Speaking of the election …. analysts at the Institute of Fiscal Studies have just warned that neither the Conservatives or Labor have a ‘ credible plan ‘for the public finances.

My colleague Julia Kollewe explains:

Paul Johnson, the director of the respected thinktank, noted that the Conservatives’ election manifesto in 2017 pledged more austerity and spending cuts, but in reality public service spending has gone up, and is due to be around £ 27 bn higher next year than implied by the manifesto. In fact, he said, it is closer to the 2017Laborpledge than the Tories’ own manifesto .

This time,the Conservatives are not promising any more spending cutsbut are not predicting any spending increases beyond those set out in September either. Their plans would leave public service spending excluding health still 14% lower in 2023 – 24 than it was in 2010 – 11. “No more austerity perhaps, but an awful lot of it baked in,” Johnson said.

TheConservativeshave pencilled in few tax changes beyond a small cut in national insurance contributions.

“If you think things are pretty much OK as they are, then you will like the Conservatives proposals for tax and spend. If you want big increases in taxation and spending then Labor and theLiberal Democratshave plenty to offer, ”Johnson said.

Pound hits six-month high against the euro after YouGov poll

Sterling is strengtheningafter a much-anticipated opinion poll showed that Boris Johnson is on track to win a comfortable majority next month.

The MRP poll, carried out by YouGov, predicted that the Conservatives would win (seats, up) , while Labor would fall to 211 seats and the Liberal Democrats would only gain one seat, g iving 13 MPs.

This would give Johnson a majority of 68 – likely Enough to push his Brexit deal through the Commons.

Although the City isn’t keen on a hard Brexit, it also feared another hung parliament and the risk of a disorderly departure from the EU.

So the pound has hit € 1. 176 for the first time since May. It’s also trading at a one-week high against the US dollar, at $ 1. 2950.

IGSquawk(@ IGSquawk)

Sterling remains higher overnight:# GBP0. 09% against other currencies# GBPUSD1. 2945 0. 18% # EURGBP) 0. 85045 -0. 11%# GBPAUD1. 91324 0. 33%# GBPJPY141. 69 0. 09%# GBPCAD1. 0. 22% (#GBPCHF) 1. ( 0. 18%# GBPEUR1. 17585 0. (%) ******************************************** (pic.twitter.com/wxvDSvuUSJ)

Howard Archer of EY Item Club predicts that house prices will keep rising by around 1% in the near term.

There are factors pushing prices up, he points out. Consumers have more purchasing power, thanks to wage growth, and interest rates are near record lows. There’s also a shortage of houses on the market, thanks to Britain’s failure to build enough new homes.

But, the labor market has recently faltered, Archer adds, with wage growth slowing and employment dropping by 58, 000 in the last quarter.

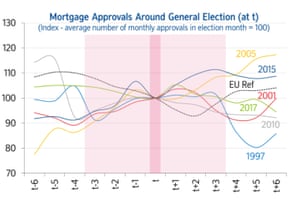

How house prices fare in general election season

As it’s general election time, Nationwide have crunched their data to show how the housing market has fared whenever Britons went to the polls.

As you can see, mortgage approvals jumped after David Cameron was surprisingly returned to Number 10 in 2015 …. but slid after the ex-PM lost his Brexit referendum the following year.

Nationwide’s Robert Gardner explains:

“While activity slowed in the period immediately following the EU referendum, this was a continuation of a trend that was driven by the introduction of additional stamp duty on second homes earlier in that year.

Tony Blair’s election win in 1997 was also followed by a sharp fall in mortgage approvals, as the newly independent Bank of England raised interest rates several times (hitting 7. 25 % in 2018).

Gardner adds:

“It appears that housing market trends have not traditionally been impacted around the time of general elections. Rightly or wrongly, for most home buyers, elections are not foremost in their minds while buying or selling their home.

Iain McKenzie, CEO, The Guild ofPropertyProfessionals, reckons the housing market will remain subdued until there’s more clarity on Brexit.

Once we know what to expect, the market can settle into a new normal and activity will start to improve as buyers and sellers get on with it.

