The Indian market had a solid start to Samvat 2076 with Nifty ending above 11, 600 on Muhurat trading on October 27.

The one-hour special trading session ended with the Sensex was up 192. (points at) , 250. 20 and the Nifty at 11, 627. (UP) . 30 points.

In the broader market, BSE Midcap and Smallcap outperformed the benchmark, closing with gains of 0. 69 percent and 1. (percent, respectively.)

All the sectoral indices ended in the green led by the auto, metal, IT, FMCG and Bank.

The biggest gainers of the day wereTata Motors,Yes Bank,M&M,InfosysandVedanta, while losers included names like (Bharti Infratel,Coal India, (Titan) ,Grasim IndustriesandMaruti Suzuki.

“The market continued the recent positive trend in Muhurat trade. There is a visible turnaround in sentiments and one hopes that we may witness a broader upmove in the markets soon, ”said Dhiraj Relli, MD & CEO, HDFC Securities.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for the Nifty is placed at 11, 597. 07 , followed by 11, 566. 93. If the index starts moving up, key resistance levels to watch out for are 11, 664. 87 and 11, 702. 53.

Nifty Bank

(Nifty Bank gained) *********************************************************************************************** 35 points at 29, 516. 30 on October 27. The important pivot level, which will act as crucial support for the index, is placed at 29, 427. 27, followed by 29, 338. 23. On the upside, key resistance levels are placed at 29, 624. 87 and 29, 733.

Call options data

Maximum call open interest (OI) of 35. 90 la kh contracts was seen at 12, 000 strike price. It will act as a crucial resistance level in the October series.

This is followed by 11, 700 strike price, which holds 24. 90 lakh contracts in open interest; and 11, 600, which has accumulated 19 . 89 lakh contracts in open interest.

Call writing was seen at the 11, 800 strike price, which added 1. 67 lakh contracts, followed by 12, 000 strike that added 1. 14 lakh contracts and 11, 700 strike that added 44, 325 contracts.

Call unwinding was witnessed at 11, 600 strike price, which shed 1. 46 lakh contracts, followed by 11, 500 which shed 46, 876 contracts and 11, 400 which shed 42, 975 contracts.

Put options data

Maximum put OI of 83 lakh contracts was seen at 11, 000 strike ***, which will act as crucial support in October series.

This is followed by 11, 500 strike price, which holds 28. 40 lakh contracts in open interest; and 11, 600 strike price, which has accumulated 22 . 47 lakh contracts in OI.

Put writing was seen at the 11, 600 strike price , which added 3. 19 lakh contracts, followed by 11, 500 strike price, which added 1. 82 lakh contracts and 11, 400 which added 1. 59 lakh contracts.

No major Put unwinding seen.

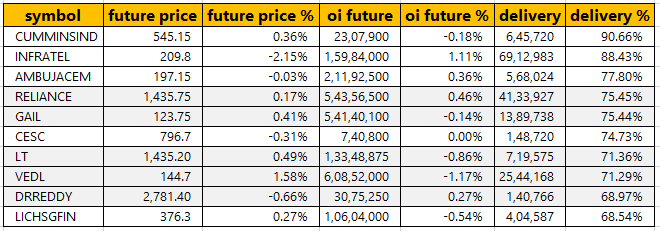

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

58 stocks saw long buildup

37 stocks witnessed short-covering

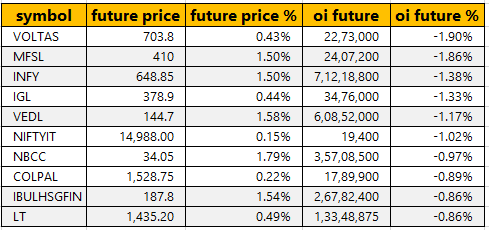

As per available data, 37 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which short-covering was seen.

32 stocks saw short build-up

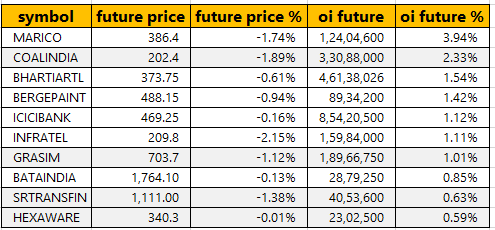

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 10 stocks in which short build-up was seen.

18 stocks saw long unwinding

Based on the lowest open interest (OI) future percentage point, here are the top 10 stocks in which long unwinding was seen.

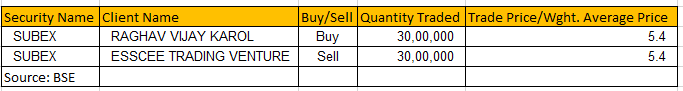

Bulk Deals

(For more b ulk deals,click here)

Upcoming analyst or board meetings / briefings

Somany Ceramics – board meeting on November 6 to consider and approve the financial results for the period ended September 30, 2019

Repro India – board meeting on November 4 to consider and approve the financial results for the period ended September 30, 2019

Tata Steel – board meeting on November 6 to consider and approve the financial results for the period ended September 30, 2019

V-Guard Industries – board meeting on November 6 to consider and approve the financial results for the period ended September 30,

Coal India – board meeting on November 11 to consider and approve the financial results for the period ended September 30, 2019

Stocks in news

Results on October 29: Bharti Airtel, Atlas Cycles, Hindustan Zinc, Petronet LNG, SKF India, Tata Metaliks, Wonderla Holidays

Marico Q2: Consolidated net profit up 17. 1% at Rs 253 crore versus Rs 216 crore, revenue down at Rs 1, 829 crore versus Rs 1, 837 crore, YoY.

Jubilant Life Q2: Net profit up 19% at Rs 249 crore versus RS 210 crore, revenue at RS 2, 266 crore versus Rs 2, (crore, YoY.

Tata Motors Q2: Consolidated net loss At Rs) .6 crore versus loss of Rs 1, 048 .8 crore, revenue down 9.1% at Rs 65, 432 crore versus Rs 71, 981 crore, QoQ.

Excel Industries completes acquisition of chemical manufacturing unit of NetMatrix Crop Care.

Tata Power – JV company signs asset purchase agreements with Tata Steel for acquisition of 120 MW Captive Gas-Based Power Plant and (MW Diesel Generating Station.) ) GVK signs binding agreements with ADIA, PSP Investments and NIIF for an investment of Rs 7, 614 crore in its airports holding company.

FII & DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 6. 61 crore, while domestic institution al investors (DIIs) purchased shares of worth Rs 54. 39 crore in the Indian equity market on October 27, as per provisional data available on the NSE.

Fund Flow

No stock under ban period on NSE

For October 29, no stock is under F&O ban.

In the F&O segment, companies in which the security has crossed 95 percent of the market-wide position limit are put under a ban for a certain period.The Great Diwali Discount!

% more savings this festive season. Get Moneycontrol Pro for a year for Rs 289 only.

Coupon code: DIWALI. Offer valid till (th November, 2019.

GIPHY App Key not set. Please check settings