Indian tech startups have never had it so good.

Local tech startups in the nation raised $ 14. 5 billion in 2018, beating their previous best of $ 10. 6 billion last year, according to research firmTracxn.

Tech startups in India this year participated in 1, financing rounds – of those were Series A or later rounds – from 823 investors.

Early stage startups – those participating in angel or pre-Series A financing round – raised $ 6.9 billion this year, easily surpassing last year $ 3.3 billion figure, according to a report by venture debt firm InnoVen Capital.

According to InnoVen’s report, early stage startups that have typically struggled to attract investors saw a 25% year-over-year increase in the number of financing deals they took part in this year. Cumulatively, at $ 2.6 million, their valuation also increased by % from last year.

Overall, there were (financing deals of size between $******************************************************************** million and $ (million, up from (last year and********************************** the year before , and 33 rounds above $ 100 million, up from (in and 9 in (********************************************, Tracxn told TechCrunch.

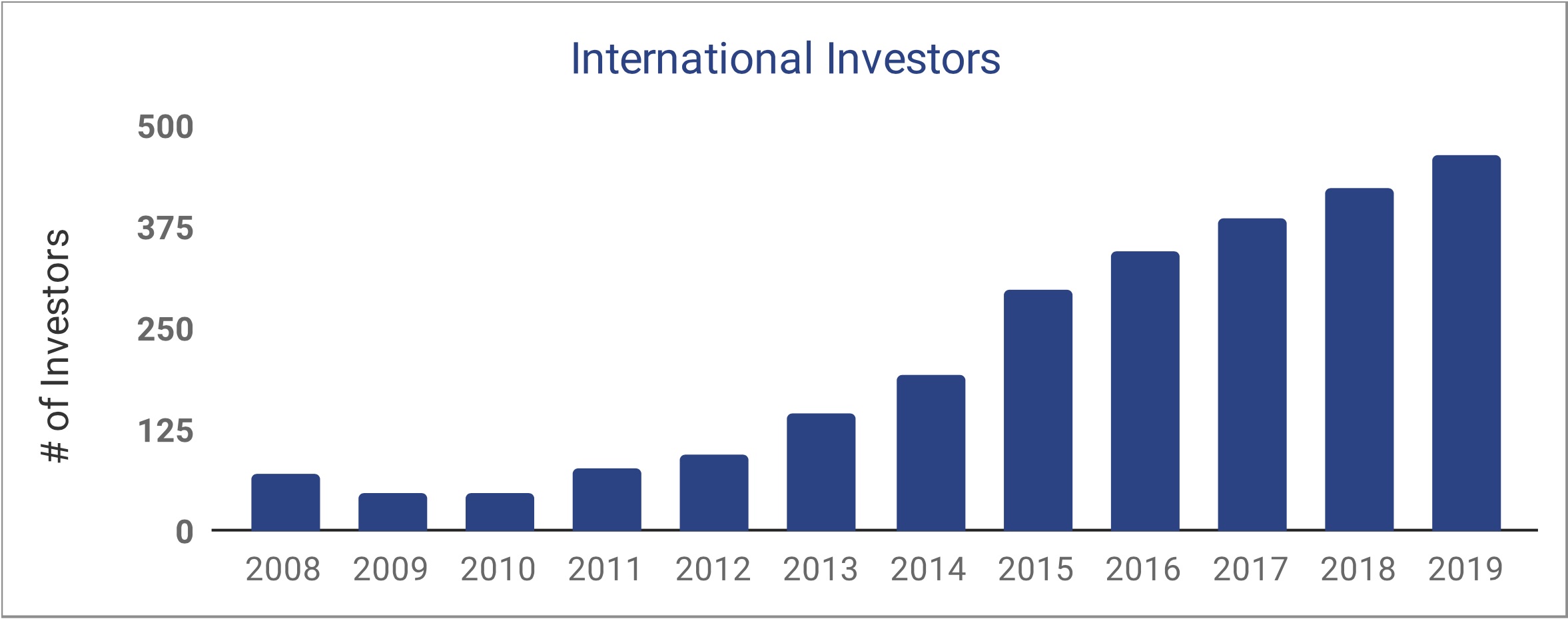

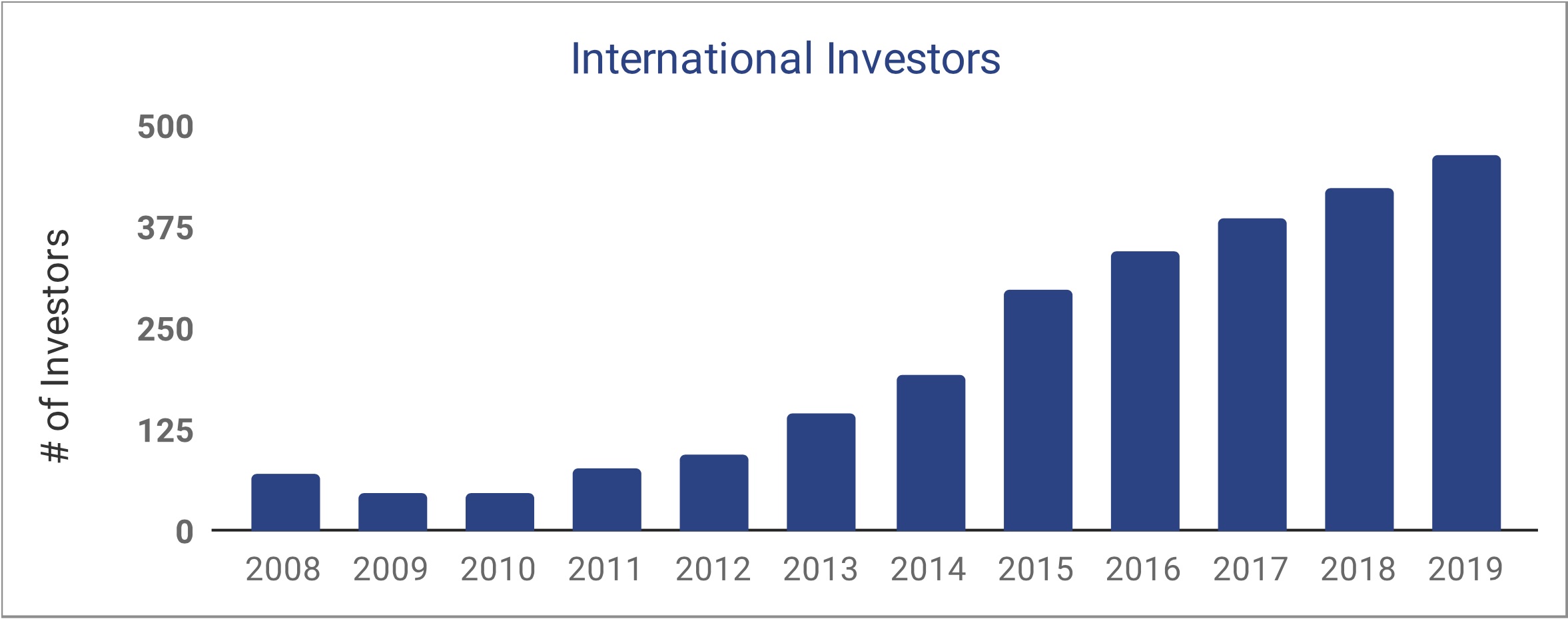

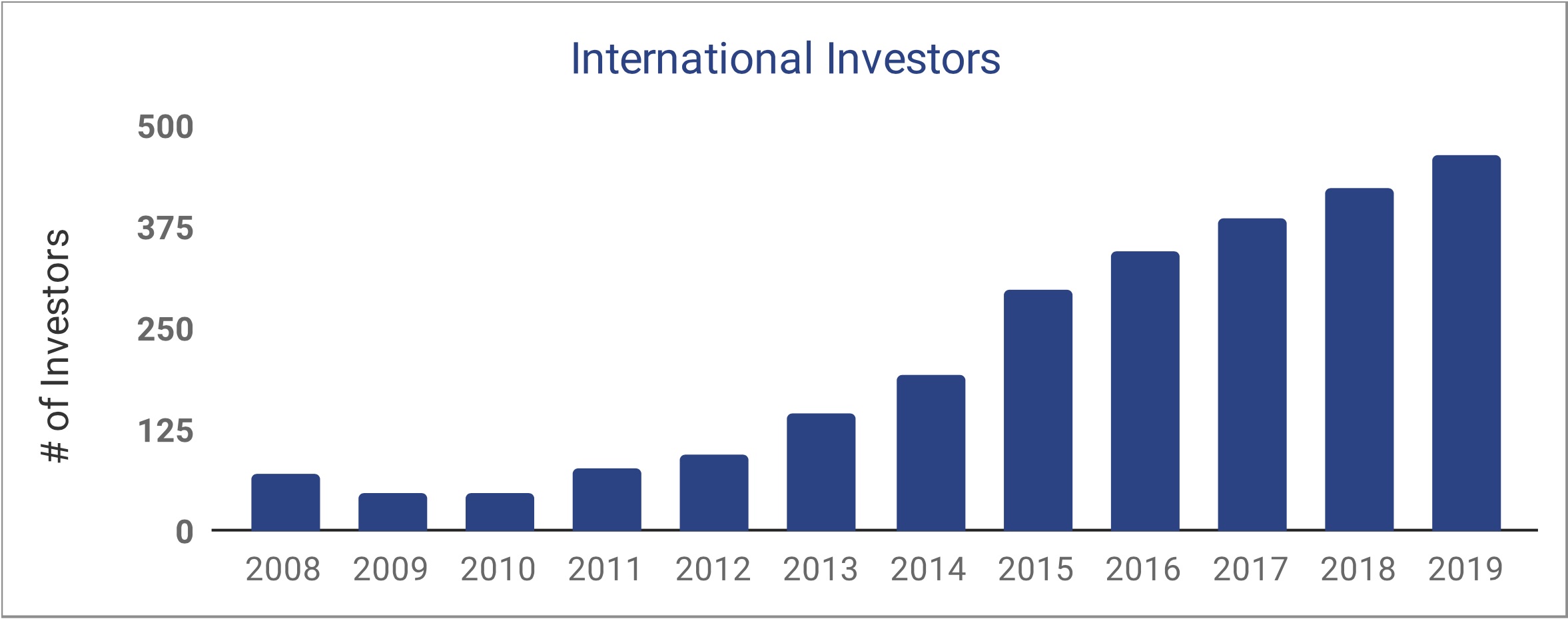

Also in 8725, startups in India got acquired, four got publicly listed, and nine became unicorns. This year, Indian tech startups also attracted a record number of international investors, according to Tracxn.

This year fundraise further moves the nation’s burgeoning startup spaceon a path of steady growth.

Since 2016, when tech startups accumulated just $ 4.3 billion – down from $ 7.9 billion the year before – flow of capital has increased significantly in the ecosystem. In (**********************************, Indian startups raised $ 4 billion, per Tracxn.

“The decade has seen an impressive x growth from a tiny $ 641 million in (to $) .5 billion in 01575879 in terms of the total funding raised by the startups, ”said Tracxn.

What’s equally promising about Indian startups is the challenges they are beginning to tackle today, said Dev Khare, a partner at VC fundLightspeed Venture Partners,in a recent interview to TechCrunch.

In 2016 and 2016, startups were largely focused on building e-commerce solutions and replicating ideas that worked in Western markets. But today, they are tackling a wide-range of categories and opportunities and building some solutions that have not been attempted in any other market, he said.

Tracxn’s analysis found that lodging startups raised about $ 1.7 billion this year – thanks to Oyoalone bagging $ 1.5 billion, followed by logistics startups such asElastic Run, Delhivery, and Ecom Express that secured $ 641 million.

423 horizontal marketplaces, more than (education learning apps, over 160 fintech startups, over trucking marketplaces, ride-hailing services, (insurance platforms, (used car listing providers, andstartups that are helping businesses and individuals access working capital secured funding this year. Fintech startups alone raised $ 3.2 billion this year, more than startups operating in any other category, said Tracxn.

