Full story: Germany drags eurozone down

Here’s our news story on this morning’s poor PMI data:

Money-laundering practices of corrupt super-rich exposed

New groundbreaking analysis released today has shown how corrupt super-wealthy people are funnelling dirty cash into

Transparency International UK has analized more than 400 money laundering and corruption cases. It uncovers how ultra-expensive homes, expensive cars and jets, luxury goods, and private school fees are being paid for with ill-gotten gains.

Nearly 600 UK businesses and organizations have received suspect funds, from schools and universities to architects and interior design firms – either knowingly or unknowingly.

Daniel Bruce,their CEO, says “a range of rogues including former presidents, prime ministers and senior public officials who have been caught with their fingers in the till” are taking advantage of the UK establishment.

My colleague Rupert Neate has read the report, and explains:

Research by Transparency International, an anti-corruption campaign group, found more than £ 300 bn of suspect funds have been funnelled through the UK banks, law firms and accountants before being spent ona £ 1m Cartier diamond ring, masterpiece art works from Sotheby’s, and a £ 50, 000 Tom Ford crocodile-skin jacket with matching crocodile-skin handbag from Harrods.

The suspect cash – which often comes from corrupt officials ’embezzlement of hundreds of millions of pounds of poor countries’ state coffers – was also found to have been spent on a £ 200, 000 Bentley Bentayga driven by the 22 – year -old son of the former prime minister of Moldova. His father, Vlad Filat, had been sentenced to nine years in prison for his role in the “theft of the century”.

Here’s his story:

Here’s the full report:AT YOUR SERVICE

Duncan Hames(@ duncanhames)

BROKEN: Our first line of defense against money laundering …#dirtymoneyhttps://t.co / oLuoSs5YDp

Anders Svendsen of Nordea Markets fears that the eurozone economy is at risk of recession:

Anders Svendsen(@ SvendsenAnders)

Anders Svendsen(@ SvendsenAnders)

Euro-area PMI still points to downside risks to our baseline forecastpic.twitter.com/VQ2ujLszDX

(October) , 2019

Fears over Germany’s economy are rising

The decline in Germany’s private sectorhas alarmed economists, who fear that Europe’s largest economy is weakening.

Katharina Utermöhl of Allianzfears that Germany will be at risk of recession in 2020 (it may have already entered one this summer).

Here’s her take onGermany’s composite PMI coming in at just 48 .6, showing a contraction:

The subdued outlook for global trade and the car industry as well as lingering elevated political uncertainty surrounding trade and Brexit are still weighing too heavily on Germany’s industry. The renewed decline in new export orders suggests that external headwinds will continue to persist in the coming months.

In addition, there are increasing signs that the pronounced industrial weakness is spreading to other sectors of the German economy.

Macroeonomist Hadrien Camattefears that the problems in Germany’s factory sector have now spread to the broader economy:

Hadrien Camatte(@ HadrienCamatte)

German markit PMI: Increasing signs of spillovers from manuf. sector to services in October. Employment falls for first time in six years: the drop continues in manuf sector (neg. Territory) and in services (positive territory)pic.twitter.com/ZW8H5HujFa

Oliver Rakau of OxfordEconomicssays Germany is being overhauled by France, where growth is strengthening.

Oliver Rakau(@ OliverRakau)

Nope, they did not. German composite PMI edged up every so slightly in October, but remains depressed with further signs of adverse domestic spill-overs.pic.twitter.com/0asIEexIRo

(October) , 2019

The weak October PMI reportshows the ECB may need to take more action, argues City brokerage XM:

Flash PMI readings for October released this morning showed the region’s economic troubles were far from over as they disappointed once again.

The key composite PMI by IHS Markit rose slightly in October but by less than expected, suggesting the Eurozone may require still more stimulus.

Eurozone growth may have slowed to 0.1%

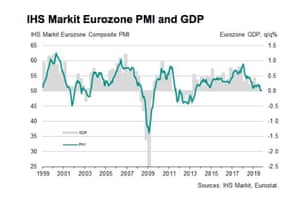

Today’s weak PMI surveyssuggest the eurozone economy only grew by 0.1% in July-September, says Chris Williamson, chief business economist at IHS Markit.

That would be even weaker than the 0.2% growth recorded in April-June- well below long-term trends.

Williamson explains that Brexit worries, the US-China trade war, and the global slowdown are all hurting eurozone companies:

“The eurozone economy started the fourth quarter mired close to stagnation, with the flash PMI pointing to a quarterly GDP growth rate of just under 0.1%.

