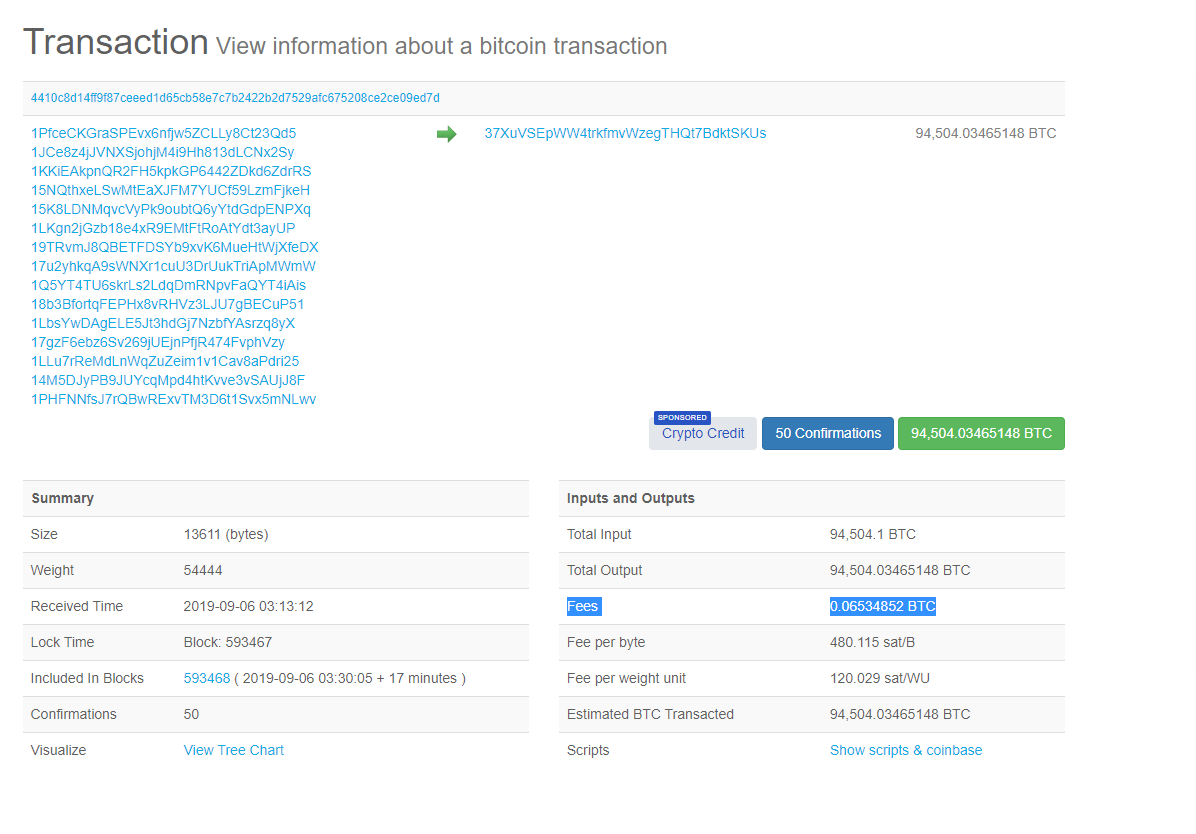

On September 6, more than $ 1 billion worth of bitcoin was sent from an unknown wallet. The transaction was processed within several hours with a $ 700 fee.

The Token Analyst team traced some of the 94, 500 bitcoin to the address of Huobi Global, a major cryptocurrency exchange, but the origins of the rest of the holdings remain unclear.

$ 1 Billion $ BTCwas transferred in one transaction yesterday. Where did that come from? ********

We took a look and saw that a large percentage of it could be traced to@ HuobiGlobaladdressespic.twitter.com/4jdeYMgyNG

– TokenAnalyst (@thetokenanalyst)September 6, 2019

In the past, large cryptocurrency exchanges and trading platforms in the likes of Binance sent bitcoin transactions in the range of hundreds of millions of dollars with small fees.

Binance just created the largest unspent transaction output existing today (but not all time) at (k BTC) nearly $ (M).https://t.co/Ot2ST 37 flU

– Antoine Le Calvez (@khannib)November 15, 2018

In November 2018, as CCNreported, Binance sent $ 600 million in bitcoin with a $ 7 fee, demonstrating the efficiency of bitcoin as a settlement layer.

Could the efficiency of bitcoin help it get a safe haven title

Wences Casares, the CEO of Xapo, wrote in an essay entitled “The case for a small allocation to bitcoin” that the efficiency of bitcoin as a decentralized network in processing information could allow it to become a major settlement layer and a network in the long term.

Based on the potential of BTC, Casares suggested the merit of a small allocation to BTC for portfolios exceeding $ 10 million of up to 1 percent.

He stated:

“The same is true for a global non-political standard of settlement. Only banks can participate in most settlement networks (like SWIFT, Fedwire, ACH in the US, CHAPS in the UK, SEPA in Europe, Visa and Mastercard, etc). Individuals, corporations and governments can only access these settlement networks through banks. Using these settlement networks takes time (sometimes days), the process is opaque and costly and, increasingly, the ability to use them is determined by political considerations. ”

In recent months, contrary to the performance of gold, bitcoin has struggled to perform strongly against the U.S. dollar, dropping by more than 30 percent since its yearly high amidst increasing geopolitical risks and uncertainty in the global market.

Analysts, like Alex Krüger said that bitcoin is not a macro asset yet and it is too early to consider it as a safe haven asset.

“Bitcoin is not yet a macro asset. It should become one as the market matures, as it’s increasingly seen as digital gold and is a hedge against the TAIL-RISK of fiat systems collapsing, i.e. a put option on central banks without expiry, ”henoted. *********************

However, in the long term, as bitcoin increasingly demonstrates non-correlation with the equities market and its potential as an efficient settlement layer, more investors are likely to view it as a safe haven asset. )

GIPHY App Key not set. Please check settings