After a rangebound session, the market ended with modest gains on December 9 helped by shares of select heavyweights, such as HDFC, Reliance Industries, and Axis Bank.

The BSE Sensex closed (points, or 0. 10 percent, up at 40, (******************************************************. 49, while Nifty ended (points, or 0.) ********************************************************************************************************** (percent, higher at , 1170 **************************************************************************************.

, 1170 **************************************************************************************.

“The market” was rangebound as investors are closely watching the upcoming economic macros like CPI inflation and IIP data for any signs of progress in the government effort to revive the economy. FIIs are likely to turn risk-averse in the domestic market as strong US job data, progress in trade talks and expectation of status quo policy from the US FED will add impetus to the global market, “said Vinod Nair, Head of Research at Geojit Financial Services.

Nifty formed a Doji candle pattern. Normally, a formation of Doji in a sideways range does not show any significant predictive signal.

The formation of the head and shoulder patterns are still intact in the Nifty, as per the daily time frame chart. This neckline of this pattern is at (**********************************************************************************************************, – 983 level. A sustainable move below this area could open up a sharp weakness in the market ahead, said experts.

We have collated (data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 11, (**********************************. (*********************************************************************************, followed by (**************************************************************************************************, ********************************************************************. If the index continues moving up, key resistance levels to watch out for are (************************************************************************************************************,************************************ and 13, 31. (************************************************************************.

********************************************************************. If the index continues moving up, key resistance levels to watch out for are (************************************************************************************************************,************************************ and 13, 31. (************************************************************************.

Nifty Bank

Nifty Bank closed slightly lower by 0. (percent at) *************************************************************************************, . (************************************************************************************************************. The important pivot level, which will act as crucial support for the index, is placed at (*********************************************************************************************, (******************************************************************. 3, followed by (**********************************************************************************************, ******************************** 9. On the upside, key resistance levels are placed at 31, (*************************************************. 9 and 39, 791. 1.

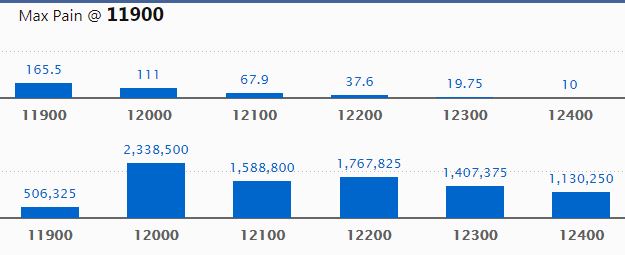

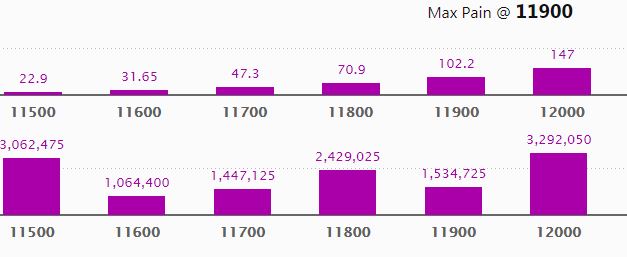

Call options data

Maximum call open interest (OI) of 25. lakh contracts was seen at the (**********************************************************************************************************, strike price. It will act as a crucial resistance level in the December series.

This is followed by (**********************************************************************************************************, strike price, which holds********************************** lakh contracts in open interest, and (**********************************************************************************************************, (******************************************************************, which has accumulated (*********************************************************************************************************. ************************************************************************** lakh contracts in open interest.

Significant call writing was seen at the 12, strike price, which added 1. 51 lakh contracts, followed by a (**********************************************************************************************************, strike price that added (***************************************************************************, ********************************************** (contracts and 11, strike which added 075, 0 contracts.

contracts.

Call unwinding was witnessed at (***********************************************************************************************************, ********************************************** strike price, which shed (**************************************************************************, contracts, followed by 12, 200 which shed****************************************************************, 889 contracts.

