M & G’s moveis the first suspension of a major property fund since the panic after the Brexit vote (explained here), says the Financial Times.

Here’s its take:

Fund manager M&G has suspended trading in its £ 2.5bn Property Portfolio, which is marketed to retail investors, after facing “unusually high and sustained outflows” it blamed on Brexit and the retail downturn.

The fund is the first major open-ended property fund to halt redemptions in this way since the crisis in the sector that caused seven funds to “gate” in 2016 following the Brexit referendum – one of the most high-profile market consequences of the vote to leave the EU.

M&G, a London-listed asset manager, said the pressure of outflows had exceeded the speed at which it can sell properties, leading it to suspend any redemption requests arriving after midday on Wednesday.

More here:M&G suspends £ 2.5bn property fund on Brexit and retail woes

Updated

Signs of distress at M & G’s Property Portfolio fund have been building in recent weeks, leading totoday’s suspension.

Last month, M&G carried out an unusual ‘intra-month valuation update’, having spotted a material (downward) move in its assets.

This update revealed that M & G’s retail property assets had lost 7.7% of their value, due to a “marked deterioration” in the retail sector.

The company says the rise of internet shopping, and the collapse of several high street chains, were to blame:

It is has been well documented that the bricks and mortar retail sector is suffering substantial headwinds. The rise of e-commerce coupled with recent retailer failures is increasing uncertainty across the sector. Retailers are reluctant to pay high rents and investors are decreasing their appetite for retail assets.

(Transaction volumes have decreased by 24% compared to the same period in 2018). Even in highly sought after locations such as Bath and Manchester, rents have declined over the last (months.

In October,fund industry tracker Morningstar spotted that £ 2bn of cash had left property funds this year– with M&G losing £ 750 m alone. That was an “echo” of the stampede after the Brexit vote, Reuters reported.

The BBC’s Simon Gompertz has also heard that the cash reserves in M & G’s property fund have run rather low, forcingtoday’s suspension.

Simon Gompertz(@ gompertz)

M&G fund suspension: I understand the Property Portfolio fund had only 5% cash and dropping, as investors pulled out money, compared with 15 – 20% with other property funds

We’ve been here before ….

Readers might also remember that a swathe of property funds were temporarily frozen after the EU referendum in 2016.

Two weeks after the vote, around £ 18 bn was locked upas asset managers barred the doors, to give time to sell office blocks and shops in order to meet redemption requests.

The fundamental problem is that these funds are open-ended, allowing a retail investor to put money in and take it out again as they like. Until too many of them want to cash in at once.

Merryn Somerset Webb, editor in chief ofMoney Week, says there is a structural problem here :

Merryn Somerset Webb(@ MerrynSW)

M&G Property Portfolio. Dealing suspended. Time for another conversation about liquid assets in open ended daily traded vehicles? Letter blames# Brexit. But better to blame the structure?https://t.co/DmH 0501 OXU

Updated

The BBC’s Simon Gompertz is tweeting a handy explanation toM & G’s shock property suspension:

Simon Gompertz(@ gompertz)

Temporary suspension in dealings in M & G’s big Property Portfolio investment fund, worth £ 2.7bn. Blames blight on UK shopping centers and streets, along with Brexit

Simon Gompertz(@ gompertz)

Property funds are like funds dealing in unlisted shares (eg Woodford Equity Income) in that they can’t sell assets quickly if investors start pulling their money out

Simon Gompertz(@ gompertz)

Investors pulled £ 750 m out of the M&G Property Portfolio fund in the first 8 months of the year

Shares in M&G have fallen by 2% since it suspended the Property Portfolio fund.

M&G: We know it’s very frustrating …..

M&G is also waiving around a third of the management fee it charges investors – to address the frustration they’ll feel about being locked into the Property Portfolio.

It says:

The funds will still be actively managed during suspension, but we understand that being unable to deal in the funds is very frustrating for our customers. In recognition, M&G is waiving 30% of its annual charge, which will end when the funds resume dealing.

Suspension will be formally reviewed on a monthly basis and we will inform investors if the level of discount changes. In all other respects, the funds will operate as normal and you will continue to receive income payments, fund reporting and updates as usual

This surprise suspension will allow M&G breathing room to raise cash (by selling property) so it can pay people who want to redeem their investment in the Property Portfolio.

It says:

In accordance with the Fund’s strategy, the suspension will allow the fund managers time to raise cash levels to pay redemptions, whilst ensuring that asset sales are achieved at market prices and investors in the Fund are safeguarded. In all other aspects, the Fund will continue to operate as normal throughout the suspension and customers will continue to receive income payment.

