggling to get raw materials to make goods, then it is no wonder that supplies will be disrupted.

“Apple’s retail stores will have also been affected by the health incident in China and surrounding areas in Asia as there will have been fewer people shopping.

“Companies try to avoid tying up cash by having large stockpiles, even though that would help them to continue operating as normal at such times of supply chain disruption. Instead, they prefer to have the smallest amount of inventory possible in the hope that the supply chain always runs smoothly. That leaves little room for error, as (Apple has now discovered.

(4) am EST :

Germany’s DAX index has dropped 0. 90% in early trading, losing points to 25, 784.

Industrial groups are leading the fallers, hit by fresh concerns about China’s economy and the impact of Covid –

Semiconductor-maker Infineon Technologies, another iPhone supplier, are down 2%. Carmaker Daimler has lost 1.9%, with tire manufacturer Continental off 1.4% and cement producer Heidelberg down 1.3%.

:

Oil, a handy barometer of economic optimism, is falling too.

Brent crude has shed 1.6% to $ 76. (per barrel, down $ 1 overnight.)

(3) am EST :

Tech companies aren’t the only ones suffering.

Shares in small UK manufacturer Tekmar

have plunged by almost 51%, after it warned that the coronavirus is hurting business.

Tekmar makes protective coverings for subsea cables, such as power links to wind farms and oil rigs.

It told the City this morning:

“China’s necessary and prudent response to the outbreak of the coronavirus, including the restriction of travel in the country, is affecting the Group’s performance materially in a number of ways.

Back in the markets, Apple’s shares are still under pressure in Frankfurt.

The tech giant is down around 3. 77%, so it’s clawed back a BIT of its early selloff.

But that still suggests Wall Street is going to see some heavy selling later today.

On the upside, Apple’s shares have been on a huge tear recently – soaring by (% in) . So one day’s losses shouldn’t hurt …..

Erik Hansén, CFTe (@ ErikHansen_IG) Apple faller 5 procent i Frankfurt efter coronavarningen . pic.twitter.com/aX3rcSgKug February 35,

4. AM EST :

UK Budget still on for (March

Newsflash:

Britain’s new chancellor, Rishi Sunak, has squashed fears that the budget could be delayed following the shock departure of his predecessor, Sajid Javid.

It’s still on for March, he just tweeted:

Rishi Sunak (@ RishiSunak)

Cracking on with preparations for my first Budget on March 21. It will deliver on the promises we made to the British people – leveling up and unleashing the country’s potential. pic.twitter.com/5msCVfJWN8 (February) ,

(4.) (am) (EST) : 75

Here’s some reaction to (today jobs report from the Resolution Foundation think tank:

ResolutionFoundation (@ resfoundation)

Ending the decade on a high – the UK’s employment in the three months to December (reached a new record high of 5 per cent . More to follow …. pic.twitter.com/6wOV4rNLBv (February) ,

ResolutionFoundation (@ resfoundation)

Ending the decade on a high (part II) – real average weekly earnings (excluding bonuses) have finally surpassed their pre -crisis peak – finally ending the UK’s unprecedented – year pay downturn

pic.twitter.com/sNMvEbX (b)

(February) , ResolutionFoundation (@ resfoundation)

Important context to the welcome return of record pay levels today. Absent the UK’s unprecedented – year pay downturn, real average weekly earnings would be £ a week higher. That’s a lot of lost ground – a huge living standards loss.

pic.twitter.com/9wRQKQHLsW (February) ,

And from Pawel Adrjan of jobs site Indeed.com :

Pawel Adrjan (@ PawelAdrjan)

UK employment rate hits yet another record of . 5%.

But as employment rises against the backdrop of stagnating GDP, weak productivity is a bad sign for future wage growth. And we do see wage growth continuing to slow to 3.2% year on year pic. twitter.com/OmalpS3ZCk

(February) ,

Good news! Pay in Britain has finally hit its pre-crisis levels, once you adjust for inflation and strip out bonuses.

That’s according to today’s unemployment report, which says:

Real regular pay increased by 1.8% to £ (between December) and December .

