Brexit uncertainty and the US-China trade war are both hurting British industry.

Fhaheen Kahn, economist at Make UK, the manufacturers’ organization, explains:

“We are 21 days away from the UK leaving the EU and today’s data shows that manufacturing is right in the eye of continued economic uncertainty. There is now a potent cocktail facing the sector of trade wars, a synchronized global downturn in major markets and political chaos which shows no signs of ending.

“The majority of sectors declined with pharmaceuticals and electrical equipment being hit especially hard and vacancies in the sector are also falling rapidly. So long as the current uncertainty persists manufacturing looks as far away as ever from returning to pre-financial crisis levels. ”

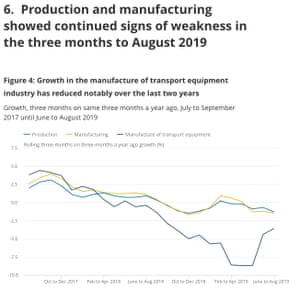

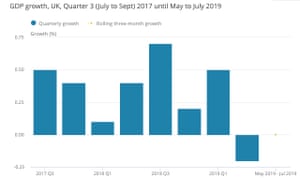

This chart, from today’s GDP report, shows the damage:

A new round of Brexit stockpiling by nervous businesses and consumers should keep the UK out of recession.

Yael Selfin, chief economist at KPMG UK, says:

“Despite the contraction in GDP in August, the risk of the UK economy falling into a technical recession is still remote, due to strong growth in July. Also a potential new round of stockpiling will likely help boost GDP growth in September and October.

The latest figures are still a cause for concern however, especially as most of the fall comes from the manufacturing sector, which is particularly vulnerable to an adverse Brexit outcome. ”

ING economist James Smith predicts that Britain will probably avoid recession in 2019 despite a gloomy August.

He writes:

UK GDP contracted by 0.1% in August, suggesting there is very little to cheer about in the UK economy at the moment …..

That said, the economy will most likely avoid a near-term technical recession. Consumer activity is continuing to grow, even if confidence remains fairly depressed. Shoppers appear to have been less fazed by the ups-and-downs of the Brexit process than businesses.

But even so, economic growth is likely to remain fairly modest for the rest of this year, averaging around 0.2-0.3% per quarter. This means that the Bank of England is likely to remain cautious, although we still feel its probably too early to be pencilling in UK rate cuts.

ING Economics(@ ING_Economics)

Still too early to be pencilling in a UK rate cut, we reckon, despite these latest gloomy GDP figureshttps: // t. co / 3rODqIm2xQ

(October) , 2019

UK GDP: instant reaction

Sky News’ economics editor, Ed Conway, agrees that Britain appears to be dodging a recession – but we’ll only know for sure in a month’s time.

Ed Conway(@ EdConwaySky)

UK economy contracts by 0.1% in Aug. Bit worse than expected. But July GDP growth revised up from 0.3% to 0.4%. At a glance it looks like the UK might have avoided recession. But much now depends on the final GDP figs for Q3, which we get in early Nov (https://t.co/dwZCagVEep)

(October) , 2019

Economist Rupert Seggins has shown how manufacturing is struggling:

Rupert Seggins(@ Rupert_Seggins)

UK GDP grew by 0.3% q / q in the 3 months to August. Main contributions came from the information & communications (0.1%) and professional services (0. 11%) sectors. Manufacturing still the biggest drag (-0.1%).pic.twitter.com/RdVoaA5zcZ

(October) , 2019

Sam Tombs of PantheonEconomicssuggests there’s no justification for the Bank of England to cut interest rates soon (as policymakers have been hinting).

Samuel Tombs(@ samueltombs)

Another better-than-expected UK GDP report. August’s 0.3% 3m / 3m% growth rate bettered the 0.1% rate expected by the consensus. Momentum in the services sector still in tact, despite the Brexit fiasco. Still no “hard” data supporting the case for the MPC to cut Bank Ratepic.twitter.com / rQ4LflScUq

(October) , 2019

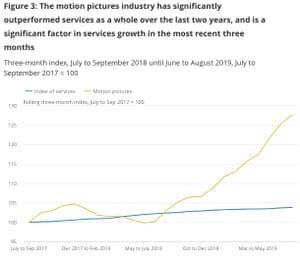

At least TV and film production is boosting the economy, points out the BBC’s Dharhini David.

Dharshini David(@ DharshiniDavid)

Lights, camera, action: spike in tv / film production drives services growth & enables 0.3% GDP growth in 3 months to Aug – sparing uk from recession for now

UK GDP: The key charts

I’ve dug through today’s growth report to find the main charts showing how the UK economy will probably avoid a Brexit recession,despite stumbling in August.

