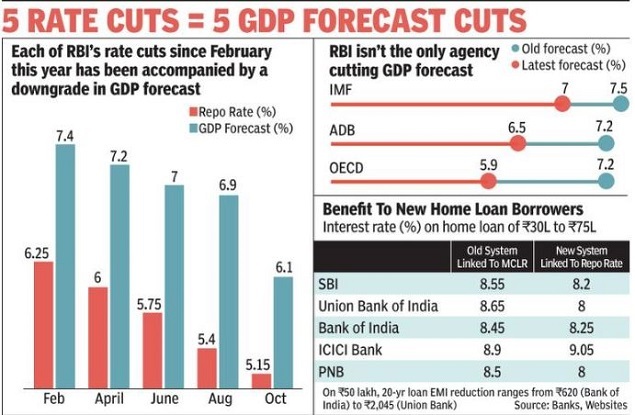

MUMBAI: As expected, the Reserve Bank of India (RBI) lowered its key policy rate yet again on Friday – the fifth successive time this year that it has done so in a bid to spur slowing economic growth. The latest cut, by a quarter percentage point, brought the benchmarkrepo rate(the rate at whichRBIlends to banks) to a nine -year low of 5. 15%. But the news was overshadowed by the RBI’s announcement that it was sharply reducing India’s growth forecast for the fiscal year to 6.1% from 6.9% earlier. Spooked investors promptly went into selling mode, resulting in the Sensex falling 434 points to 37, 673.

The five repo rate cuts that have taken place during RBI governorShaktikanta Das‘s tenure collectively add up to 135 basis points (bps). While the earlier 115 bps rate cuts brought down bank lending rates by only 29 bps, the current revision will immediately get passed on in full. RBI has asked banks to link their lending rates to an external benchmark like the repo rate, which has been chosen by most banks. As a result, SBI’s interest rate on home loans (below Rs 30 lakh) is set to fall below 8% for the first time in more than a decade.

The cut in GDP growth estimate is the sharpest in recent memory and follows GDP growth slowing to an over 6-year low of 5% in April-June quarter. The government has unveiled a raft of measures to stimulate the economy, including a major revamp of corporate tax rates. “The 135 bps cumulative reduction in repo rate delivered in 2019 along with the recent cut in corporate tax by the government should help to revive growth in coming months, ”said Zarin Daruwala, CEO, India, Standard Chartered Bank.

The decision of the RBI’smonetary policy committeeto cut the repo rate was unanimous with one member, Ravindra Dholakia, seeking a 40 – bps cut. While RBI’s rate cut was modest considering its sharp downward revision of growth, Das promised to continue with an ‘accommodative ’policy as long as is necessary to ensure growth momentum.

While this stance was prompted by benign inflation, the ‘top priority’ for Das is growth, which at 6.1% is forecast to be at a seven-year low.

According to HDFC CEO Keki Mistry, lending rates linked to repo can be volatile. “In the short term, rates may go down by another quarter percentage but as economic activity picks up, the repo rate will rise. Those who are not used to this volatility could have a problem, ”he said.

Besides dealing with the prospects of slower growth, Das also had to allay fears arising out of a spate of failures among NBFCs and the fraud in Punjab &MaharashtraCooperative Bank – one among the top five cooperatives in the country.

GIPHY App Key not set. Please check settings