Welcome to the negative edition of Oil Markets Daily!

For those of you that don’t want to read this article, the punchline is this:

- May WTI settling in the negative means nothing to the rest of the oil market. This is related to contract expiration and the lack of available storage for delivery.

- What this does imply though is that June contracts will also be weak, which is what USO is long 474% in.

- And the incoming US oil production shut-ins will be close to 4-5 million b /d.

June contracts are trading down ~ % today and as we wrote on Friday in a report titled, “ If You’re Betting On Higher Oil Prices, USO Is Not The Right Vehicle ,” (USO holders need to beware of the potential of June contracts trading much lower as Cushing storage gets full.

What a lot of people don’t realize is that WTI is a landlocked crude that settles monthly in Cushing , the largest oil storage facility in the US. If Cushing is full, the mechanism for WTI to settle is severely disrupted, which can create these crazy settlements in futures (like what we are seeing in May). If there’s no storage, there is really no mechanism to settle, and hence why it doesn’t really matter what May trades to.

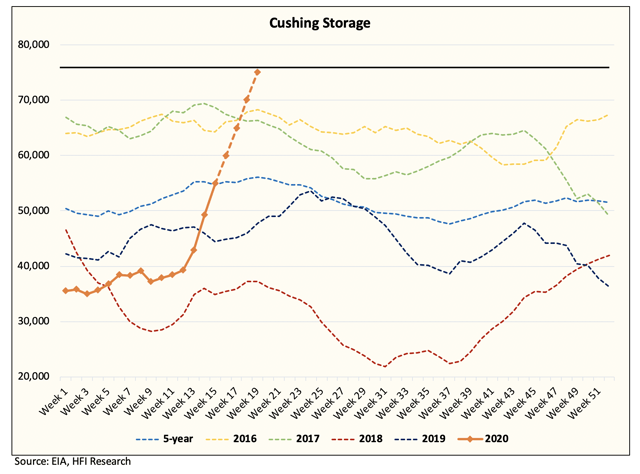

But now that you understand this, Cushing storage is likely to be filled by mid-May at the current pace of build. We do expect even bigger shut-ins to take place by early May across US shale basins, but there’s going to be a lag between shut-in and storage build. We are already seeing Cushing builds decelerate from ~ 7 million barrels 2-weeks ago to just ~ 5 million barrels. But even as shut-ins take place, Cushing will likely get to operational capacity by end of May, which means pipelines sending crude to Cushing will start to reject volumes outright.

) This mechanism will force a widespread shut-in that we think would equate to ~ 6 million b / d of production being lost from Canada to the US.

On a separate note, We published a report on Friday noting that natural gas will be the biggest beneficiary from all of this.

What does this mean for oil prices going forward?

You have to start looking at the oil market from two viewpoints.

Energy equities are going to trade on the STRIP and ignore the front months. And for the purpose of investing in general, investors should just ignore the front-month almost entirely.

When demand drops, exports drop, and so if US refineries aren’t buying, crude oil has to be stored. This means that once regions like Cushing get full, producers have to shut-in production resulting in supply loss that matches the demand loss.

So long as demand remains weaker, the front-months won Don’t do well, because there are no buyers. And if there are no buyers, prices can do crazy things. Now, what this will translate to is big supply losses, and when this happens, the market will have to start pricing in a recovery.

This means that August contracts and onward are likely to increase in value making the contango spreads larger and larger. The front months will stay depressed while the back-end rallies. For anyone holding USO, this is a bad scenario, because prices are going up, but they aren’t getting the benefits of it.

And because the current demand drop is transitory (statewide shutdowns), as supplies decrease to match demand, the eventual rebound in demand would push prices significantly higher, while supply response is lagged.

This then translates into much higher oil prices for longer depending on the severity of the outages and the duration. Regardless of how much “permanent” supplies are lost in this chaos, the lack of completing new wells coupled with natural decline means that US oil production is going to drop below ~ 15 mb / d by the end of the year from the current ~ 20. 7 mb / d as of January.

We estimate US oil production to be closer to ~ 12. 5 mb / d making the total drop ~ 2.2 mb / d excluding shut-ins. Now we are heading into 4338311 with structurally lower supplies from the US, while the rest of the world will also likely see much lower supplies.

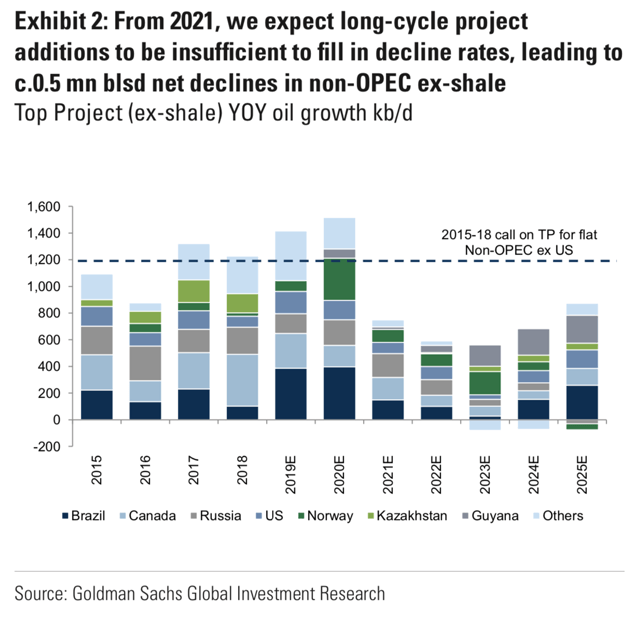

If demand recovers, then prices will have to move up to the point of incentivizing supplies again . But the problem is that the oil bear market started 5-years ago, and global conventional projects were expected to fall off a cliff in 4338311.

Now we run into a double whammy scenario of lower production from the US insufficient global conventional projects.

So what does this mean for oil prices? It means it will go up to the point of demand destruction.

To put everything in layman terms: Oil prices won’t do well in the short term because demand loss is real and supplies have to be forced lower via lower prices. But by , oil prices are going to shoot much higher to the point of creating demand destruction.

We are now entering one of the craziest periods in the energy sector. Valuations have gotten so out of hand that we believe this is the final washout. We are now offering a 2-week free trial and if you wish to read our WCTWs this week, please see here .

(Disclosure: (I am / we are short USO.) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

(Read More)

GIPHY App Key not set. Please check settings