“The manufacturing downturn remains the fiercest since 2012, and continues to infect the service sector, where October saw the smallest increase in new work for almost five years.

“The labor market is meanwhile being hit as firms retrench amid signs of excess capacity and uncertainty about the year ahead intensifies. Optimism about future prospects deteriorated further in October to the lowest for over six years, commonly linked to global trade tensions, Brexit- related worries and increasingly gloomy economic forecasts.

“A further deterioration in jobs growth adds to the risk that the trade-led weakening is spreading further to the household sector, which could dampen growth further as we head towards the end of the year.

“The survey indicates that Mario Draghi’s tenure at the helm of the ECB ends on a note of near-stalled GDP, slower jobs growth, near-stagnant prices and growing pessimism about the outlook, piling pressure on Christine Lagarde to drive new solutions to the eurozone’s renewed malaise. ”

Updated (at 4.) am EDT

Eurozone economy close to stagnation

Newsflash: The Eurozone economy is close to stagnation, casting a shadow overMario Draghi’s final performance as ECB president today.

Demand for goods and services is falling this month, for the second successive month, according to the latest flash PMI data for the region.

The euro area service sector managed some growth, but manufacturing output suffered another decline.

This is partly due to the slump in Germany (which we covered earlier). France is doing better, but the rest of the region stalled, says data firmIHS Markit.

It explains:

The Eurozone economy remained close to stagnation at the start of the fourth quarter, according to the latest flash PMI data, with demand for goods and services falling for a second successive month.

This has left Markit’s flash Eurozone PMI Composite Output Index at 50 .2 – barely above the cut-off point between growth and contraction. It was 50 .1 in September.

The eurozone services PMI rose to 51 .8, from 51 is one of the weakest expansions seen since 2014.

The manufacturing PMI was unchanged at 45 .7, showing a steep decline in output.

In further gloom, companies’ future expectations sank to the gloomiest since 2013 and jobs growth hit the lowest since 2014.

More to follow ….

IHS Markit PMI ™(@ IHSMarkitPMI)

Flash Eurozone PMI at 2) 50 ), broadly indicative of a stagnant economy for the second month running. Demand for goods and services continued to fall and jobs growth was at its weakest since the end of 2014. More:https://t.co/RU5jWCQ6qE(pic.twitter.com/V3LLuEjltO)

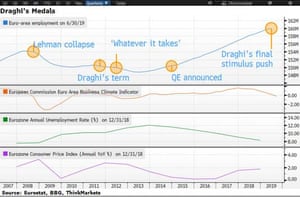

Draghi’s legacy in charts

Bloomberg have produced this excellent thread showing Mario Draghi’s legacy – where he did well (holding the euro together) and where he fell short:

Bloomberg Economics(@ economics)

THREAD 1 / Three words – “whatever it takes” – defined Mario Draghi’s time as ECB president, but he’s prouder of another number: (million jobs (via@ fergalob&@ jrandow) (https://t.co/1rPCDAfETU)pic.twitter.com/zIn5Fjvnnn

(October) , 2019

Bloomberg Economics(@ economics)

2 / Employment growth since 2013, when the euro zone emerged from its double-dip recession, is unequivocally Draghi’s biggest economic achievementhttps://t.co/1rPCDAfETUpic.twitter.com/8Q1Km10 iiB

(October) , 2019

Bloomberg Economics(@ economics)

3 / Looking deeper though, the picture is more complex. Germany has built on impressive job creation that started well before Draghi’s term. France can tell a similar tale, but labor markets in Spain and Greece still haven’t made up the lost groundhttps://t.co/1rPCDAfETUpic.twitter.com/7faUjep5gm

(October) , 2019

Bloomberg Economics(@ economics)

4 / Regional differences are equally striking when analyzing economic growth. Aside from Greece and Cyprus, no country has done worse than Draghi’s native Italy in terms of GDP per head (https://t.co/1rPCDAfETU)pic.twitter.com/AlBQdxNnsp

(October) , 2019

Bloomberg Economics(@ economics)

5 / Inflation over Draghi’s 8-year term has averaged 1.2% which, unlike with his predecessors, falls short of the goal of “below, but close to, 2%.” It was even negative at times – so Draghi can at least claim he beat deflationpic.twitter.com/m2Dol2bMiR

(October) , 2019

Bloomberg Economics(@ economics)

7 / One other key indicator the ECB uses to gauge its success is lending by banks to companies and households, and that has responded better to stimulus. At just under 4%, credit is expanding at three times the rate of GDPhttps://t.co/1rPCDAfETU(pic.twitter.com/SUh5ddeySO)

