House prices jump: What the experts say

Here’s some snap reaction tothe surprise rise in UK house prices last month:

Mark Harris, chief executive of mortgage brokerSPF Private Clients:

‘It might be a little surprising to see the biggest monthly rise in house prices since February but the end of year can see a spike in sales as people aim to be in their new home for Christmas.

Jonathan Hopper, managing director ofGarrington Property Finders:

With average wages rising at more than twice the rate of consumer inflation, homes are becoming steadily more affordable in many parts of the country.

“Mortgages remain cheap and the relative lack of competition among buyers, even for good homes, is enticing more strategic buyers to pounce.

“For now, the election has brought forward the traditional December slowdown, adding to the build-up of delayed demand.

Lucy Pendletonof estate agentsJames Pendleton:

“Contributing to the pick up in the annual pace of growth is the London market, which has started to bubble away again.

“In the capital, a big jump in the number of sales going to best-and-final offers is going hand in hand with increasing footfall through front doors as buyers’ appetites return.

UK house prices jump

Just in: UK house prices jumped 1% in November, the fastest monthly rise in seven months.

That’s according to mortgage lender Halifax, and suggests that the clouds of political uncertainty may be lifting a little.

On an annual basis, prices were 2.1% higher than a year ago, Halifax reports.

Russell Galley, managing director at Halifax, explains that low interest rates – and a shortage of properties – are keeping prices up.

“Average house prices rebounded somewhat in November, with annual growth of 2.1% being driven by the biggest monthly rise since February, following two months of modest falls.

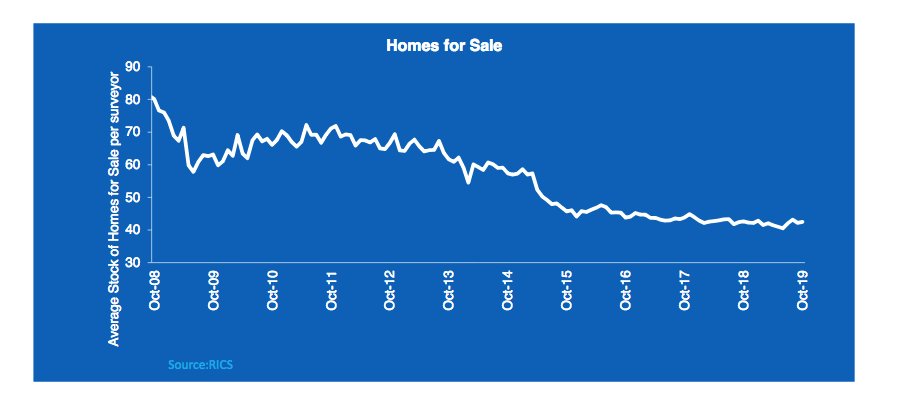

Prices are now up by £ 3, 904 since the start of the year. While a degree of uncertainty remains evident, it’s also clear that buyers and sellers are responding to factors such as improved mortgage affordability and the limited supply of available properties.

It is these issues which we believe will continue to underpin the resilience evident in the market for most of 2019. Over the medium term we expect the emerging trend of modest gains to continue into next year. ”

Ioan Smith(@ moved_average)

# UKHalifax house price index … housing stock is still pantspic.twitter.com/OpXwltw2kW

German recession fears after ‘disastrous’ factory data

The slump in German factory output in Octoberis so bad that it could drag the wider economy back towards recession.

Oliver Rakau of OxfordEconomicssays the plunge in production is “disastrous”, and could mean that the economy shrinks in the final quarter of this year.

Germanyonly just dodged a recession, with modest growth in Q3, but Q4 is not starting well. Earlier this week, factories reported a drop in orders, which could signal further weakness in the months ahead.

