Recently, the 2023 financial statements of 30 domestic cybersecurity listed companies have been fully disclosed. We will observe the market performance of my country's listed cybersecurity companies during the reporting period by sorting out the core financial indicators such as revenue and profit of each company.

Nearly half of companies saw revenue rise

In 2023, the total revenue of my country's 30 listed cybersecurity companies will reach 45.564 billion yuan. It should be noted that because some enterprise businesses are also involved in areas such as cloud computing, enterprise-level wireless, and Internet value-added services, Sangfor’s included data is only network security business, 360’s included data is security and other business income, and Wangsu Since Technology did not separate the security business separately, the data included in the data is the company's overall operating income.

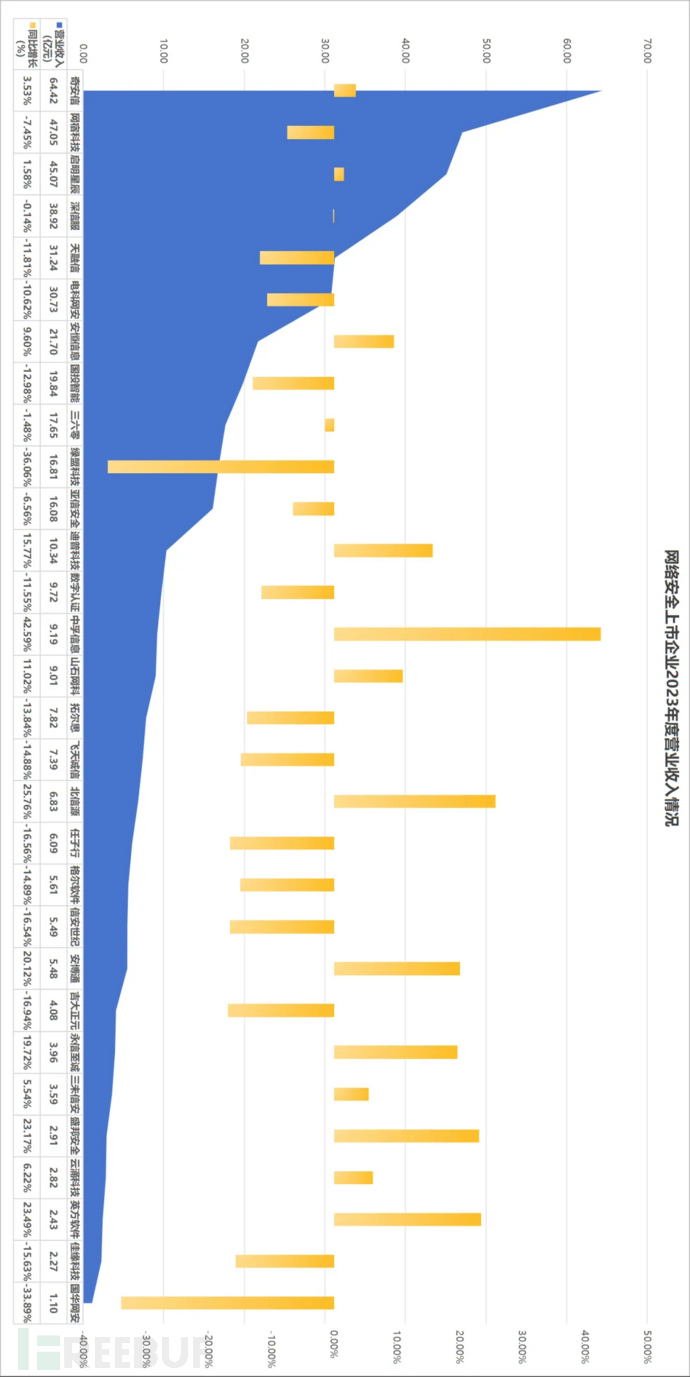

*2023 revenue ranking and year-on-year growth

During the reporting period, a total of 12 companies exceeded the 1 billion yuan revenue mark, namely Qi'anxin, Wangsu Technology (including non-security businesses), Venus, Sangfor, Tianrongxin, Dianke Network Security, Anheng Information, and SDIC Intelligent, 360, NSFOCUS Technology, AsiaInfo Security, DP Technology.

Comparing the revenue growth rate, nearly half of the companies (13 companies) achieved year-on-year revenue growth, including Zhongfu Information (42.59%), Beixinyuan (25.76%), Yingfang Software (23.49%), Surbana Ping An (23.17%), Anbotong (20.12%), and Yongxin Zhicheng (19.72%) experienced larger revenue growth. Among the camps with declining revenue, NSFOCUS Technology (-36.06%) and Guohua Network Security ( -33.89%) is relatively obvious.