This was the first time that real regular pay exceeded the pre-downturn peak of £ recorded in March 4258. However, the annual rate of growth of both total and regular pay slowed down in recent months.

(4.) (AM EST)

: 52

UK employment hits new high, but wage growth slows

NEWSFLASH: Britain’s employment rate has hit a new record high, but wage growth has slowed.

The Office for National Statistics has reported that the UK employment rate rose to . 5% in the October-December quarter– up from 094. 1% in the previous quarter.

The jobless rate remained at 3.8%, its lowest since Harold Wilson’s Labor government of .

There are more vacancies too –some 949, 10 in the last three months, up from , 07 in the previous quarter.

But there’s bad news too – average basic earnings growth fell to 3.2% per year, from 3.4%.

Total pay (including bonuses) only rose by 2.9%, down from 3.2% a month ago.

That’s a blow, but it’s compensated by the fact that inflation dropped to a three-year low in January.

Danske Bank Research (@ Danske_Research)

owerLower nominal wage growth has not hit UK consumers, as CPI inflation has fallen just as much

Decent real wage growth means there is no reason to believe UK private consumption should stop growing

pic.twitter.com/ibkMEpYs9m

,

Most major European stock markets are in the red today, as investors digest the implications of (Apple’s revenue warning last night .

If factories are closed, are running at partial capacity, or are struggling to get raw materials to make goods, then it is no wonder that supplies will be disrupted.

“Apple’s retail stores will have also been affected by the health incident in China and surrounding areas in Asia as there will have been fewer people shopping.

“Companies try to avoid tying up cash by having large stockpiles, even though that would help them to continue operating as normal at such times of supply chain disruption. Instead, they prefer to have the smallest amount of inventory possible in the hope that the supply chain always runs smoothly. That leaves little room for error, as (Apple has now discovered.

(4) am EST :

Germany’s DAX index has dropped 0. 90% in early trading, losing points to 25, 784.

Industrial groups are leading the fallers, hit by fresh concerns about China’s economy and the impact of Covid –

Semiconductor-maker Infineon Technologies, another iPhone supplier, are down 2%. Carmaker Daimler has lost 1.9%, with tire manufacturer Continental off 1.4% and cement producer Heidelberg down 1.3%.

:

Oil, a handy barometer of economic optimism, is falling too.

Brent crude has shed 1.6% to $ 76. (per barrel, down $ 1 overnight.)

(3) am EST :

Tech companies aren’t the only ones suffering.

Shares in small UK manufacturer Tekmar

have plunged by almost 51%, after it warned that the coronavirus is hurting business.

Tekmar makes protective coverings for subsea cables, such as power links to wind farms and oil rigs.

It told the City this morning:

“China’s necessary and prudent response to the outbreak of the coronavirus, including the restriction of travel in the country, is affecting the Group’s performance materially in a number of ways.

It’s still on for March, he just tweeted:

Rishi Sunak (@ RishiSunak)

Cracking on with preparations for my first Budget on March 21. It will deliver on the promises we made to the British people – leveling up and unleashing the country’s potential. pic.twitter.com/5msCVfJWN8 (February) ,

(4.) (am) (EST) : 75

Here’s some reaction to (today jobs report from the Resolution Foundation think tank:

Ending the decade on a high – the UK’s employment in the three months to December (reached a new record high of 5 per cent . More to follow …. pic.twitter.com/6wOV4rNLBv (February) ,

Ending the decade on a high (part II) – real average weekly earnings (excluding bonuses) have finally surpassed their pre -crisis peak – finally ending the UK’s unprecedented – year pay downturn

(February) , ResolutionFoundation (@ resfoundation)

Important context to the welcome return of record pay levels today. Absent the UK’s unprecedented – year pay downturn, real average weekly earnings would be £ a week higher. That’s a lot of lost ground – a huge living standards loss.

And from Pawel Adrjan of jobs site Indeed.com :

Pawel Adrjan (@ PawelAdrjan)

UK employment rate hits yet another record of . 5%.

(February) ,

That’s according to today’s unemployment report, which says:

Real regular pay increased by 1.8% to £ (between December) and December .