M&G suspends dealings in property fund

NEWSFLASH: One of Britain’s biggest fund managers has just suspended dealing in its multi-billion property fund.

M&G has blamed Brexit for the temporary move, saying political uncertainty has made it hard to sell property assets to meet redemption requests from investors in its Property Portfolio.

The crisis on the high street – with many retailers shutting stores – is another factor.

In a letter to investors, M&G says:

In recent months, continued Brexit-related uncertainty and ongoing structural shifts in the UK retail sector have prompted unusually high outflows from our property fund for retail investors.

Given that these circumstances and deteriorating market conditions have significantly impacted our ability to sell commercial property, we have temporarily suspended dealing in the interests of protecting our customers.

The assets owned by the M&G Property Portfolio, such as office buildings and shopping centers, are held for the long term and take time to buy and sell, making it difficult to immediately meet sudden and sustained levels of redemptions. Suspending the funds at this time will allow the fund managers, Fiona Rowley and Justin Upton, time to restore the cash levels by selling assets in an orderly manner and preserve value for our investors.

What does it mean?

The Property Portfolio holds 91 commercial properties across the UK, and manages assets of £ 2. 54 billion.

Funds of its type take money from investors, invest it in commercial property assets, and pay returns from rental payments and capital appreciation.

As M&G points out, those properties are hard to sell quickly (unless you accept a firesale price). So if too many investors want to withdraw their money at the same time, the fund can struggle to meet those redemptions.

Trump: China talks are going well

Back on trade ….Donald Trumphas told reporters in London that talks with China are going “very well”.

During a press event with German chancellor Angela Merkel, Trump said:

Discussions are going very well, and we’ll see what happens.

That’s a more upbeat assessment than yesterday, when the president hinted that he might not sign off a deal for another year.

This is likely to reassure markets; a cynic might question whether Trump is keen to reverse yesterday’s selloff with some good publicity.

But the BIG headlines are on Trump calling Justin Trudeau “two-faced” after video emerged showing Canada’s PM laughing about Trump with Boris Johnson, Emmanuel Macron, Mark Rutte and Princess Anne.

Updated

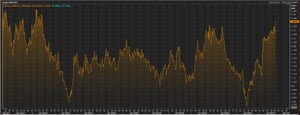

Pound hits 31 – month high vs euro

Boom! Sterling has now hit its highest level against the euro since May 2017.

General election speculation has driven the pound up to € 1. 182 against the single currency, a 31 – month high.

Traders are increasingly betting on a Conservative victory next week. The pound is also benefitting from the fact thatthis morning’s service sector data was less bad than feared(but really not good!).

We should remember, though, that one pound was worth € 1. (before the Brexit referendum ….)

Ian Strafford-Taylor, CEO of currency and payments firmEquals, suggests the pound is still vulnerable to political drama:

“The pound is now trading at its highest level in over two-years off the back of more election rumors and polls, showing once again how it is at the mercy of British politics. As it stands the pound is at 1. 18 against the euro which we haven’t seen since May 2017. ”

“However, the outcome of next week’s general election will not spell the end of the pound’s rocky journey as the future of the UK’s relationship with the EU remains uncertain. We’ve seen in the run-up to past elections that the pound has had a turbulent time, and with more than just a new Prime Minister at stake we shouldn’t get used to these kinds of rates just yet. ”

Newsflash: Rather fewer jobs were created at American companies last month than expected, a new report shows.

The ADP payroll, which measures US employment, has risen by 67, 000 in November, much weaker than the 140, 000 which Wall Street expected.

October’s payroll has been revised lower too, to 121, 000 from 125, 000.

This might be a sign that the US economy is losing momentum; we’ll get a better picture on Friday, when the broader Non-Farm Payroll survey of US labor is released.

Sterling is continuing to climb, and is now up a whole cent today at $ 1. 309.

That’s a new seven-month high against the US dollar, the strongest position since May 7th.

Aviation News: Budget airline Ryanair is planning to close two bases, due to the ongoing delays to Boeing’s 737 MAX jet.

Ryanair says it now expects to only receive 10 737 MAX aircraft in time for next summer, not The 20 previously expected. That means it will carry a million fewer passengers – 156 m, not 157 m – and force it to shutter operations at Nuremberg and Stockholm Skavsta.

Boeing is still trying to get the 737 Max recertified, following the two fatal crashes blamed on a flawed anti-stall mechanism.

Updated

GIPHY App Key not set. Please check settings