Still image from the boom of SpaceShipTwo (via Virgin Galactic’s Twitter page ).

Virgin Galactic Shares Shoot Into Space

Since early December, shares of Virgin Galactic (NYSE:

SPCE ) have more than quadrupled in value.

The spike in SPCE shares – and in the huge volume in call options traded on those shares – was the subject of a Bloomberg article Tuesday by Luke Kawa and Bailey Lipschultz (“Virgin Galactic Frenzy Starting To Look A Little Like Tesla” Run “). In it, the authors noted that call option volume had jumped from a notional value of about 0.5% of Virgin Galactic’s market value at the end of 131469 to nearly 19% of its market value this week. They pointed out that traders buying calls on the stock could itself be driving the stock higher:

Derivatives that can extract even more gains from Virgin Galactic have become a favorite among retail investors, judging by activity on message boards like r / wallstreetbets . When a fresh option is written, a dealer who sells it will typically hedge their exposure by buying a certain amount of the stock so as not to accumulate a short position, and will tend to buy more shares in the event of a continued rally.

To give you a flavor for the Reddit message board Bloomberg linked to there, it includes messages such as “ $ SPCE will make me a millionaire “. If you’re long SPCE and want to add some downside protection here, given the bubbly recent price action, we’ll look at a way of doing so below.

Adding A Parachute To Virgin Galactic Shares

Because Virgin Galactic shareholders from last year are sitting on large gains, I decided to use a larger decline threshold when scanning for hedges for it. I scanned for the optimal, or least expensive, static hedges to protect against a greater-than – % drop in 1 , 17 shares of the stock by next January. Here’s what I found.

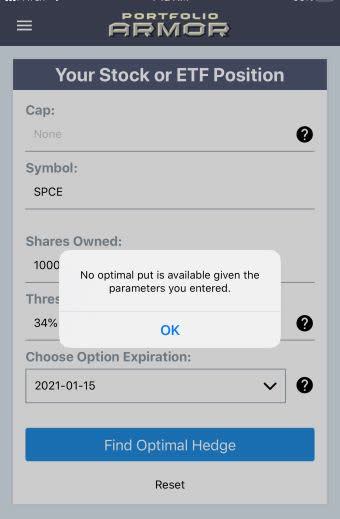

Uncapped Upside – Unavailable

As of Tuesday’s close, it was too expensive to hedge SPCE against a> % decline by next January with optimal puts. If you scanned for them, you received this error message notifying you of that.

What that error message means, in this context, is that the least expensive puts to protect against a> % decline in the stock over this period cost more than 38% of your position value.

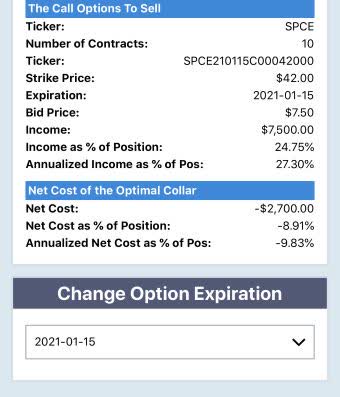

Capped Upside, Negative Cost

If you were willing to cap your possible upside at % by next January, this was the optimal collar to protect against a> % drop by then.

Here, the net cost was negative, meaning you would have collected a net credit of $ 2, 649, or 8. 366% of position value, when opening this hedge, assuming you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

Here, the net cost was negative, meaning you would have collected a net credit of $ 2, 649, or 8. 366% of position value, when opening this hedge, assuming you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads.

Wrapping Up: Possible Upside Net Of Hedging Cost

Recall that the collar above was capped at 90. That was your possible upside not taking into account hedging cost. To get your possible upside net of that, you need to subtract the hedging cost from the cap: (% -) -8. (%)=(% 8.) (%=) 335%. While a nearly 73% decline may seem sedate compared to the ride some of you have had so far on Virgin Galactic, it may be an approach to consider here. Bear in mind that, if the stock corrects between now and January, you can potentially use that opportunity to buy back the short leg of your collar at a much lower price, thus removing your upside cap.

Better Returns By Reducing Outliers

Better Returns By Reducing Outliers

I take a unique approach to security selection in my Marketplace service, working to generate better returns by reducing outliers. The top names I select using this process are significantly less expensive to hedge than Virgin Galactic. You can read about my approach in this article, “ Better Returns By Reducing Outliers “.

GIPHY App Key not set. Please check settings