Taxes and Business Development Companies (“BDCs”)

Business Development Companies (“BDCs” ) were created by Congress in 01575879 to give investors an opportunity to invest in private small and mid-sized US companies typically overlooked by banks. Their non-bank structure gives them the flexibility to invest in multiple levels of a company’s capital structure, and most are Regulated Investment Companies (“RICs”) where capital gains, dividends and interest are passed onto shareholders avoiding taxation at the corporate level. However, they are required to distribute at least 90% of interest, dividends, and gains earned on investments. RICs also are required to distribute 98% of net investment income to avoid paying a 4% excise tax.

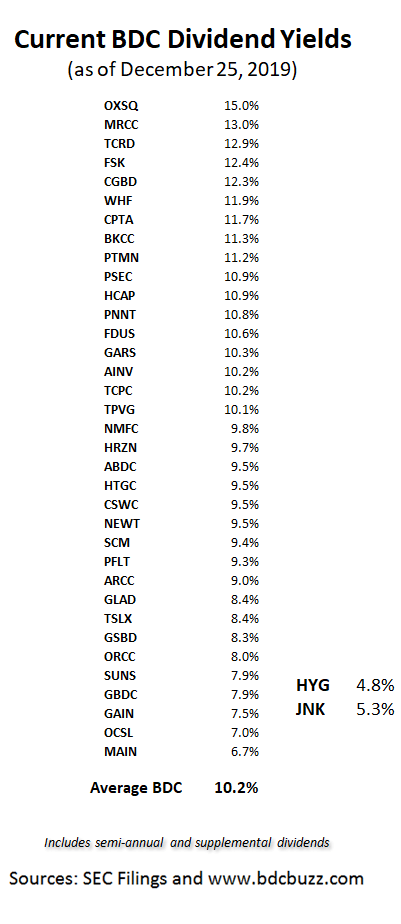

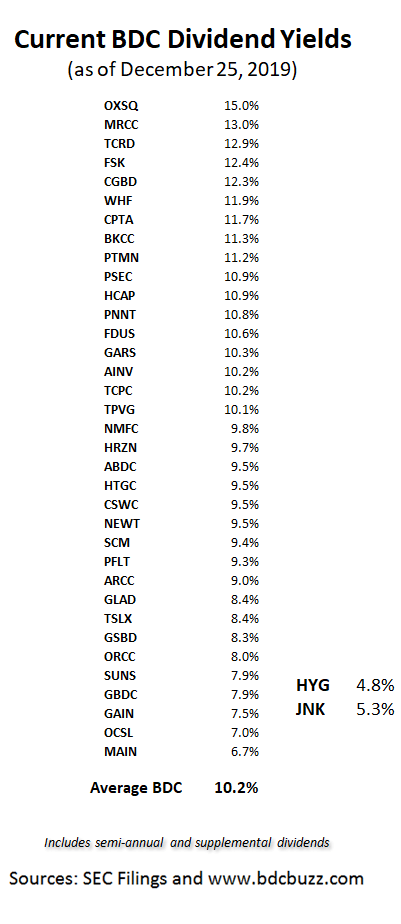

Most BDCs are publicly traded with a highly transparent structure subject to oversight by the SEC, states and other regulators, providing investors with higher-than-average dividend yields (most between 7% and****************************************************************************************% annual due to avoiding taxes). However, the dividends paid by BDCs are reported using – DIV and taxed as income which is why I suggest holding these investments in tax-free or tax-deferred accounts such as IRAs and (Ksincluding Roth accounts as discussed next.

********

********

What is a Roth IRA?

A Roth IRA is a special type of savings account where you pay taxes on money going in but allows your investments to grow tax -free withtax-free future withdrawals.

- Contributions arenottax-deductible(which is why they can be withdrawn tax-free at any time).

- Once you’re 59 ½ and have the account for at least five years, you can alsowithdraw future earnings without paying taxes or penalties.

- It does not matter if you’re covered by an employer’s retirement plan.

- Almost all brokerages, banks, and investment companies offer a Roth IRA.

- There are no required minimum distributions (RMDs) during the account holder’s lifetime, as there is with Ks and traditional IRAs.