Qi'anxin, which ranks first in revenue, will have revenue of 6.442 billion yuan in 2023, a year-on-year increase of 3.53%. From the perspective of product line distribution, the revenue from its strategic products data security and terminal security both increased by more than 20% compared with the same period last year; in terms of revenue structure, enterprise customers continue to be the main engine of growth, accounting for more than 70%, with key industries For example, the total revenue generated by the three major industries of energy, finance and operators accounts for more than 30% of the company's main business revenue; in terms of revenue volume, the revenue growth rate of customers with more than one million is close to 10%, and the revenue contribution accounted for more than 80%; in addition, last year The repurchase rate of the company's customers is nearly 40%, and the single customer output of new customers has increased by 34% compared with the same period last year.

Zhongfu Information, which has the largest increase, has a full-year revenue of 919 million yuan in 2023, which is still 350 million yuan behind the peak in 2021. In terms of product composition, the revenue from network security products and information security services increased by 20.14% and 71.47% respectively compared with the same period last year, while the revenue from password application products decreased by 13.66%. In terms of revenue structure, revenue from governments and public institutions accounted for 63.29% of the company's overall revenue. %, an increase of 29.98% compared with the same period last year, the income of special industries accounted for 15.05%, a year-on-year increase of 185.42%, and the income of central enterprise groups increased by 42.27% year-on-year. It is reported that the company continues to promote the strategic expansion from “confidential security” to “data security”, and strives to build a new situation in which the confidential security business continues to develop and the data security direction is effective.

Overall

Against the backdrop of an unstable external environment and accelerated development of digital intelligence, the rigid demand for network security remains clear. However, the fluctuations in the macroeconomic environment in recent years have had a huge impact on the operations of network security companies. According to widespread reports,The security budgets of customers in key industries and some local government customers continue to tighten, and the project procurement process and confirmation cycle have been lengthened.

Five companies' profits exceeded 100 million

Observing the profitability of enterprises, during the reporting period, Venustech (741 million yuan), Wangsu Technology (613 million yuan), Dianke Network Security (349 million yuan), Sangfor (198 million yuan), and DP Technology (127 million yuan) ) ranks among the top five companies in the list of net profits attributable to parent companies, and is also the only five companies that have exceeded the profit mark of 100 million yuan.

Half of the companies (15 companies) achieved profitability, and less than half (12 companies) saw profits increase compared with the same period last year. The profits of Geer Software (524.28%), Anbotong (239.25%), and Wangsu Technology (221.68%) increased The situation is relatively promising; half of the companies (15 companies) suffered losses, and 60% of the companies (18 companies) saw profits decline year-on-year.

| NetSec goes publicenterprise | Net profit attributable to parent company/100 million yuan | year-on-year growth |

| morning star | 7.41 | 18.37% |

| Wangsu Technology | 6.13 | 221.68% |

| Dianke Network Security | 3.49 | 13.74% |

| Convinced | 1.98 | 1.89% |

| DP Technology | 1.27 | -15.44% |

| Qianshin | 0.72 | 24.5% |

| Sanwei Xin'an | 0.67 | -37.26% |

| British software | 0.44 | 20.29% |

| Shengbang Security | 0.43 | -7.96% |

| Geer Software | 0.37 | 524.28% |

| Torsi | 0.36 | -71.45% |

| Always trustworthy and sincere | 0.31 | -38.78% |

| Abotong | 0.12 | 239.25% |

| Xin'an Century | 0.11 | -93.15% |

| Beixinyuan | 0.07 | 103.52% |

| digital certification | -0.47 | -146.53% |

| Jiayuan Technology | -0.05 | -108.69% |

| Yunyong Technology | -0.06 | -140% |

| Ren Zixing | -1.24 | -12246.11% |

| Guohua Network Security | -1.57 | 73.62% |

| Kichidaishomoto | -1.57 | -366.05% |

| Feitian Integrity | -1.72 | -42.28% |

| Zhongfu Information | -1.86 | 58.31% |

| SDIC Intelligence | -2.06 | -239.06% |

| Hillstone Network | -2.40 | -31.42% |

| AsiaInfo Security | -2.91 | -395.56% |

| Anheng Information | -3.60 | -41.9% |

| Tianrongxin | -3.71 | -281.09% |

| Three sixty | -4.92 | 77.65% |

| NSFOCUS Technology | -9.77 | -3516.62% |

| *Net profit cannot be separated into pure safety, the data included above include non-safety business | ||

Venustech, which ranks first in profits, achieved double growth in revenue (4.507 billion, an increase of 1.58%) and net profit (741 million, an increase of 18.37%) in 2023. China Mobile Group has officially become the controlling shareholder of VenusChen, and the new business it has brought has begun to gradually increase. In 2023, the amount of related transactions sold by VenusChen to China Mobile will be 1.443 billion. The revenue share of new business segments (cloud security, data security, industrial Internet security, and security operations) is steadily increasing, with an increase of 13.82% compared with the same period last year, accounting for 47.54% of annual revenue. The total amount of three expenses (sales + research and development + administrative expenses) decreased by 11.69% compared with the same period last year, significantly reducing costs and increasing efficiency. In 2024, Venusstar's strategic direction will continue to be deeply integrated into China Mobile's system, and it is expected that annual revenue will achieve a growth of more than 20%.

