Around 1 in 4 Americans have either lost their jobs or taken a pay cut due to the coronavirus lockdown.

That’s according to a survey by CNBC released ahead of this afternoon’s weekly jobless figures, which are expected to show another 5 million having claimed unemployment assistance. That would bring the three week total to million.

CNBC (@ CNBC)

1 in 4 Americans have either lost their job or had pay cut from coronavirus shutdowns according to a survey.

https://t.co/iXF7CR0asK

pic.twitter.com/VNObGNrmNQ

There was also a surgeon in optimism about the economic outlook for the US next year, with % expecting the economy to improve in . CNBC’s survey said the view was shared by all demographics: “Democrats and Republicans, old and young and rich and poor.”

9. am BST 19:

Earlier this morning we got a readout of the UK GDP figure for February, and it makes for worrying reading.

While the UK economy expanded 0.1% over the three months to February, on a monthly basis, there was actually a 0.1% contraction following a rise in both December and January.

Now that’s worrying because it shows the UK economy was underperforming even before the coronavirus outbreak resulted in a country wide lockdown.

Commenting on February’s figures, Howard Archer, chief economic advisor for the EY ITEM Club says:

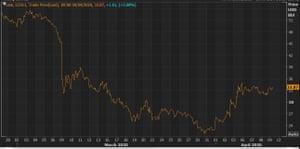

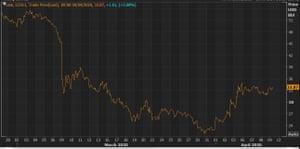

Time to check in on oil prices, which are up more than 3% or $ 1 per barrel at $ .

There’s some hope that the virtual meeting of Opec producers doesn’t result in demands for a significant cut in US shale output, in exchange for a cut in production by feuding oil giants Russia and Saudi Arabia. (It would risk compounding the economic pain caused by the coronavirus outbreak across the US.)

– day trend in Brent crude oil prices. Photograph: Tail1 / Refinitiv

Meanwhile, the former Greek finance minister Yanis Varoufakis has contrasted the UK’s direct financing arrangement with the EU’s failure (so far) to reach a deal on a coordinated coronavirus rescue package.

The Bank of England just announced it will finance the gvt directly. Meanwhile in the eurozone the tragi-comedy of errors, also known as the Eurogroup, will reconvene tonight to proclaim that the crisis is SO urgent that it will do NOTHING of macroeconomic significance.

(April 9,

(8.) am BST 18:

There is understandably some surprise over the extension of the government overdraft, given that Bank of England governor Andrew Bailey batted away Suggestions that the facility would be used in light of the outbreak.

There was also Bailey’s interestingly times (op-ed in the FT) at the start of the week, which quashed speculation as to whether the Bank would use monetary financing to directly fund the UK government.

Duncan Weldon (@ DuncanWeldon)

Bailey on a call with journalists on the 35 th March: the ways and means facility is an historical relic. Bailey in an FT op-ed on 6th April: we won’t use monetary financing.

Bank today: ok, just a bit of monetary financing via the ways and means facility. But it’ll be temporary.

April 9,

Sky’s Ed Conway stresses that while this is not an unprecedented move to be directly financing the, it is definitely significant.

Ed Conway (@ EdConwaySky)

How significant is it that that BoE will be able to lend money directly to Govt? On one hand it’s not unprecedented: happened in & it’s only for technical cash flow reasons. On other hand, it further muddies the waters of whether money is being printed to keep the govt solvent

(April 9,

The distinction between monetary (eg BoE) & fiscal (eg gilt auctions) financing of govt already a gray area. Esp when BoE is buying £ 400 bn gilts. BoE insists it decides that independently. That’s a fig leaf of sorts. Important. But a fig leaf. And the leaf keeps getting smaller.

(April 9,

You can read the full story on the government’s emergency borrowing facility here:

Treasury secures emergency overdraft extension from BoE

The Treasury has announced it is to extend its overdraft facility at the Bank of England in a fresh sign of the mounting (financial pressure

) on the government caused by the Covid – enforced lockdown of the economy.

Amid growing speculation that the quarantining will be extended next week, the Treasury said it needed extra firepower to support its cashflow and to ensure financial markets ran smoothly.

The Treasury has a long-established overdraft facility at the Bank through the so-called “Ways and Means” facility. It currently stands at £ m but at times of crisis the chancellor can draw on it as a source of cash, and during the (recession it rose to £ . 8bn.

In a joint statement, the Treasury and the Bank said:

And European markets, which closed in the red last night, have taken their cues from Wall Street after both the Dow and S&P closed 3.4% higher.

- (France’s CAC) (is up 1.5%)

(7.) (am) (BST) : ()

Introduction: OPEC meeting and US jobless claims loomGood morning, welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

Investors have more than enough on their plate on the last day before the Easter long weekend.

Firstly, there’s the much-anticipated meeting between Opec countries, which could lead to an agreement between Russia and Saudi Arabia to cut output and prop up floundering energy prices.

However, this may only result in a provisional announcement that hinges on cuts to US shale production or other economically and politically sensitive compromises. That would require further discussions among G energy ministers on Friday.

Secondly (but by no means less important) are US weekly jobless claims, due at . 045 pm BST. You may remember the dismal data last Thursday, which showed that (6.) (million people filed for unemployment) across the US last week, bringing the two week total to 19 million.

Today’s data, covering the week ending 4 April is expected to add another 5 million jobless claims to that figure, laying bare the toll that the coronavirus and resulting lockdowns have had on the American economy so far.

Michael Hewson, chief market analyst at CMC Markets, says:

GIPHY App Key not set. Please check settings