Full story: Bank of England vote raises chances of interest rate cut

Here’s our economics editor Larry Elliott on todayBank of Englandforecasts, and interest rate decision:

The chances of a cut in interest rates have increased after two members of the Bank of England’s key policy body responded to a growth downgrade inspired byBrexitand a trade war by voting for cheaper borrowing.

In the first split vote on Threadneedle Street’s monetary policy committee (MPC) since June 2018, the Bankvoted 7-2to keep official interest rates on hold at 0. 75%, but two of the outside experts the government appointed to the committee, Jonathan Haskell and Michael Saunders, said the weakness of the economy warranted an immediate reduction.

The Bank thinks the short-term prospects for the economy have improved because the risk of a no-deal Brexit has diminished, but it expects the level of national output – gross domestic product – over the next three years to be 1% lower than it had anticipated in August.

It said three-quarters of the downgrade had been because of changes in asset prices and a gloomier global outlook since the summer, while the rest came from changes to the Bank’s Brexit assumptions offset by the impact of the boost to public spending announced by Sajid Javid in September. The Bank believes the chancellor’s measures will increase the level of output by 0.4%.

The Bank’s latest monetary policy report for the first time included precise Brexit assumptions based on the withdrawal agreement the prime minister struck with the EU. It believes leaving the EU will lead to the economy growing more slowly but had previously been basing its forecasts on the average impact over 15 years. Threadneedle Street says Boris Johnson’s deal means it is now possible to quantify the effects up until the end of 2022.

Professor Costas Milas of Liverpool University fears that parts of the BoE’s growth projections (see here) may be too optimistic:

What is really striking is that Business investment growth is expected to stay flat at 0. 25% in 2020 and then (magically) shoot up to to 4% in 2021 and further up to 4.5% in 2022 which appears at odds with the 3% average growth rate over the pre-crisis period!

This is puzzling.

For this to happen, the UK will almost certainly have to reach a great new deal with the EU which will arguably be identical to the current status quo …

Updated

Dr Kerstin Braun, President of trade finance provider Stenn Group, suspects UK interest rates may be cut in early 2020.

She fears that the UK economy is ‘running out of gas’, after several years of Brexit uncertainty:

“Mark Carney is right to hold rates for now. Brexit and trade worries have been weighing on the economy and now a snap general election has been thrown into the mix. But even if we avoid a Brexit crash out, or if Brexit is scrapped all together, the UK is slowly running out of gas, driven down by persistent uncertainty and the flagging global economy. European stocks might be up after some tariffs have been rolled back, but it will take time to undo the damage caused by the trade war.

“The MPC has been hinting at a rate cut for a while, with or without a confirmed Brexit deal, but it’s likely to be at least three more months of paralysis before we see a move. Business investment will consequently be lacking, and thus no resulting lift to the wider economy. Sterling will likewise muddle along.

“This limbo is starting to feel like‘ the new normal ’when it should only be temporary. UK businesses need to be able to withstand the burden of this longer wait. ”

Here’s Commerzbank’s take on the Bank of England’s growth forecast cuts, and the split over interest rates:

Given the headwinds facing the UK as a result of Brexit issues and mounting global headwinds, it was perhaps no real surprise that two members of the MPC voted for a rate cut this month – the first split decision since June 2018. This comes on the back of a growth forecast that has been revised down compared to August.

For the first time the BoE has explicitly outlined the assumptions underpinning its Brexit view, assuming a FTA which enables tariff-free EU goods trade but nonetheless results in other frictions that will curb trade growth.

Yael Selfin, chief economist at KPMG UK, predictsMark Carneycould bow to pressure and extend his term again, if Brexit isn’t resolved soon.

She says:

“Carney’s potentially last inflation report painted a cautiously optimistic outlook for the UK economy, but further Brexit delays could see him and business uncertainty stay for longer.

“TheBank of Englandremains concerned about limited upside to capacity. A relatively smooth transition to new UK-EU relations, coupled with a removal of some of the current global headwinds, could therefore see interest rates start rising earlier than markets currently anticipate.

“However, with the final UK-EU trade deal likely to take some time to conclude, uncertainty is likely to last longer, causing business investment and overall economic growth to be more muted than what the BoE is expecting at the moment. ”

TUC: Growth cuts are Tory legacy

The TUC is disappointed that the UK economy is now expected to be 1% smaller in 2022 than the Bank thought back in August (underthose new growth forecasts).