This is a disastrous industrial production number out of Germany. Production tumbled 1.7% m / m in October marking a new cyclical low, which is likely to push Q4 GDP trackers into negative territory. 1 / n

Oliver Rakau(@ OliverRakau)

The drop resulted primarily from sharp production cuts in the capital goods sector & in construction, while consumer and intermediate goods rose. The 1% gain for intermediates furthers the signals of bottoming out there as inventory adjustments look to have run their course. 2 / n

Oliver Rakau(@ OliverRakau)

On intermediates, the strong rise in chemical output was a positive. Within capital goods, the car sector, mechanical engineering and heavy transport equ. were weak spots, but electronics was positive. 3 / n

Oliver Rakau(@ OliverRakau)

And remember that Oct. industrial turnover was reported flat-ish & is less revision prone. So, the risks of a Q4 GDP contraction have risen after the weak retail & industrial reports, it is too early into the quarter to give up given the usual volatility in German data. 5/5

Today’s data suggests that the German economy is continuing to flirt with stagnation and contraction in the final quarter of the year.

Capacity utilization has dropped to its lowest level since early 2013. At the same time, the well-known supply-side constraints have also started to ease but not with the same magnitude as capacity utilization. The lack of skilled employees and too little equipment as limiting factors have dropped to their 2017 – levels, suggesting that the current slump in manufacturing is still a combination of supply-side and demand-side factors.

Looking ahead, both soft and hard indicators bode ill for industrial activity in the months ahead. Production expectations show very tentative signs of stabilization at low levels but order books are still shrinking and inventories remain high. Trade conflicts, global uncertainty and disruption in the automotive industry have put the entire German industry in a headlock, from which it is hard to escape.

Updated

Analysts: Biggest fall in German industrial production in a decade

Introduction: German industrial output falls sharply

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

2019 is turning into a year to forget forGermany. Factory output has slumped again as problems at home and abroad batter Europe’s largest economy.

Industrial output fell by 1.7% month-on-month in October, new figures show. That’s much worse than expected, showing that the recession across German factories hasn’t eased up.

On an annual basis, output was 5.3 % lower than in October 2018, as trade tensions and problems in Germany’s car industry have hurt activity.

The decline was driven by a 4.4% month-on-month slide in production of capital goods – the pricy heavy-duty machinery and equipment that has been the bedrock of Germany’s economy.

Germany’s problems are part of a wider picture – manufacturing data has been weak around the globe this year as the world economy has slowed. But it has certainly suffered more than most.

Germany’s economy ministry fears that it could take several months for the situation to stabilize. It says:

“The economic weakness in industry remains.

However, the latest developments in new orders and business expectations indicate that a stabilizing trend could emerge in the coming months. ”

Reaction to follow ….

Also coming up today

Investors will scrutinise the latest US jobs report for signs that America’s labor market is slowing.

Over in Vienna, Opec are trying to hammer out a 500, 000 barrels / day cut to oil production levels. There’s clearly a disagreement over how to implement the deal – ministers talked late into the night, when they were due at a gala dinner to celebrate the success of the alliance #awkward.

European stock markets are expected to open higher, shaking off the jitters that sparked a selloff earlier this week. Traders are still hoping for progress in the US-China trade talks, before the 15 December deadline when Washington could impose new tariffs.

IGSquawk(@ IGSquawk)

European Opening Calls:# FTSE7161 0. 33%# DAX( 0. 57% # CAC5831 0. 51% (# AEX) 595 0. 63% # MIB ( 0.) %# IBEX9293 0. 54%# STOXX3670 0. (%) December 6, 2019

And the future of UK trucking business Eddie Stobart will be decided today, as shareholders vote on a rescue plan.

My colleague Jasper Jolly explains:

The vote will pit William Stobart, the third son of the company’s founder, against his childhood friend and former brother-in-law, Andrew Tinkler.

If their competing bids fall through, the company could collapse under the weight of a huge debt pile months before its 50 th birthday.

The agenda

- 1. 30 pm GMT: US non -farm payroll for November.Expected to show 183, 000 new jobs created, up from 128, 000

GIPHY App Key not set. Please check settings