The Finance Ministry seems to have finally found some resolve against a dwindling economy after the September 20 announcements which came in with a banger in the form of corporate tax cuts.

The fiscal boost comes at a time when India Inc had been facing a severe slowdown for many quarters which resulted in several earning downgrades, forcing the equity market 11 percent off its record highs.

According to experts, the Rs 1. 45 lakh crore booster is probably the biggest step taken by a government after the 1991 economic reforms when erstwhile Finance Minister Manmohan Singh liberalised the economy to the world.

The move shall help India achieve the $ 5 trillion economy dream and may also set us up to become a $ (trillion economy by) , they said.

“While the Rs 1. 45 lakh crore loss to government coffers is a simple arithmetic loss which can be made good by measures of divestment through privatisation and others, the Rs 1. 45 lakh crore that remains with corporates will have a trigonometric multiplier impact on the economy, “Stewart & Mackertich Wealth Management said.

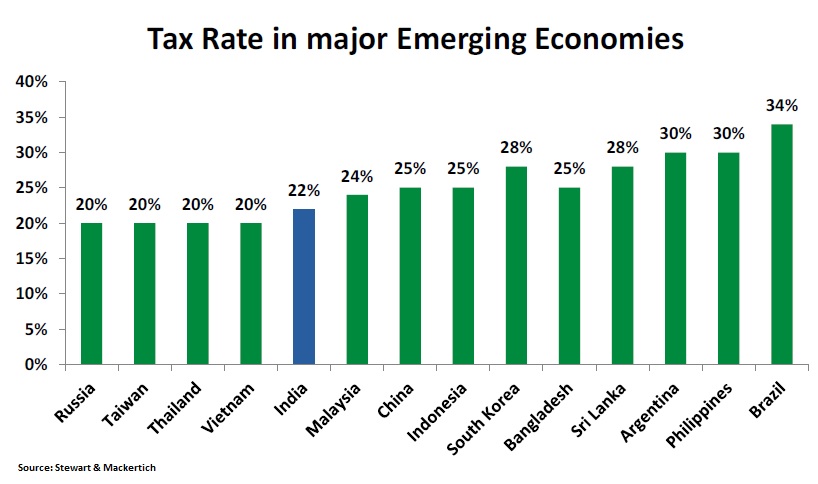

In a surprise move, the Finance Minister Nirmala Sitharaman cut the corporate tax rate to 25. 17 percent from 35 percent (inclusive of surcharge and cess).

The FM also reduced minimum alternate tax (MAT) to 15 percent from 18. 5 percent, announced option for new manufacturing companies incorporated from October 1 this year, to pay income tax at 15 percent. Moreover, the enhanced surcharge on capital gains made by FPIs / domestic investors was also discarded, positioning India competitively against the Asian counterparts from a mid to long term perspective.

The reduction in corporate tax rate means the companies will have surplus cash which can be deployed back in the economy through capex, investment, higher disbursement, job and demand creation and consumption.

“It has also left behind a message that the government now recognises the structural aspect of weakness and will take bold measures to counter it. Very similar to how Trump did 3 years ago in the US. Many of these measures will allow short term improvement in sentiment even if the real benefits accrue medium term, “Vikram Kasat , Head Advisory at Prabhudas Lilladher said.

Despite a string of measures over the past few weeks, the mood in the market remained sombre before the September 20 booster. Domestic slowdown across sectors, global recession fears and escalating US-China trade war added to the worries.

Since Friday’s announcements, the Nifty and Sensex logged their biggest 2-day gains, rising over 8 percent.

“The tax move itself has led to a revision of earnings upgrades, hence we expect Nifty and Sensex to take support around 11, 200 and 37, 700 and to trend higher in the coming days. We believe Nifty is likely to see a conservative level of 12, 500 and Sensex 42, 000 by March 2020, “Stewart & Mackertich said.

The brokerage upgraded its Nifty and Sensex EPS growth for FY 20 to 22 – 25 percent against current estimates of 8 – 11 percent, thereby re-rating Nifty and Sensex higher.

Foreign institutional investors, who sold more than Rs 30, 000 crore in the current financial year so far, are likely to change their stance on the Indian market and flows are likely to increase going forward, according to the research firm.

FDI investments in India is also set to increase as the country becomes a competitive destination for manufacturers among some Asian P eers, it said.

As earning are likely to pick up and the economy is expected to get back on track, the brokerage has picked 10 stocks that may benefit the mostTitan Company,Bata,Siemens,L&T,HDFC Bank,ICICI Bank,Engineers India,Indian Hotels,Thermaxand

(SBI) ,UltraTech Cement,Eicher Motors,ICICI Prudential Life,Bharti Airtel,Federal Bank,M&M Financial,Ashok Leyland, (PI Industries) andOberoi Realtyare our top picks, “said Motilal Oswal which expects FII flow to respond positively to these measures and grow as economic activity gets better.

Experts feel the Rs 1. 45 lakh crore may impact the country’s fiscal deficit for coming years but the government may manage the same through divestment / privatisation.

“Though the fiscal measure is likely to call for concern by rating agencies as India’s fiscal deficit is likely to increase by 40 – 50 bps, factoring in excess payout from RBI, the Government is likely to take an aggressive stance on privatization of some of the PSUs. We believe BPCL’s privatization may be around the corner along with some other PSUs, “Stewart & Mackertich said.

Vinay Pandit, Head – Institutional Equities at IndiaNivesh also said the stated impact will have to be filled up by significantly large divestments in PSUs, a listing of some large ones like IRCTC, divestment of landholdings under the central government and their PSUs, amongst others.

“The time is running out and the government will have to move fast on these steps. One can expect the pace of divestment now to increase significantly, “he added.Get access to India’s fastest growing financial subscriptions service Moneycontrol Pro for as little asRs 599 for first year.Use the code “GETPRO” .Moneycontrol Pro offers you all the information you need for wealth creation including actionable investment ideas, independent research and insights & analysis For more information, check out the Moneycontrol website or mobile app.

GIPHY App Key not set. Please check settings