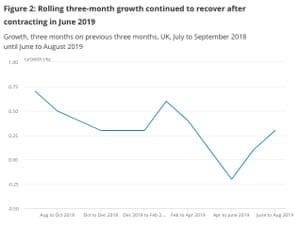

This shows how rolling three-month growth took a nasty tumble at the start of the summer, but has since recovered:

Britain is officially half-way into recession, having contracted by 0.2% in April-June.

But to be an official recession, it needs to also contract in July-September. That looks unlikely, given we now know GDP rose by 0.3% in June-August.

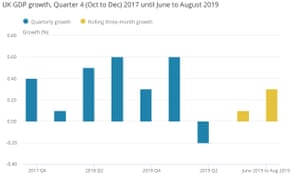

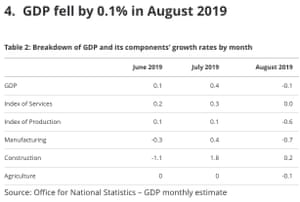

But August wasn’t a happy time for the economy. This charts shows how industry and agriculture both contracted, while service sector firms stalled:

TV and film work boosts GDP

Britain’s film and TV production industry boosted growth in the last three months

The Office for National Statistics ’head of GDP, Rob Kent-Smith, explains:

“Growth increased in the latest three months, despite a weak performance across manufacturing, with TV and film production helping to boost the services sector.”

According to the ONS, Britain’s motion picture industry has grown output by a quarter since 2017 , thanks to big box office productions includingStar Wars: The Last JediandPaddington 2.

Service sector grows, but manufacturing stumbles

Britain’s services sector provided the bulk of the growth, as usual.

The ONS reports that services GDP grew by 0.4% over the last quarter, driven by the “professional, scientific and technical sector”.

But in August, the service sector was flat.

Manufacturing had a worse time of it, though, shrinking by 0.7% in August. That’s despite car factories working more than usual, having shifted their summer shutdown forward to April (in preparation for Brexit at the end of March).

Although August was weak, July and June were stronger than expected.

The ONS has revised July’s growth up, from 0.3% to 0.4%. June has also been nudged up to 0.1%, from zero.

That’s why the three-month / three-month growth rate hit 0.3%, stronger than expected.

It also means September’s GDP, due in a month’s time, would need to be pretty weak to put Britain into recession.

UK economy shrinks by 0.1% in August

NEWSFLASH: Britain’s economy contracted by 0.1% in August, according to the Office for National Statistics’ latest growth report.

That’s a little weaker than expected, and the first monthly contraction since April.

But over the last three months the UK economy grew by 0.3%, the ONS says. That’s a little better than forecast, and could ease fears of a Brexit recession.

More to follow!

Former UK chancellor Philip Hammond has warned Brexiteers that their dreams of striking new free trade deals once Britain has left the EU don’t add up.

In an interview with the Daily Telegraph, Hammond explains that such deals would have “very limited” economic value, and certainly wouldn’t compensate for the loss of tariff-free, frictionless trade with the EU.

He’s arguing for a “rapid-fire zero-tariff trade deal with Europe”, even though it would restrict the UK from striking similar deals with other countries.

The Telegraph’s Peter Foster has tweeted the key points:

Peter Foster(@ pmdfoster)

EXC: So.@ PhilipHammondUKhas finally said it – the entire ‘bucaneering Britain’# Brexitnarrative is based on a fallacy.

The much anticipated free trade deals don’t outweigh costs of barriers to trade with EU from# Brexit1 / Thread

Full interview:https://t.co/S3pqTDr0eT…

Peter Foster(@ pmdfoster)

Think about that for a sec.

The whole row over the backstop and quitting the Customs Union is so we can win the right to make ourselves poorer.

So says the for Chancellor. They have “very limited” economic potential. / 2pic.twitter.com/VNwwhd3Na4

(October) , 2019

Peter Foster(@ pmdfoster)

As you’d expect from ‘Spreadsheet Phil’ he’s not making it up – he’s run the numbers. (See research by LSE, HMT,@ jdportesand others).

They are mad:

UPSIDE from FTAs all FTA is less than 0.5% additional GDP by 2030

DOWNSIDE of Canada minus deal? Negative 4-7% ‘lost’ GDP / 3pic.twitter.com/0so5wnAfez

(October) , 2019

European stock markets have just dropped smartly into the red, after China launched another broadside at America.

Beijing’s foreign ministry accused Washington of ‘smearing China’ over its crackdown in Xinjiang, by blacklisting companies and refusing to issue visas to officials.

Reuters has the details:

Beijing said on Thursday that comments by U.S. Secretary of State Mike Pompeo accusing China of human rights violations in its treatment of Muslims constituted a smear against China.

Foreign Ministry spokesman Geng Shuang made the comments at a daily briefing Thursday. He did not mention Pompeo in particular.