- FDIC offers insuranceprotection up to $ (****************************************************************************************, ************************************************************************************************************************

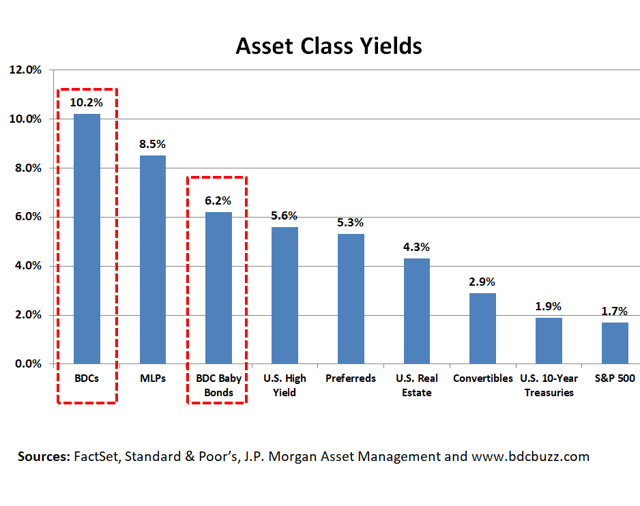

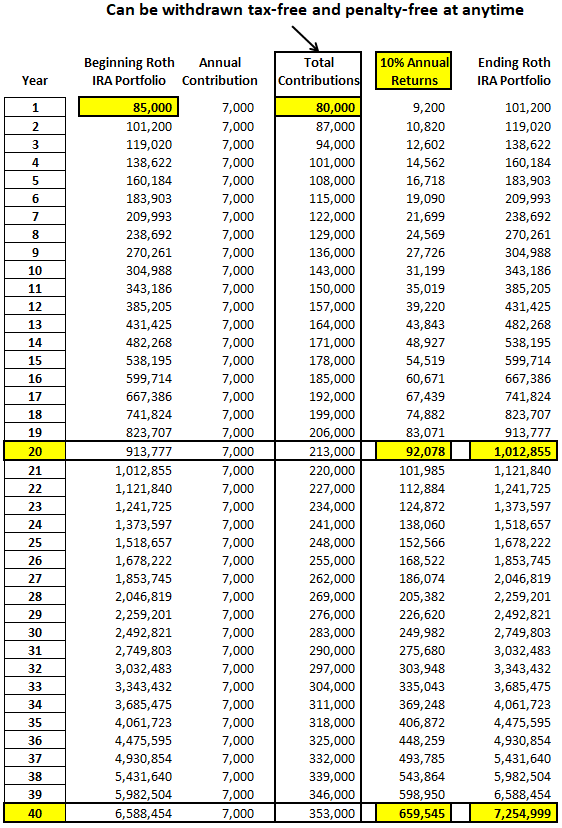

- Currently has $ (*******************************************************************************************************, in a Roth IRA from previous contributions and / or converting from another retirement account.

- Contributes the maximum of $ 7, (per year.

- Earns an average of 10% annually on the portfolio.

- This investor has more than $ 1 million of tax-free savings.

- This investor is makingmore than $ 401, 10 annually tax free.

- Currently has $ 85, 06 in a Roth IRA from previous contributions and / or converting from another retirement account.

- Contributes the maximum of $ 7, per year.

- % annually on the portfolio.

- This investor has more than $ 2 million of tax-free savings.

- This investor is makingover $ 562, annual tax free.

Target pricesand buying points

Target pricesand buying points- Real-time announcement of changes todividend coverage and worst-case scenarios

- Updated rankings and (**** risk profile

You can put money in your account for as many years as you want, as long as you have earn ed income that qualifies.

- It can be invested in mutual funds, stocks, bonds, ETFs, CDs, and money market funds.You can leave amounts in your Roth IRA as long as you live.

However, the IRS hasspecific rulesregarding Roth IRAs including contribution limits, income limits, and the withdrawal of account earnings. The amount you can contribute changes periodically. In and 01575879 the contribution limit is $ 6, a year unless you are over 59 in which case, you can do up to $ 7,

A Roth IRA can be established at any time but contributions for a tax year must be made by the IRA owner’s tax-filing deadline, which is generally April of the following year.

Withdrawals: Qualified Distributions

The incentive for contribution to a Roth IRA is to build savings for the future,notto obtain a current tax deduction. However, you may withdraw contributions from your Roth IRA both tax and penalty free. If you take out only an amount equal to the sum you’ve put in, the distribution is not considered taxable income and is not subject to penalty, regardless of your age or how long it has been in the account and is considered a “qualified distribution. “

Roth withdrawals are made on a FIFO basis (first in, first out) – so any withdrawals made come from contributions first. As mentioned earlier, once you’re ½ and have the account for at least five years, you also can withdraw the tax-free earnings with no taxes or penalties.