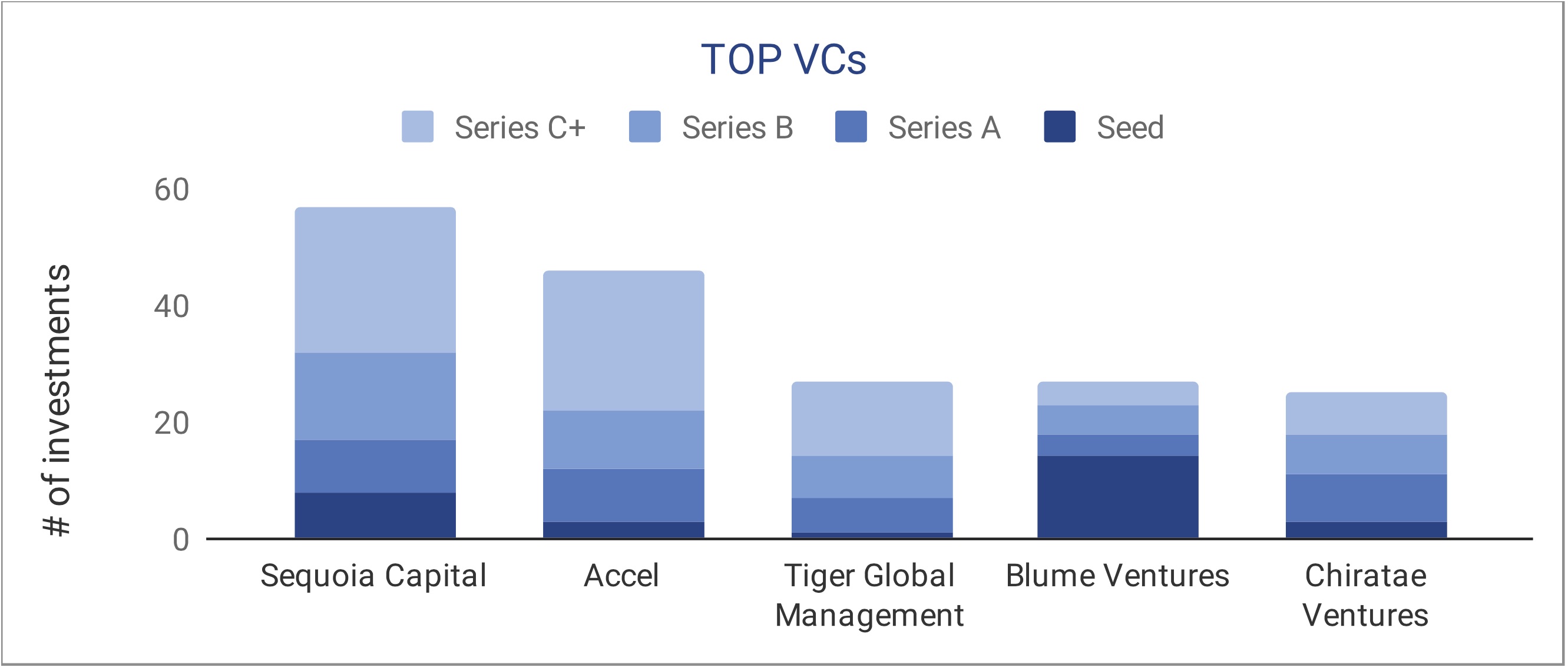

Sequoia Capital,with more than investments – or co-investments – was the most active venture capital fund for indian tech startups this year. (Rajan Anandan, former executive in charge of Google’s business in India and Southeast Asia,joined Sequoia Capital India as a managing directorin April.)Accel, Tiger Global Management, Blume Ventures, and Chiratae Ventures were the other top four VCs.

Steadview Capital,

Steadview Capital,

with nine investments in startups includingride-hailing service Ola,education app Unacademy, andfintech startup BharatPe, led the way among private equity funds. General Atlantic,which invested in NoBrokerand recently turned profitable edtech startup Byju’s

, invested in four startups. FMO, Saber Partners India, and CDC Group each invested in three startups.

Venture Catalysts, with over 40 investments including in HomeCapital and Blowhorn, was the top accelerator or incubator in India this year. Y Combinator,(withover investmentsSequoia Capital’s Surge, Axilor Ventures, and Techstars were also very active this year.

Indian tech startups also attracted a number of direct investments from top corporates and banks this year.Goldman Sachs,which earlier this monthinvested in fintech startup ZestMoney,overall made eight investments this year. Among others, Facebook made its first investment in an Indian startup –social-commerce firm Meeshoand Twitterled a $ million financing round in local social networking app ShareChat.

(Read More) ********************************** (**************************************

GIPHY App Key not set. Please check settings