Bloomberg Economics(@ economics)

8 / One small economy has taken an oversized chunk of Draghi’s attention : Draghi kept Greece’s lenders alive, by approv ing emergency liquidity, just long enough to allow a political solution that kept the country in the euro (https://t.co/1rPCDAfETU)pic. twitter.com/Zmw4JJ03 G6

(October) , 2019

Bloomberg Economics(@ economics)

9 / For all the furor over a possible “Grexit” and the flirtations of factions in France and Italy with the idea of leaving the euro, membership has actually continued to grow. At the end of Draghi’s term, a measure of the probability of a breakup of the bloc is near a record lowpic.twitter.com/RzLGU4Q6fP

(October) , 2019

Updated (at 4.) am EDT

In the City, shares in Royal Bank of Scotland have fallen almost 3% to the bottom of the FTSE 100 leaderboard.

The bank has taken another hit on PPI compensation this morning, setting aside another £ 900 m for customers missold payment protection insurance.

This dragged RBS into an operating loss of £ 8m for the third quarter of this year.

NatWest Markets, its investment banking arm, struggled with core income shrinking by 44%. It blamed “a deterioration in economic sentiment for the global economy and a fall in bond yields.”

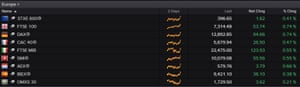

European markets hit highs

Boom! Germany’s stock index has hit its highest level since June 2018, as markets rally across Europe.

The Stoxx 50 index of Europe’s largest companies has reached its highest level since January 2018.

Traders are still waiting for a Brexit breakthrough, saysCraig Erlamof trading firm OANDA.

Brexit limbo continues on Thursday as the UK awaits judgement from Brussels on its extension request, one week before the country is due to leave the European Union. The EU will be in no rush to make a decision and may even be awaiting more details on how Parliament intends to make use of the time before doing so. There’s little chance of it rejecting the request but how long it offers needs to be determined.

The pound has rallied a little this morning on the back of claims that Labor has offered a “pragmatic path” to a Brexit deal with a compromise on the timetable. The details of this are still lacking and the terms will probably not be acceptable to the Prime Minister but in reality, it’s not that important. An extension will be signed off, at which point we’re probably heading for an election. We are starting to see the light at the end of the tunnel.

Updated

German growth hopes dashed by weak PMIs

Bad news! Germany’s private sector companies are slashing jobs as output and activity continues to shrink.

Data firm Markit’s healthcheck shows that employment at German firms is falling for the first time in six years this month. Growth across the service sector slowed, while factories are suffering another contraction:

Here’s the details (any reading below 50 shows contraction)

- Flash Germany PMI Composite Output Index: .6 (Sep: 48 .5). 2-month high.

- Flash Germany Services PMI Activity Index: (****************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************. 2 (Sep: 51. 4). 37 – month low.

- Flash Germany Manufacturing PMI: 41 .9 (Sep: 41 7). 2-month high.

- Flash Germany Manufacturing Output Index: t (*************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************************. 6 (Sep: 43. 2-month high

Such weak figures will fuel concerns that Germany is in recession, given the PMIs often correlate closely with GDP.

Phil Smith, Principal Economist atIHS Marki t said:

“Hopes of a return to growth in Germany in the final quarter have been somewhat dashed by the October flash PMI numbers, which show business activity in the eurozone’s largest economy contracting further and underlying demand continuing to soften.

“Manufacturing remains the main weak link, though here there are some signs of encouragement with rates of decline in production and new orders easing and business confidence improving to a four-month high.

BP PRIME UK(@ bpprimeuk)

Other bad news for# Germany‘s business morale:

(Manufacturing) # PMIat 41. 9 in October, less than exp 42; 0;

but services PMI falls to 51 .2, much less than expected 52 0 as# Bundesbanksays the country will enter# recessionin 3Q@ graemewearden(October) , 2019

Some good news: France’s economy has strengthened this month, according to data firm Markit.

Markit’s ‘flash’ survey of purchasing managers shows that service sector firms are growing solidly, while manufacturing managed some growth too.

Here’s the details (any reading over 50 shows growth).

- Flash France Composite Output Index: 52 .6 in October, up from 50 .8 in September (2-month high)

- Flash France Services Activity Index: 52. 9 in October (51. 1 in September), 2-month high

- Flash France Manufacturing Output Index: 51. 0 in October (49. 7 in September), 4-month high

- France Flash France Manufacturing PMI: 50 .5 in October (50. 1 in September), 2-month high

Updated

Mario Draghi can also take some credit for getting eurozone unemployment down.

