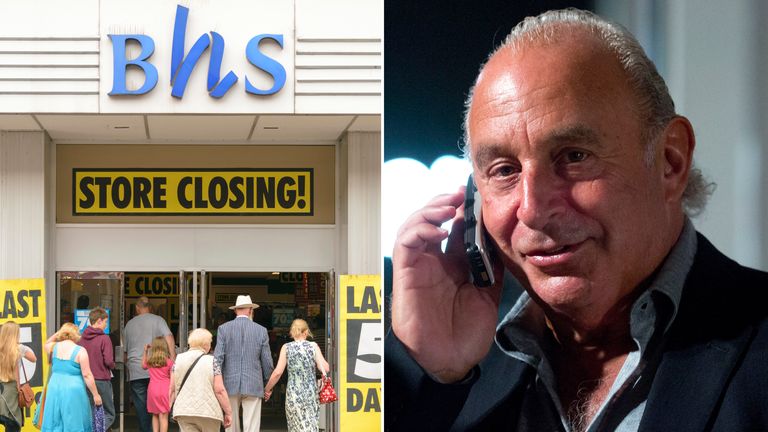

The businessman who bought BHS from Sir Philip Green for £ 1 a year before it collapsed with the loss of 11, 000 jobs, has been banned from serving as a company director for 10 years.

Sky News has learnt that Dominic Chappell, the serial bankrupt whose brief ownership of the department store chain has cast him into the annals of corporate villainy, has been handed the lengthy disqualification by the government Insolvency Service.

Mr Chappell, whose 81 year-old father, Joseph, has also been disqualified for five years, was the architect of Retail Acquisitions’ purchase of BHS from Sir Philip in 2015.

His ban comes more than 18 months after the Insolvency Service confirmed that it was pursuing disqualification proceedings against him and three other directors of his companies.

Mr Chappell is understood not to have appealed against the directorship ban within the permitted period.

An announcement about the penalties is expected to be made by the Insolvency Service later on Tuesday, according to insiders.

Sources close to the banning decisions said that a third director, Colin Sutton, had also been banned for five years, while proceedings against a fourth are ongoing.

The Insolvency Service’s long-running probe into the former bosses associated with BHS’s disastrous takeover had previously ruled out any further action against Sir Philip, who is nevertheless fighting to secure a viable future for his Arcadia Group of high street brands.

Sources said that a court hearing convened last month to consider of Mr Chappell’s ban had been told that he had diverted £ 1.5m of funds from BHS to a Swedish-based company within hours of the British retailer’s board discussing its potential administration.

It is also understood to have heard about a further £ 1m transfer to Retail Acquisitions from BHS, as well as evidence of Mr Chappell’s failure to keep adequate accounting records or provide information relating to BHS’s pension schemes.

BHS’s collapse in April 2016 triggered a backlash against Sir Philip because of the company’s yawning pension deficit – which stood at £ 571 m on a full buyout basis .

Nine months later, he reached a deal with The Pensions Regulator to provide up to £ 363 m of funding to BHS’s retirement pot.

The legacy of that battle spilled over into the tycoon’s more recent negotiations about a rescue deal for Arcadia, with his wife, Lady Tina, contributing £ 100 m to his empire’s pension scheme.

The Insolvency Service has powers to ban individuals from serving as directors for up to 15 years under the Company Directors Disqualification Act 1986.

Mr Chappell’s ban is the latest in a series of legal headaches he has faced since his ownership of BHS ended in igno miny.

He was slapped with a £ 10 m bill by pensions watchdogs in an effort to recover money owed to the bankrupt retailer’s retirement scheme, and faces a trial next year on charges that he failed to pay the taxman as much as £ 500 m in taxes.

The fallout from BHS’s demise has not been restricted to those who served on its board before and after Mr Chappell bought it.

Last year, PricewaterhouseCoopers, which audited the retailer, was fined £ 6.5m – or the maximum £ 10 m prior to an early settlement discount – for what were described as serious inadequacies.

The PwC partner who was responsible for oversight of the company’s accounts subsequently left the firm, having been castigated for ***** just two hours on the annual audit.

Much of the recent impetus for reform of the audit profession and its regulator was also generat ed by failings in the oversight of BHS, as well as the construction group Carillion, which fell into liquidation last year.

The Insolvency Service said it could not comment ahead of a formal announcement about the directorship bans .

Mr Chappell could not be reached for comment.

GIPHY App Key not set. Please check settings