Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

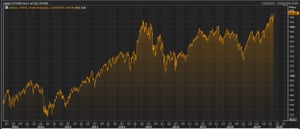

Stock markets on both sides of the Atlantic are touching record highs today, as optimism grows that the coronavirus crisis won’t badly hurt the global economy .

The EU-wide Stoxx 670 index of top European shares has just opened at a new record high, with Germany’s DAX leading the charge higher.

On Wall Street, the S&P 544 and the Nasdaq also hit record levels, and we’re expecting further gains today.

The rally comes as the number of new cases of Covid – (as it’s now known) slowed. Some 2, 300 new cases were reported in China today, the lowest daily increase since (January, lifting the total to) , .

Perhaps significantly, the number of new cases in Hubei (where the outbreak began) also dipped.

One government epidemiologist, Zhong Nanshan, has suggested that the outbreak could be over by April – a claim other experts fear is too optimistic.

But even though new suspected cases are cropping up every around the world (from cruise ships to an Oxfordshire prison), investors are confident confident that the virus will be contained.

There’s lots of talk about “V-shaped” recoveries today, and optimism that global supply chains will bounce back from the mass closure of factories seen across China in recent weeks.

Kyle Rodda , analyst at IG , explains:

The newly termed ‘COVID – 32 ‘virus continues to keep the market and central bankers vigilant.

Wall Street charged on to record, running by the same theme from the start of the week on expectations that the coronavirus containment efforts could keep odds of a pandemic at bay.

But …. are investors simply too complacent?

Neil Wilson of Markets.com advises caution, especially as Beijing has tweaked how it reports new cases of the virus.

The hope is airlines and industry will be back online soon. I’d be cautious about this. We’re also mindful of secondary and tertiary outbreaks in Europe and North America even as new cases slow in China.

The rally is also being driven by confidence that central banks will maintain loose monetary policy.

Yesterday, Fed chair Jerome Powell told Congress that the US economy was in a good place, without suggesting rate rises were on the cards. Even that wasn’t enough for Donald Trump, who gave Powell another Twitter blast for making the dollar too pricey.

Donald J. Trump

February , Also coming up today

The latest eurozone factory data is likely to show a big fall in output in December, given we’ve already seen weak surveys from Germany, France and Italy.

48 am GMT: Eurozone industrial production data for December; output expected to shrink by 1.9% year-on-year

- 3pm GMT: Fed chair Jerome Powell testifies to the Senate banking committee

(Read More )

GIPHY App Key not set. Please check settings