TUC Head of EconomicsKate Bellblames the austerity program implemented since 2010, saying:

“This is the Conservatives’ economic legacy. Their decade of cuts and under-investment has put growth in the slow lane.

“When Britain needed rebuilding, they chose austerity and tax breaks for wealthy corporations. And they have damaged confidence in our economy by threatening a reckless no-deal.

“We need leaders who will put working families first, not their rich mates and donors.”

Both chancellor Sajid Javid and shadow chancellor John McDonnell have outlined plans to borrow and spend more if they win next month’s general election:

Updated

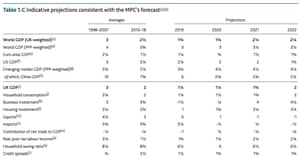

This chart, from today’s Monetary Policy Report, gives a detailed view of the Bank of England’s new forecasts.

It shows a predicted bounce-back in business investment in 2021 and 2022, as the weight of Brexit uncertainty is lifted.

But exports are seen falling in 2021 and 2022, with imports little changed.

And household consumption growth, which has kept the economy growing in recent years, is expected to be lower than average

Remember: These forecasts are based on the revised UK-EU Brexit deal agreed by Boris Johnson last month.

Previously, the BoE assumed a smooth and orderly Brexit, and a range of potential outcomes.

Samuel Tombs(@ samueltombs)

Why is Carney, at the end of his term, being so diplomatic about the impact of the new Brexit deal? Economists are pretty united that Boris’ deal is negative for GDP, relative to May’s. He put the boot in after the ref., Highlighting economy’s underperformance. Why so timid now?

Here’s our economics correspondent Richard Partington on Mark Carney’s comments about Brexit:

Richard Partington(@ RJPartington)

Mark Carneysays that “Brexit uncertainties are dominating” for the slowdown in UK growth (though global economy issues have also had an impact)

(November 7, 2019

Richard Partington(@ RJPartington)

Carney gives Javid some powerful support: He says the deal is expected to remove some of the uncertainty facing businesses and households, and that GDP growth will pick up during 2020 as a consequence. A Brexit Dividend?

Richard Partington(@ RJPartington)

Carney says the boost to growth was based on an assumption that the move to a new UK-EU trading relationship would be smooth.

Risks to this forecast are “skewed to the downside”

“Events will see whether that transpires,” he adds.

(November 7, 2019

Carney refuses to critique Johnson’s Brexit deal

The economics press pack then make a final attempt to pinMark Carneydown about Brexit , and the impact of Boris Johnson’s deal. But it’s not too successful.

Q: Just to clarify …. is the Bank saying that the economy will grow faster under the Brexit deal than if we’d not voted to leave, or not?

That’s not a question that we have to answer, Mark Carney replies.

The BoE doesn’t have the “remit, mandate, or the luxury of comparing it to a parallel situation” he adds.

Q: What will happen to your forecasts after the election if Britain doesn’t leave the EU?

They will change, Carney smiles, moving his hands back and forth. But he won’t guess how.

Q: Will Brexit uncertainties rise if Britain doesn’t leave the UK on 31 January next year?

It depends how businesses react, says Carney. We’ll adjust accordingly.

It also depends how much progress is made towards defining the ‘deep free trade deal’ that both side want, he continues.

That’s the end of the press conference. I’ll post a summary and reaction next.

Q: The Labor party want theBank of Englandto play a role in fiscal policy – would you welcome that?

Mark Carneypoints out that the BoE works to a mandate, while maintaining independence from government. It needs to have targets, and the tools to achieve them.

That’s a hint that some problems can’t be tackled through monetary policy, and financial stability measures.

Back in June, Labor saidthe Bank could play a role in the climate emergency. It has also called for action on productivity – which is also beyond the Bank’s current remit.

Q: How steep are the barriers to theBank of Englandeasing monetary policy, on a rating of 1 to 10?

I’m so not going to answer that question, Carney chuckles.

But on the broad point, the Bank’s economists and policymakers don’t see the imbalances that push the economy into recession.

If there isn’t a material improvement in trade tensions, the global economy would probably stabilize, and pick up, he adds.

Updated (at 8.) 25 am EST

Q: Do you think rising trade tensions are the new normal?

Mark Carneyreplies that protectionist measures are more “persistent, pervasive and damaging” than expected a few years ago.

(Q: Is theBank of Englandmore likely to cut rates next, rather than hike them, given two policymakers voted to cut rates at this week’s meeting?

It largely depends how risks, such as the Brexit process, play out, Carney explains.

GIPHY App Key not set. Please check settings