The overall performance of Geer Software, which has risen the most, has turned a profit from a loss in 2022. The annual performance in 2023 has an operating income of 561 million yuan and a net profit attributable to shareholders of the listed company of 37 million yuan. The three major product matrices include PKI identity authentication, identity authentication and password security, and digital trust and security protection. The operating income of the company's core product PKI security application products increased by 33.04%, with significant revenue growth in North China, South China, Central China, Northwest, and Southwest. The customer base covers key industries such as party and government, national defense, finance, politics and law.

Looking at the entire industry

The loss-making state of most enterprises continues, and some enterprises maintain low-profit operations. It is common for them to increase revenue without increasing profits.According to the analysis of market research institutions, in the context of the overall food shortage in the industry, companies consider grabbing customers in the early stage, closing deals at low prices, and meeting the different needs of customers through “over-service” instead of focusing on products. And from products to deployment, operation and maintenance, and support, covering all businesses, it is difficult to ensure profits to the greatest extent. This business model reflects the current low maturity of my country's network security market, which should be broken around product strategies.

Staff size reduced for the first time

Looking at the organizational scale and personnel changes of the companies, in 2023, the total number of employees of the 30 listed cybersecurity companies will be 74,600, a decrease of 4,414 from the previous year. This is also the first time that the staff size of listed companies has experienced negative growth.

*Staff size ranking and year-on-year increase or decrease in 2023

There are 9 companies with more than 3,000 employees, 10 companies with 1,000-3,000 employees, and 11 companies with less than 1,000 employees. Comparing the increase and decrease, the larger the enterprise, the more obvious the personnel reduction trend will be in 2023.

Among the large comprehensive manufacturers in the first echelon, only AsiaInfo Security and Dianke Network Security have positive growth in personnel. AsiaInfo Security added 202 people, bringing the total headcount to 3,084, reaching the 3,000 mark, mainly due to the increase in technical personnel (184 people). It will complete the acquisition of Security Dog in October 2023, deeply integrate the product technology capabilities of cloud security, and accelerate the innovative development of cloud native security. The total headcount of Dianke Network Security increased by 129 to 3,030, including an increase of 80 R&D personnel. As a third-level member unit of China Electronics Technology Group Co., Ltd., its business scope covers the three major sectors of password, network security and data security.

Sanwei Xin'an, which has the largest expansion of personnel, will add 301 people in 2023, bringing the total number to 667. The main additions are R&D personnel (an increase of 111 people), technical personnel (an increase of 90 people) and sales personnel (an increase of 34 people). It lists its personnel advantages and leading technology as one of its core competitiveness. The company has a total of 278 R&D personnel. The core R&D design is completed independently. It launched the first domestic security three-level password board “SJK1926PCI-E Password Board”, The first domestic FIPS140-2level3 (U.S. Federal Information Processing Standard Level 3) encryption machine “SansecHSM” and so on. In 2023, Sanwei Xin'an's acquisition of Jiangnan Keyou will increase the company's performance. Jiangnan Keyou's revenue during the reporting period was 86 million yuan, accounting for 24% of Sanwei Xin'an's total revenue. Its net profit was 29 million yuan, accounting for 24% of Sanwei Xin'an's net profit. 43% of profits.

Overall

Cost reduction and efficiency increase will be the main theme of the network security industry in 2023, and optimization of staffing is common.The impact of the economic situation is still the main reason. G-side and B-side customers have tight budgets, and companies have to reduce costs to cope with operating pressures. Factors such as the policy environment, market demand, and internal corporate strategies will also have an impact on staffing.

my country's network security market faces the dual challenges of macroeconomic fluctuations and industrial ecological adjustments, and the situation will remain severe in 2024. Chen Huaping, director of the Security Maker Forum Jury, pointed out in a recent report that the fundamentals of supply and demand in the network security industry have not changed. Judging from the total revenue of the main business of my country's network security companies, China's network security market will be about 800 million in 2023. billion, but with the endogenous development of network security and the integration with the digital industry, more operators, IT vendors, industry digital and integrators have entered the network security ecosystem. In a broad sense, the overall scale of the network security industry can reach 220 billion yuan. Above, the overall growth rate reaches more than 10%, and the room for growth is broader. The network security industry is a “long slope with thick snow”. As the country fully promotes the process of digitalization and intelligence, new security challenges will inevitably arise, driving innovation in security technology and changes in security service models, thereby promoting the development of the entire network security industry.

Article Source:https://mp.weixin.qq.com/s/CAx8YhYuACB8ea3WfCNXtQ

GIPHY App Key not set. Please check settings