At the moment there is a lack of stock coming onto the market as sellers hold back and remain on the side-lines. I think this will change once we put Brexit behind us, and we can move forward as a country. For now, the positives are that money continues to be cheap to borrow and property prices are more realistic. ”

Moving forwards as a country could take some time, though. Even if Britain does leave the EU at the end of January, a new cliff-edge would loom in December 2020 to get a free trade deal agreed.

2019 has been an “annus horribilis” * for the housing market, saysGuy Harrington, CEO of property lenderGlenhawk,adding:

October’s marginally higher growth may reflect the market’s quietly increasing confidence that the general election result may not be the disaster it feared, but overall it’s a case of ‘bring on the new decade’.

Worryingly for UK vendors, with neither the Tory or Labor manifesto offering much cause for optimism, it may take more than a general election and Brexit resolution to rouse the market from its deep slumber. ”

* -this Latin phrase was popularized in 1992 by the Queen , whomight be tempted to use it again this year….

London’s housing market has been in a real rut since the Brexit vote, with price falling for months.

But is the worst over? Patrick Alvarado, director of central London estate agent Nicolas Van Patrick, reports the market is now “picking up”.

Alvarado says:

Over the past three months, we have sold most of our properties, many of which had been sitting on our books for more than a year, so there is reason to be quietly optimistic.

Agents tend to be bellwethers for future movements in the market and there is no doubt that we are seeing more buyers get on with it and step into the market, which bodes well for the future. ‘

Despitethis month’s rise in prices, UK house price inflation is still sharply lower than before the EU referendum.

Back in 2016, house prices were rising at around 5% per year, not the sub-1% growth seen in 2019.

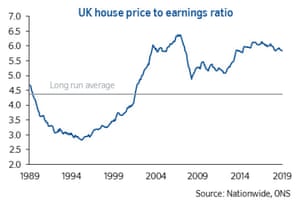

Basic pay growth hit 4% this year, meaning the price / earnings ratio has dipped. But it’s still sharply over its long-term average (making it much harder for young adults to get onto the housing ladder, compared with earlier generations)

Introduction: UK house prices pick up

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

After months of being dampened down by economic and political uncertainty, Britain’s housing market may be flickering back to life.

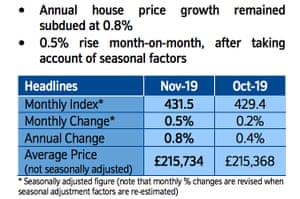

House pricesrose by0.5%in November, according to the latest survey from Nationwide. That’s the strongest monthly growth since July 2018 , up from just 0.2% in October.

On an annual basis (a better measure), prices are up0.8%compared with November 2018, as buyers shrug off the uncertainty over who will be in Downing Street after 12 December.

That’s the strongest year-on-year increase since April, but still weaker than in 2018 when prices were rising by over 2%. It means the average property is now worth £ 215, 734.

House prices have now been rising by less than 1% for a whole year, below the rate of inflation and wage growth. That should make property slightly more affordable (or slightly less unaffordable?) For first-time buyers and those looking to trade up.

Prices are currently below the record high of £ 217, 663 set in July:

Robert Gardner,Nationwide’s Chief Economist, says the confusion over Britain’s exit from the EU has weighed on the housing market.

“Annual house price growth remained below 1% for the 12 th month in a row in November, at 0.8%, though this was the strongest outturn since April.

Indicators of UK economic activity have been fairly volatile in recent quarters, but the underlying pace of growth appears to have slowed as a result of weaker global growth and an intensification of Brexit uncertainty. To date, the slowdown has largely centred on business investment, while household spending has been more resilient.

More details to follow …..

Also coming up today

It could be a quiet day in the markets, with American traders away celebrating Thanksgiving.

Investors may be more nervous about the USC-China trade talks, after Donald Trump signed two US bills supporting Hong Kong’s pro-democracy protesters. That’s a rebuff to China, which had urged the president to block the legislation.

The agenda

- 10 am GMT: Eurozone business climate survey

- 1pm GMT: German inflation for November

Updated

GIPHY App Key not set. Please check settings