Thestock markettook asubstantial step forwardon Wednesday, bringing the Dow, S&P 500, and Nasdaq all closer to their all-time highs.

Here are ten individual stocks headlining the market’s upward swing.

Winners: Tesla, Boeing, & Apple Impress

Tesla (NASDAQ: TSLA)

Teslastock led the Nasdaq with a spectacular 5. 61% rally. TSLA’s single-day surge came one day after TipRanksreportedthat JMP analyst Joseph Osha believes that the stock is undervalued by 45% .

Model S just set record for fastest 4 door ever at Laguna Seca, video tmrw

– Elon Musk (@elonmusk)September 11, 2019

The icing on the cake? Elon Muskrevealedthat the Tesla Model S had broken the speed record for a four-door sedan at Laguna Seca Raceway, a famous California racetrack.

Boeing (NYSE: BA)

Boeingstock surged 3% after CEO Dennis Muilenburg said that he expects the controversial 737 MAX toreturn to servicebefore the end of 2019. The company’s most popular jet has been grounded since March, contributing to a72% plungein year-over-year Plane deliveries.

Apple (NASDAQ: AAPL)

Appletrailed only Boeing among Dow Jones Industrial Average stocks, rising 2. 85% the day after it debuted the (iPhone) . Wall Street cheered the smartphone’s $ 50 price cut , and the Tim Cook-led firm’s market cap briefly touched$ 1 trillion.

Merck (NYSE: MRK)

Merck stock experienced a 1. 51% relief rally on Wednesday following a brutal start to the week. MRK clung to gains despite aReuters reportuncovering evidence that a court had allowed the drugmaker to conceal a drug’s risks.

Caterpillar (NYSE: CAT)

Trade war bellwetherrose 1. 11% amid continued optimism that the US and China will make progress toward a new trade agreement.

Losers: Trump Sends Chevron Lower

Take-Two Interactive (NASDAQ: TTWO)

Gaming company Take-Two Interactive was one over several companies hit hard by Apple’s Tuesday product launch event. Shareholders are particularly concerned about the impact that Apple’s $ 4. 99 per month Arcade service will have on the mobile gaming market. ****** Meanwhile, TTWO subsidiary 2K Games remains mired in waves of backlash related to NBA 2K 20. Customers are upset both about thequality of the gameand its notoriousmicrotransactions system.

3M (NYSE: MMM)

Shares in 3M declined 1. 44% a day after a company executive enduredquestioningby the House of Representatives in connection with its use of chemical substances calledPFAS. Congress is reviewing legislation that would curtail the use of PFAS, which are commonly used in waterproofing but might contribute to cancer and other health problems.

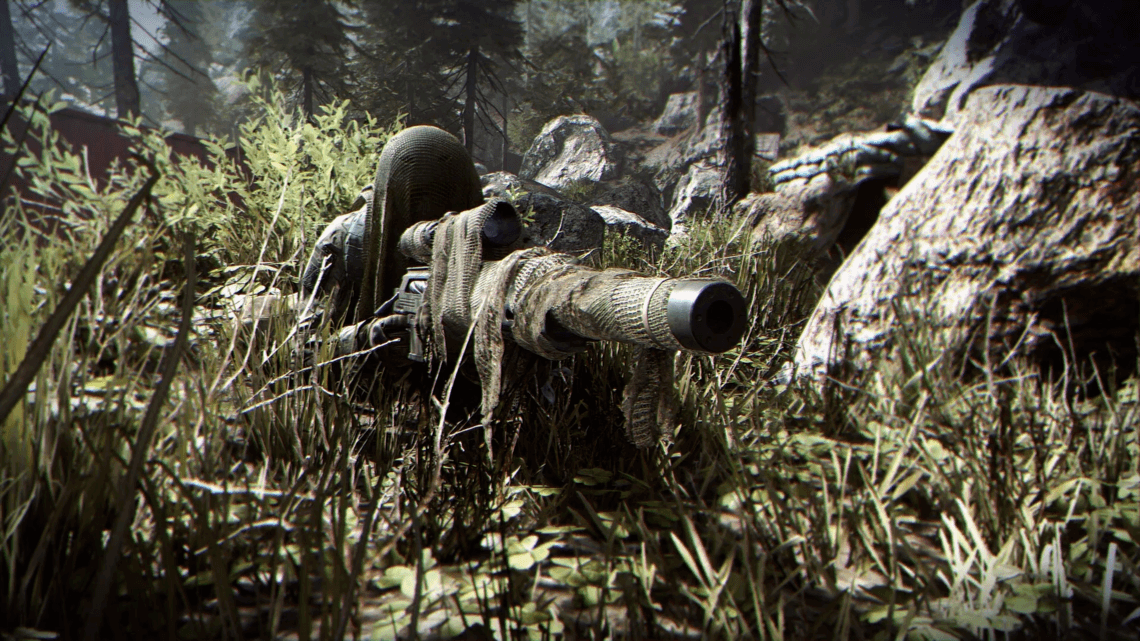

Activision Blizzard (NASDAQ: ATVI)

(Activision Blizzard) stock slid 1. 32% amid concerns that its flagshipCall of Dutyfranchise is suffering from Brand Fatigueand that the upcoming Modern Warfare sequel will drag on growth. Analysts also point to the disappointingSekiro: Shadows Dielaunch as another warning sign for ATVI.

GameStop: (NYSE: GME)

Beleaguered video game retailerGameStopwas forced to watch its shares careen 9. 53% lower in response to a report that it wouldclose 200 storesby the end of the year. CFO James Bell also revealed that shareholders should expect even more closures over the next 24 Months.

Chevron (NYSE: CVX)

Chevron shares dipped 0. 92% after Bloomberg published a report revealing that President Trumpdiscussed easing sanctions on oil-rich Iranin advance of a possible meeting with Iranian President Hassan Rouhani. Former National Security Advisor John Bolton, whom Trump fired on Tuesday, opposed that strategy. The report also ignited a 2. 68% plunge in the price of crude oil.

Last modified (UTC): September 11, 2019 6: 10 PM

GIPHY App Key not set. Please check settings