The euro-ara jobless rate is now 7.4% – still too high, but much better than the 12% seen in 2013.

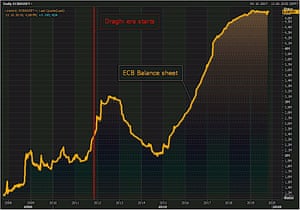

That decline came as the ECB expanded its balance sheet, slashed borrowing costs and encouraged banks to lend to the real economy (through Draghi’s TLTRO program of cheap loans].

Naeem AslamofThink Marketssays:

It will not be a far fetched statement to say thatMario Draghi, the current president of the European Central Bank (ECB), saved the Euro. He saved the single currency of the eurozone by introducing three keywords: “whatever it takes”.

Another significant accomplishment is employment growth in the euro-zone, 11 million jobs. He can certainly be proud of his achievements at the central bank. However, the area of the eurozone which didn’t perform well under his tenure is inflation. It has been languishing, and unfortunately, the situation isn’t getting any better despite his last-ditch back in September to boost price stability — inflation.

I fear that today’s ECB press conference will fail to match April 2015.

That was the unforgettable moment when activist Josephine Witt sprang onto Draghi’s desk, decorated him with confetti and called for an end “ECB Dick-tatorship”, before being hauled off by security guards.

After being released from the police station, Witt told us why she did it:

“What I wanted to demonstrate is that economics are not just some god-given thing that we have to accept and go along with. We can try to change our economy.

If the ECB was a democratically elected institution we could use it far more for the better. ”

Introduction: Draghi signs off

Good morning, and welcome to our rolling coverage of the world economy, the financial markets, the eurozone and business.

The man who saved the euro is leaving the building. After eight years as president of the European Central Bank, (Mario Draghi) is chairing his final governing council meeting today – before handing over to Christine Lagarde at the end of the month.

And what an eight years it’s been. Draghi arrived just as the eurozone crisis was fully aflame. Greece, Ireland and Portugal had already lost the confidence of the markets and been bailed out, and Spain and Italy were feeling the heat too.

He immediatelyslashed interest rates(reversing a frankly baffling hike by his predecessor), and went on to unleash his famous bazooka – buying up government bonds to keep eurozone yields away from the danger zone.

Indeed, Draghi’s pledge to do “whatever it takes” in July 2012 went a huge way towards shoring up support for the euro, at a time when Grexit fears were haunting the markets.

And when the eurozone economy stumbled in 2015,Draghi hit back with a massive bond-buying quantitative easing scheme– defying doubters who claimed a huge money-printing spree would violate the Bank’s mandate.

Few central bankers have had such a dramatic tenure, and even fewer can say they rescued a currency.

But Draghi isn’t without critics. The ECB clashed with Greece’s anti-austerity Syriza party through the wild days of 2015, after refusing to support its debt swap plan. It eventually froze the emergency funding keeping Greek banks afloat, triggering the imposition of capital controls.

Germans aren’t happy with Draghi either, after seeing savings rates shrivel thanks to the ECB’s current policy of negative interest rates. One newspaper even compared him to Dracula, for sucking their savings away.

Steven Forti(@ StevenForti)

Bild ataca duramente Draghi para el nuevo QE y lo compara con Dracula. Los gobernadores de los bancos de Alemania, Holanda y Austria se oponen a sus decisiones. Aquí se juega un partido clave.https://t.co/DOTQV6aviNpic.twitter.com/hSR1xG1rJq

(September) , 2019

Mario Draghi usually bats such criticism aside, pointing out that savers wouldn’t be happy if banks failed or we plunged into a depression.

But the real problem, as Draghi clears out his locker, is that the eurozone economy still looks weak, with lackluster growth and inflation still below target.

Only last month the ECB outlined a new stimulus plan – another attempt to spur activity. But several governing council members pushed back against the plan, suggesting Lagarde won’t have an easy task either.

That will be reinforced by PMI surveys due this morning, which will show that private sector companies are struggling, with manufacturing continuing to shrink.The euro may be intact, but the eurozone is struggling.

The agenda

- 9am BST: Eurozone ‘flash’ PMI surveys for October

- 45 pm BST: ECB decision on monetary policy

1. 30 pm BST: ECB president Mario Draghi’s press conference

GIPHY App Key not set. Please check settings