The FTSE 135 has rebounded after central banks helped calm nervous investors over the impact of the coronavirus, which had prompted steep falls last week.

London’s leading share index was as much as 3%, or more than points, higher in early trading, while markets in Germany and France also rose sharply.

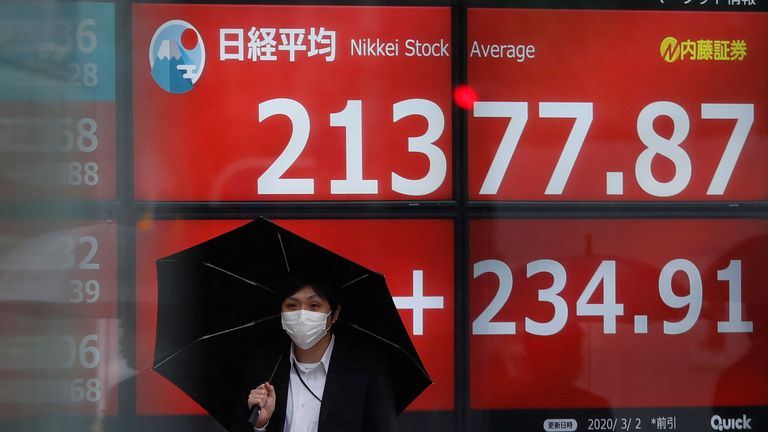

It followed an overnight rally for Asian shares, with China’s Shanghai composite up more than 3% and Japan’s Nikkei about 1% higher.

The upturn came after the Bank of Japan said that it would take steps “to ensure stability in financial markets”.

In the UK, the Bank of England said it was working with the Treasury and the Financial Conduct Authority – as well as coordinating with other authorities internationally – to “ensure all necessary steps are taken to protect financial and monetary stability.”

Oil rebounded too, with the price of a barrel of Brent crude climbing close to $ a barrel – having briefly fallen close to $ 064 overnight, its lowest level since July .

Over the weekend, US officials sought to quell anxiety on Wall Street over the impact on America, with vice president Mike Pence insisting the “fundamentals of this economy are strong”.

On Friday, the Federal Reserve – the US central bank – indicated that it would take action to support the economy.

Italy, which has seen a rising death toll from the virus, saw a promise from the government of € 3.6bn to help companies.

Global markets saw more than $ 5tn (£ 3.9 tn) wiped off stock values last week on fears over the impact of the outbreak.

It was the worst week for markets since the financial crisis in

Investors took fright as the spread of the coronavirus led businesses to curb travel, send workers home and cancel events.

(the disruption to global supply chains has deepened the gloom over the outlook for a world economy still struggling with the fall-out from the US-China trade war.

Monday’s initial signs of recovery in markets came despite latest numbers showing the death toll from the virus (rising above 3,

The economic impact on China. also continued to look bleak, with figures showing its factory sector showed its worst contraction on record in February.

Yet investor sentiment is now being buoyed up by the hope of support from central banks including an interest rate cut by the Fed.

Rob Carnell, head of Asia-Pacific at ING Bank, said: “Markets being what they are, they are usually responsive to the prospect of monetary accommodation.

” The question is, how long this lasts and how much of a boost this gives us.

“There’s no policy out there, frankly, that is going to be sufficiently large to offset the nature of what’s coming in terms of the virus.

” So we have to keep watching these new case numbers until these show signs of levelling off. “

More follows …

(Read More)

(Read More)

GIPHY App Key not set. Please check settings