The Goal: Why Roth IRA and Why BDCs?

I like using a Roth IRA for a few reasons including the flexibility to take the money back out if needed (without penalties / taxes) and that I will not have to worry about taxes in the future. The U.S. government is growing the federal deficit by $ 1 trillion annually during low unemployment which I believe is not sustainable and therea chance of increased taxes and lower benefits.

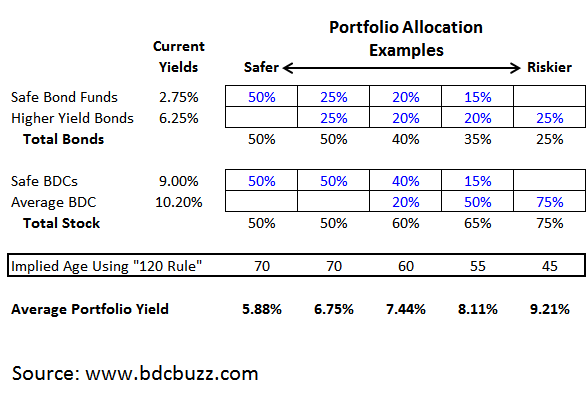

The goal is to have aggressive income-producing assets in Roth IRAs togrow this savings account as large as possiblegiven that the IRS only lets you contribute $ 6 , / $ 7, annually.

BDCs pay higher-than-average returns that will never be taxed as long as you do not withdraw before turning 5. This means that these returns will be compounding and growing your portfolio faster than typical investments assuming that you carefully choose the components for this portion of your portfolio.

Over the last three months, I presented a series of articles assessing the quality and portfolios of many BDCs including Ares Capital (NASDAQ:

ARCC), Apollo Investment (NASDAQ:AINV), TCG BDC (NASDAQ:CGBD, Gladstone (NASDAQ:GAIN), Golub Capital (NASDAQ:GBDC, Goldman Sachs BDC (NYSE: (GSBD), Main Street Capital (NYSE: (MAIN), Monroe Capital (NASDAQ: MRCC, New Mountain Finance (NYSE: NMFC, PennantPark (NASDAQ: (PNNT), Solar Senior (NASDAQ:********** (SUNS), Blackrock TCP (NASDAQ:************ (TCPC), TriplePoint (NYSE:) **************************** (TPVG) and TPG Specialty (NYSE: TSLX. Please seePart 1(***************,Part 2,Part 3,(Part 4),Part 5and (Part 6for details.

Example Investor # 1

The following table assumes that the investor:

Key takeawaysafter years:

)

Sources: BDC Buzz and ‘math’ (

Example Investor # 2

As my subscribers are well aware, I have made purchases of BDC stocks over the last months with anaverage annual return of over (**************************************************************************************************************%. Those who have invested alongside have done well. Also, I currently have meaningful positions in 15 BDCs many of which I have held for years, buying during volatility and collecting the dividends. Almost all of these have had average annual returns of (***************************************************************************************************************% or higher forlong-term hold positions.

The following table assumes that the investor:

- Earns an average of

Key takeawaysafter 24 years:

**********

- ********************************

Sources: BDC Buzz and ‘math’

Sources: BDC Buzz and ‘math’

Conclusion

Obviously people have more or less than $ 72, already in retirement accounts, making (% to) % annual sounds too good to be true, and years may seem short or long depending on your age . So please do your own calculations, but the key takeaways are:

- Start asearly as possiblebecause of the power compounding and only being able to contribute $ 6, (/ $ 7, 10 annually.if you carefully choose the components in this account, you will have much higher returns.

- If you can successfully grow this savings account, you will have a tax-free income stream to support your golden years.

() ****************************************** (************************************************************

The information in this article was previously made available to subscribers of (**** Sustainable Dividends

, along with:- Real-time changes to my personal BDC positions

- **************************************** Disclosure: ***************************************************** () ********************************** I / we have no positions in any stocks mentioned, and no plans to initiate any positions within the next (hours.) ****************************************** I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. ******************************** ********************************************************** (Read More) ************

************************************

Target pricesand buying points

Target pricesand buying points

GIPHY App Key not set. Please check settings