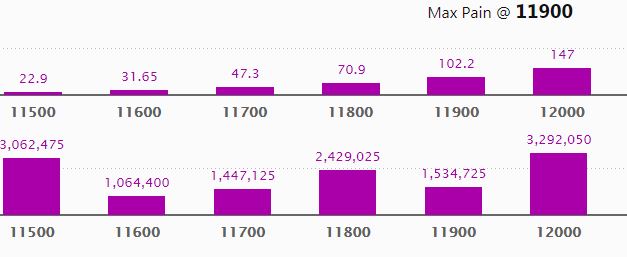

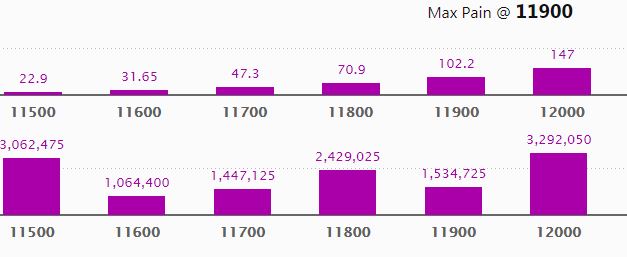

Put options data

Maximum put open interest of 32 **************************************************** (lakh contracts was seen at************************************************************************************************** , 11 strike price, which will act as crucial support in the December series.

This is followed by 11, 528 strike price, which holds (************************************************************************************************. lakh contracts in open interest, and (**********************************************************************************************************, strike price, which has accumulated (************************************************************************************************. lakh contracts in open interest.

Put writing was seen at the 11, 937 strike price, which added nearly 1 . lakh contracts, followed by an (***************************************************************************************************, ************************************************ (strike, which added 1.) lakh contracts.

Put unwinding was seen at (***********************************************************************************************************, (strike price, which shed, contracts, followed by (**************************************************************************************************, strike which shed 17, (contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

**************************************************************** (stocks saw long buildup

**************************************************************** (stocks saw long buildup

Based on open interest (OI) future percentage, here are the top stocks in which long buildup was seen.

6 stocks saw long unwinding

6 stocks saw long unwinding

stocks saw short build -up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top stocks in which short build-up was seen.

**************************************************************************************************** stocks witnessed short-covering

**************************************************************************************************** stocks witnessed short-covering

As per available data, stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on open interest (OI) future percentage, here are the top stocks in which short-covering was seen.

Bulk deals

Bulk deals

(For more bulk deals, click here

click here )

)

Upcoming analyst or board meetings / briefings

The board of Bharti Infratel will meet on December 12 to consider and approve the interim dividend.

The respective boards of Vibrant Global Capital, Salem Erode Investments and Ashika Credit will meet on December to consider and approve their quarterly results.

(The board of La Tim Metal & Industries will meet on December to consider the merger of its subsidiary.

Stocks in the news

Quess Corp:Board approved allotment of 7. 15 crore shares to eligible shareholders of Thomas Cook.

Hero MotoCorp:Company will increase ex-showroom prices of its motorcycles & scooters from January 1.

SRF:SEBI exempted ABR Family Trust from complying with requirements with respect to offered indirect acquisition of control in SRF.

Jindal Steel & Power:Promoter released pledge on (lakh shares (0.) percent equity (on December 3.

PC Jeweler:CRISIL downgraded the company long & short-term ratings to bank loan facilities to ‘D’.

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs crore, while domestic institutional investors (DIIs) also bought shares of worth Rs **************************************** crore in the Indian equity market on December 9, provisional data available on the NSE showed.

Fund flow

Stock under F&O ban on NSE

Yes Bank is under the F&O ban for Decembe r 10. Securities in the ban period under the F&O segment include companies in which the security has crossed (percent of the market-wide position limit.) Are you happy with your current monthly income ? Do you know you can double it without working extra hours or asking for a raise? Rahul Shah, one of the India’s leading expert on wealth building, has created a strategy which makes it possible … in just a short few years. You can know his secrets in his FREE video series airing between (th to) **************************************************************************************************** th December. You can reserve your free seat here.

**********************

Read More**************************

GIPHY App Key not set. Please check settings