U.S. *** Secretary of State Mike Pompeo said in a television interview on Wednesday that China’s treatment of Muslims, including the Uighurs, in western China was an “enormous human rights violation” and Washington will continue to raise the issue.

This has further dampened hopes of a trade deal breakthrough at this week’s talks in Washington, and knocked 0.4% off the pan-European Stoxx (index.

Slowing economic growth and weak trade haven’t stopped the rich spend-spend-spending, if the latest results fromMoët Hennessy – Louis Vuittonare any guide.

The luxury goods brand, also known as LVMH, grew its sales by 11% in the third quarter of 2019, beating forecasts. Fashion and leather goods sales grew by 19%, led by its largest brands Louis Vuitton and Dior.

LVMH said it had shaken off “the difficult context in Hong Kong” – clearly demand for expensive handbags and coats falls when protesters and police are clashing in the streets.

LVMH’s shares have jumped 3.8%, this morning, and lifted shares across the luxury sector with Christian Dior up 4.1% and Burberry gaining 1%.

LVMH(@ LVMH)

LVMH, the world’s leading luxury products group, recorded a 16% increase in revenue, reaching € 38 .4 billion in the first n ine months of 2019. Organic revenue grew 11% compared to the same period of 2018.

Learn m ore➡️https://t.co/TMHcp0CXrF(# LVMH)pic.twitter.com/A8ffRC62 Gv

Pound hits one-month low against the euro

Sterling just slipped to a one-month low against the euro.

It touched € 1. 1105 for the first time since early September, meaning it has lost 2.3% against the euro in the last three weeks.

Much of those losses have been driven by worries about a no-deal Brexit. Today, though, is more about the euro itself. It’s rallying, after the Financial Times reported that the European Central Bank ignored advice from its own officials not to relaunch its stimulus program last week.

These divisions could make it harder for the ECB to loosen monetary policy even further.

Germany hit by export slump

Germany’s economy is also struggling, compounding the risks to the UK economy.

New data show that German exports slumped by 3.9% year-on-year in August, the worst performance this year, with imports falling by 3.1%.

This increases the risk that Europe’s largest economy has fallen into recession this autumn, buffeted by the US-China trade war. Germany, like the UK, suffered a small contraction in April-June.

Destatis news(@ destatis_news)

Based on provisional data, the Federal Statistical Office (Destatis) also reports that German (#exports) decreased by 3.9% and# importsby 3.1% in August 2019 year on year.https://t.co/WCyTEEbiGEpic.twitter.com/Cd8YXqszRa

(October) , 2019

https://twitter.com/destatis_news/status/ 1182176725318459392

Introduction: UK GDP report

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Two of the City’s big fears – a Brexit-induced recession and a full-blown trade war – are in the spotlight today.

The latest UK GDP report, due at 9. 30 am, is expected to show that growth fizzled out in August. Economists predict GDP was unchanged during the month, after rising 0.3% in July.

And over the last three months, GDP is expected to have only risen by 0.1% – much slower than usual.

Given the economy actually shrank in April-June, there’s clearly a risk that Britain’s economy stagnates. It could even slide into a full-blown recession later this year as Brexit uncertainty continues to hit business investment.

The economy may have got one Brexit boost – car factories stayed open in August, having brought their usual summer shutdown forwards to April. That should have boosted manufacturing output during the month.

But with the eurozone also looking weak, and global trade slowing, there’s not much optimism about today’s August GDP report.

Here’s what the City’s expecting:

- Monthly GDP:unchanged in August compared with July

- Growth in June-August:Up just 0.1% compared with March-May.

- Manufacturing production:Down 0.4% compared with September 2018, but up 0.2% month-on-month

- Services output:flat in August.

- 9. 30 am BST:UK monthly GDP report for August – expected to show GDP was flat month-on-month

- 9. 30 am BST:UK visible trade balance for August – expected to show a deficit of £ 10 bn, up from £ 9.1bn in July

- 1. 30 pm BST:US consumer price inflation for September – expected to show prices rose 0.1% in the month

- 3pm BST:IMF to publish its latest Global Financial Stability Report

- 3. 30 pm BST:IMF to publish its latest Fiscal Monitor

We ‘ ll also get UK trade data, expected to show Britain’s goods deficit with the rest of the world widened in August.

But the big trade story is happening in Washington today, where a Chinese delegation led by vice-premier Liu He will meet US counterparts later today.

Hopes of a breakthrough in the ongoing trade war aren’t high, as theUS has just blacklisted 28 Chinese companies over human rights abuses against Muslim groups in Xinjiang province.

China has briefed that Liu He will offer to buy more US agricultural goods in an attempt to break the deadlock, but they’ve also hinted that the two-day talks could end early.

The agenda

Updated (at 3.) am EDT

GIPHY App Key not set. Please check settings