This was the first time that real regular pay exceeded the pre-downturn peak of £ recorded in March 4258. However, the annual rate of growth of both total and regular pay slowed down in recent months.

(4.) (AM EST)

: 52

UK employment hits new high, but wage growth slows

The Office for National Statistics has reported that the UK employment rate rose to . 5% in the October-December quarter– up from 094. 1% in the previous quarter.

The jobless rate remained at 3.8%, its lowest since Harold Wilson’s Labor government of .

There are more vacancies too –some 949, 10 in the last three months, up from , 07 in the previous quarter.

But there’s bad news too – average basic earnings growth fell to 3.2% per year, from 3.4%.

Total pay (including bonuses) only rose by 2.9%, down from 3.2% a month ago.

That’s a blow, but it’s compensated by the fact that inflation dropped to a three-year low in January.

owerLower nominal wage growth has not hit UK consumers, as CPI inflation has fallen just as much

Decent real wage growth means there is no reason to believe UK private consumption should stop growing

,

Most major European stock markets are in the red today, as investors digest the implications of (Apple’s revenue warning last night .

If factories are closed, are running at partial capacity, or are struggling to get raw materials to make goods, then it is no wonder that supplies will be disrupted.

“Apple’s retail stores will have also been affected by the health incident in China and surrounding areas in Asia as there will have been fewer people shopping.

“Companies try to avoid tying up cash by having large stockpiles, even though that would help them to continue operating as normal at such times of supply chain disruption. Instead, they prefer to have the smallest amount of inventory possible in the hope that the supply chain always runs smoothly. That leaves little room for error, as (Apple has now discovered.

(4) am EST :

Germany’s DAX index has dropped 0. 90% in early trading, losing points to 25, 784.

Industrial groups are leading the fallers, hit by fresh concerns about China’s economy and the impact of Covid –

Semiconductor-maker Infineon Technologies, another iPhone supplier, are down 2%. Carmaker Daimler has lost 1.9%, with tire manufacturer Continental off 1.4% and cement producer Heidelberg down 1.3%.

:

Oil, a handy barometer of economic optimism, is falling too.

Brent crude has shed 1.6% to $ 76. (per barrel, down $ 1 overnight.)

(3) am EST :

Tech companies aren’t the only ones suffering.

Shares in small UK manufacturer Tekmar

have plunged by almost 51%, after it warned that the coronavirus is hurting business.

Tekmar makes protective coverings for subsea cables, such as power links to wind farms and oil rigs.

It told the City this morning:

“China’s necessary and prudent response to the outbreak of the coronavirus, including the restriction of travel in the country, is affecting the Group’s performance materially in a number of ways.

Most major European stock markets are in the red today, as investors digest the implications of (Apple’s revenue warning last night .

If factories are closed, are running at partial capacity, or are struggling to get raw materials to make goods, then it is no wonder that supplies will be disrupted.

“Apple’s retail stores will have also been affected by the health incident in China and surrounding areas in Asia as there will have been fewer people shopping.

“Companies try to avoid tying up cash by having large stockpiles, even though that would help them to continue operating as normal at such times of supply chain disruption. Instead, they prefer to have the smallest amount of inventory possible in the hope that the supply chain always runs smoothly. That leaves little room for error, as (Apple has now discovered.

(4) am EST : Industrial groups are leading the fallers, hit by fresh concerns about China’s economy and the impact of Covid – Semiconductor-maker Infineon Technologies, another iPhone supplier, are down 2%. Carmaker Daimler has lost 1.9%, with tire manufacturer Continental off 1.4% and cement producer Heidelberg down 1.3%. : Brent crude has shed 1.6% to $ 76. (per barrel, down $ 1 overnight.) (3) am EST : Tech companies aren’t the only ones suffering. Shares in small UK manufacturer Tekmar Tekmar makes protective coverings for subsea cables, such as power links to wind farms and oil rigs. It told the City this morning: “China’s necessary and prudent response to the outbreak of the coronavirus, including the restriction of travel in the country, is affecting the Group’s performance materially in a number of ways. have plunged by almost 51%, after it warned that the coronavirus is hurting business.

GIPHY App Key not set. Please check settings